Motorola 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

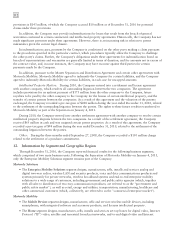

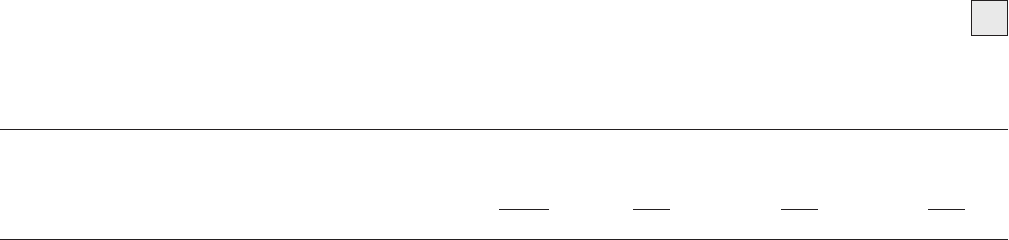

111

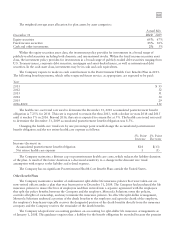

December 31, 2009

Total

Long-term

Receivable

Current Billed

Due

Past Due

Under 90 Days

Past Due

Over 90 Days

Municipal leases secured tax exempt $ 8 $ — $ — $ —

Commercial loans and leases secured $ 72 $ — $ 5 $ —

Commercial loans unsecured $ 74 $ — $ — $ 2

Total long-term receivables $ 154 $ — $ 5 $ 2

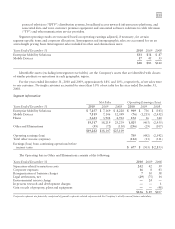

The Company uses an internally developed credit risk rating system for establishing customer credit limits. This

system is aligned and comparable to the rating systems utilized by independent rating agencies.

The Company policy for valuing the allowance for credit losses is on an individual review basis. All customer

financing receivables with past due balances greater than 90 days are reviewed for collectibility. The value of

impairment is calculated based on the net present value of anticipated future cash streams from the customer. At

December 31, 2010, there were a de minimus number of loans and leases which were impaired with an allowance

for credit loss totaling $3 million, compared to with an allowance for credit loss of $9 million at December 31,

2009.

11. Commitments and Contingencies

Legal

Iridium Program: The Company was named as one of several defendants in putative class action securities

lawsuits arising out of alleged misrepresentations or omissions regarding the Iridium satellite communications

business which, on March 15, 2001, were consolidated in the federal district court in the District of Columbia under

Freeland v. Iridium World Communications, Inc., et al., originally filed on April 22, 1999. In April 2008, the

parties reached an agreement in principle, subject to court approval, to settle all claims against Motorola in

exchange for Motorola’s payment of $20 million. During the three months ended March 29, 2008, the Company

recorded a charge associated with this settlement. On October 23, 2008, the court granted final approval of the

settlement and dismissed the claims with prejudice.

The Company was sued by the Official Committee of the Unsecured Creditors of Iridium (the “Committee”) in

the United States Bankruptcy Court for the Southern District of New York (the “Iridium Bankruptcy Court”) on

July 19, 2001. In re Iridium Operating LLC, et al. v. Motorola, plaintiffs asserted claims for breach of contract,

warranty and fiduciary duty and fraudulent transfer and preferences, and sought in excess of $4 billion in damages.

On May 20, 2008, the Bankruptcy Court approved a settlement in which Motorola is not required to pay anything,

but released its administrative, priority and unsecured claims against the Iridium estate and withdrew its objection

to the 2001 settlement between the unsecured creditors of the Iridium Debtors and the Iridium Debtors’ pre-petition

secured lenders. This settlement, and its approval by the Bankruptcy Court, extinguished Motorola’s financial

exposure and concluded Motorola’s involvement in the Iridium bankruptcy proceedings.

Other: The Company is a defendant in various other suits, claims and investigations that arise in the normal

course of business. In the opinion of management, the ultimate disposition of these matters will not have a material

adverse effect on the Company’s consolidated financial position, liquidity or results of operations.

Other

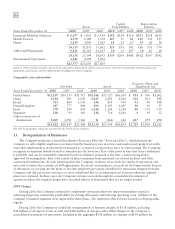

Leases: The Company owns most of its major facilities and leases certain office, factory and warehouse space,

land, and information technology and other equipment under principally non-cancelable operating leases. Rental

expense, net of sublease income, for the years ended December 31, 2010, 2009, and 2008 was $131 million,

$146 million, and $171 million, respectively. At December 31, 2010, future minimum lease obligations, net of

minimum sublease rentals, for the next five years and beyond are as follows: 2011—$205 million; 2012—

$146 million; 2013—$78 million; 2014—$54 million; 2015—$31 million; beyond—$41 million.

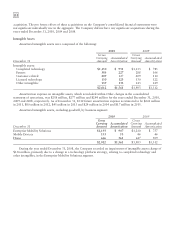

Indemnifications: The Company is a party to a variety of agreements pursuant to which it is obligated to

indemnify the other party with respect to certain matters. Some of these obligations arise as a result of divestitures

of the Company’s assets or businesses and require the Company to hold the other party harmless against losses

arising from the settlement of these pending obligations. The total amount of indemnification under these types of