Motorola 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

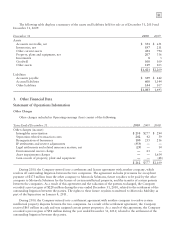

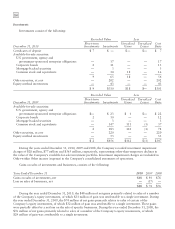

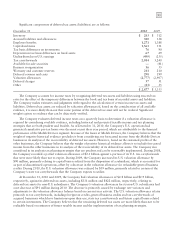

Other Assets

Other assets consists of the following:

December 31 2010 2009

Intangible assets, net of accumulated amortization of $1,561 and $1,312 $ 451 $ 591

Long-term receivables, net of allowances of $3 and $9 262 117

Royalty license arrangements 228 255

Contract-related deferred costs 181 286

Value-added tax refunds receivable 63 127

Other 243 304

$1,428 $1,680

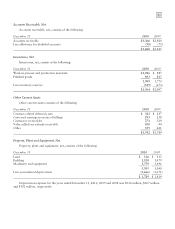

Accrued Liabilities

Accrued liabilities consists of the following:

December 31 2010 2009

Deferred revenue $1,071 $ 836

Compensation 804 542

Customer reserves 373 321

Tax liabilities 293 246

Warranty reserves 249 209

Billings in excess of costs and earnings 226 253

Contractor payables 194 235

Customer downpayments 106 159

Other 1,388 1,340

$4,704 $4,141

Other Liabilities

Other liabilities consists of the following:

December 31 2010 2009

Defined benefit plans, including split dollar life insurance policies $2,183 $2,450

Deferred revenue 496 601

Postretirement health care benefits plan 277 287

Unrecognized tax benefits 76 196

Other 510 453

$3,542 $3,987

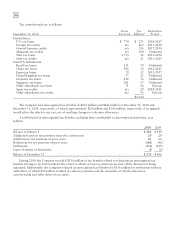

Stockholders’ Equity Information

Share Repurchase Program: During the years ended December 31, 2010 and 2009, the Company did not

repurchase any of its common shares. During the year ended December 31, 2008, the Company repurchased

1.3 million of its common shares at an aggregate cost of $138 million, or an average cost of $107.24 per share, all

of which were repurchased during the three months ended March 29, 2008. These amounts give effect to the

Reverse Stock Split, which occurred on January 4, 2011.

The repurchase of common shares took place under programs approved by the Board of Directors, authorizing

the Company to repurchase an aggregate amount of up to $7.5 billion of its outstanding shares of common stock

over a period of time. This authorization expired in June 2009 and was not renewed. The Company has not

repurchased any shares since the first quarter of 2008. All repurchased shares have been retired.

Payment of Dividends: During the year ended December 31, 2010, the Company did not pay cash dividends

to holders of its common stock. During the year ended December 31, 2009, the Company paid $114 million in cash