Motorola 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

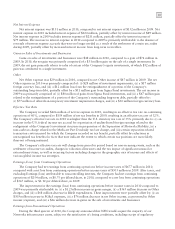

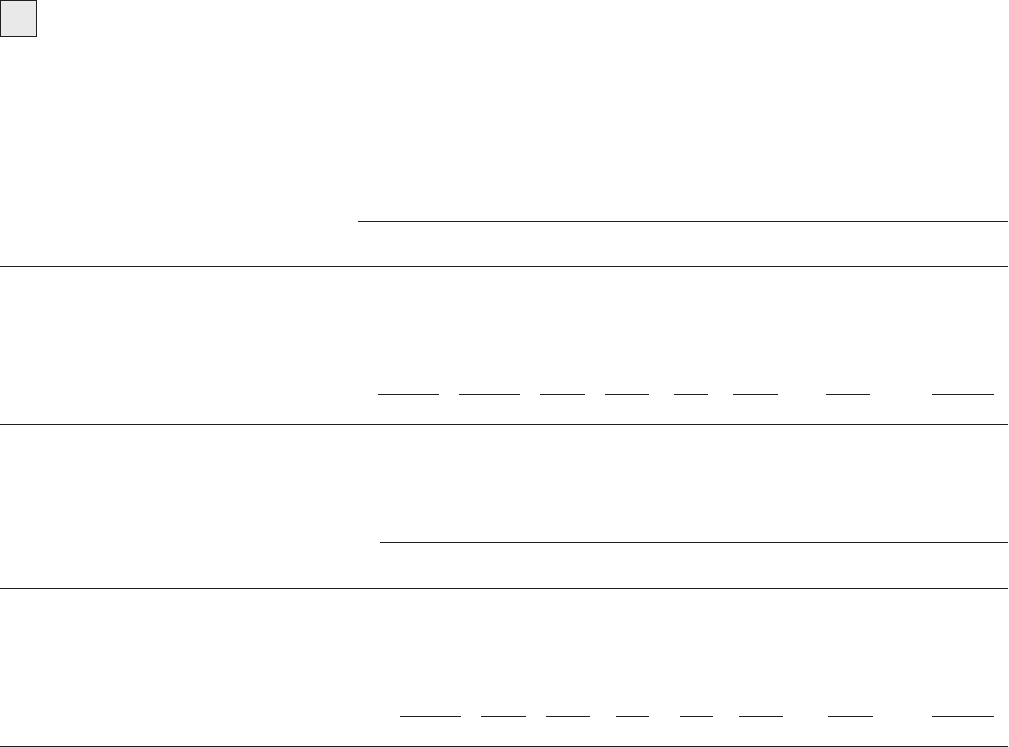

Contractual Obligations and Other Purchase Commitments

Summarized in the table below are the Company’s obligations and commitments to make future payments

under long-term debt obligations (assuming earliest possible exercise of put rights by holders), lease obligations,

purchase obligations, tax obligations and other obligations as of December 31, 2010.

Payments Due by Period

(in millions) Total 2011 2012 2013 2014 2015

Uncertain

Timeframe Thereafter

Long-Term Debt Obligations $2,660 $ 605 $405 $ 5 $ 4 $ 4 $ — $1,637

Purchase Obligations 586 482 67 36 1 — — —

Lease Obligations 555 205 146 78 54 31 — 41

Tax Obligations 234 100 — — — — 134 —

Other Obligations 100 — — — — 100 — —

Total Contractual Obligations $4,135 $1,392 $618 $119 $59 $135 $134 $1,678

Amounts included represent firm, non-cancelable commitments.

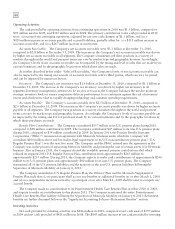

Summarized in the table below are the Company’s obligations and commitments to make future payments as of

January 4 2011, following the Separation of Motorola Mobility.

Payments Due by Period

(in millions) Total 2011 2012 2013 2014 2015

Uncertain

Timeframe Thereafter

Long-Term Debt Obligations $2,660 $605 $405 $ 5 $ 4 $ 4 $ — $1,637

Lease Obligations 343 124 86 52 37 21 — 23

Tax Obligations 209 100 — — — — 109 —

Purchase Obligations 106 63 26 17 — — — —

Other Obligations 100 — — — — 100 — —

Total Contractual Obligations $3,418 $892 $517 $74 $41 $125 $109 $1,660

Amounts included represent firm, non-cancelable commitments.

Long-Term Debt Obligations: All of the publicly-held long-term debt, including the current portion of long-

term debt, remained with Motorola Solutions following the Separation of Motorola Mobility and totaled

$2.7 billion.

Lease Obligations: The Company owns most of its major facilities, but does lease certain office, factory and

warehouse space, land, and information technology and other equipment, principally under non-cancelable

operating leases. Following the Separation of Motorola Mobility, the Motorola Solutions’ future minimum lease

obligations, net of minimum sublease rentals, totaled $343 million. Rental expense, net of sublease income, was

$131 million in 2010, $146 million in 2009 and $171 million in 2008.

Tax Obligations: Following the Separation of Motorola Mobility, Motorola Solutions has approximately

$209 million of unrecognized income tax benefits relating to multiple tax jurisdictions and tax years. Based on the

potential outcome of the Company’s global tax examinations, the expiration of the statute of limitations for specific

jurisdictions or the continued ability to satisfy tax incentive obligations, it is reasonably possible that the

unrecognized tax benefits will change within the next 12 months. The associated net tax impact on the effective tax

rate, exclusive of valuation allowance changes, is estimated to be in the range of a $50 million tax charge to a $75

million tax benefit, with cash payments not expected to exceed $100 million.

Purchase Obligations: The Company has entered into agreements for the purchase of inventory, license of

software, promotional activities, and research and development, which are firm commitments and are not

cancelable. Following the Separation of Motorola Mobility, the Motorola Solutions’ obligations in connection with

these agreements run through 2013, and the total payments expected to be made by the Company under these

agreements totaled $106 million.

The Company enters into a number of arrangements for the sourcing of supplies and materials with take-or-pay

obligations. Following the Separation of Motorola Mobility, the Motorola Solutions’ obligations with these

suppliers run through 2013 and total a minimum purchase obligation of $83 million. The Company does not