Motorola 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

for discounts, price protection, product returns, and customer incentives, among others. These estimates and

assumptions are based on management’s best estimates and judgment. Management evaluates its estimates and

assumptions on an ongoing basis using historical experience and other factors, including the current economic

environment, which management believes to be reasonable under the circumstances. We adjust such estimates and

assumptions when facts and circumstances dictate. Illiquid credit markets, volatile equity, foreign currency, energy

markets and declines in consumer spending have combined to increase the uncertainty inherent in such estimates

and assumptions. As future events and their effects cannot be determined with precision, actual results could differ

significantly from these estimates. Changes in those estimates resulting from continuing changes in the economic

environment will be reflected in the financial statements in future periods.

Reclassifications: Certain amounts in prior years’ financial statements and related notes have been reclassified

to conform to the 2010 presentation.

2. Discontinued Operations

During the three months ended October 2, 2010, the Company announced an agreement to sell certain assets

and liabilities of its Networks business to Nokia Siemens Networks B.V. (“NSN”). The total assets and total

liabilities included in the Transaction, which are preliminary estimates subject to change, are $1.4 billion and

$1.1 billion, respectively, based on balances as of December 31, 2010. The Transaction is expected to close during

the first quarter of 2011, subject to the satisfaction of closing condition, including receipt of regulatory approvals.

During the three months ended July 3, 2010, the Company completed the sale of its Israel-based wireless

network operator business formerly included as part of the Enterprise Mobility Solutions segment. The Company

received $170 million in net cash and recorded a gain on sale of the business of $20 million before income taxes,

which is included in Earnings from discontinued operations, net of tax, in the Company’s consolidated statements of

operations.

During the three months ended April 4, 2009, the Company completed the sale of: (i) Good Technology, and

(ii) the biometrics business, which includes its Printrak trademark. Collectively, the Company received $163 million

in net cash and recorded a net gain on sale of the businesses of $175 million before income taxes, which is included

in Earnings from discontinued operations, net of tax, in the Company’s consolidated statements of operations.

Beginning in the third quarter of 2010, the results of operations of the portions of the Networks business

included in the transaction with NSN, as well as the results of operations of the previously disposed businesses

discussed above, which were deemed to be immaterial for presentation as discontinued operations at the time of

their disposition, are reported as discontinued operations. All previously reported financial information has been

revised to conform to the current presentation.

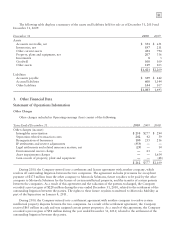

The following table displays summarized activity in the Company’s consolidated statements of operations for

discontinued operations during the years ended December 31, 2010, 2009 and 2008.

Years Ended December 31 2010 2009 2008

Net sales $3,541 $3,917 $5,039

Operating earnings 562 333 151

Gains on sales of investments and businesses, net 19 190 6

Earnings before income taxes 586 500 220

Income tax expense (benefit) 207 184 23

Earnings from discontinued operations, net of tax 379 316 197

The assets and liabilities of the Networks business, as well as the assets and liabilities of the previously disposed

businesses recorded by the Company prior to the closing of the underlying transactions, are reported as assets and

liabilities held for sale in the applicable periods presented.