Motorola 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

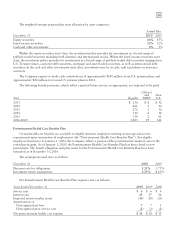

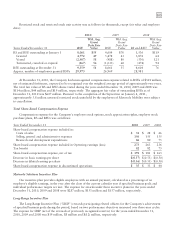

The following table summarizes the changes in fair value of our Level 3 assets:

2010 2009

Balance at January 1 $19 $134

Transfers to (from) Level 3 3(16)

Payments received and securities sold (11) (78)

Permanent impairments — (2)

Mark-to-market gain (loss) on Sigma Fund investments included in Other income (expense) 4(19)

Balance at December 31 $15 $19

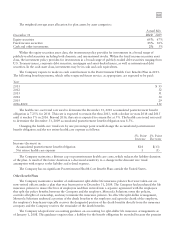

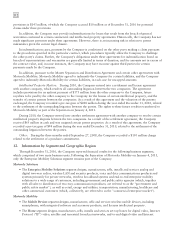

Pension and Postretirement Health Care Benefits Plan Assets

The fair value of the various pension and postretirement health care benefits plans’ assets by level in the fair

value hierarchy as of December 31, 2010 were as follows:

Regular Plan

December 31, 2010 Level 1 Level 2 Level 3 Total

Common stock and equivalents $1,222 $ 3 — $1,225

Commingled equity funds — 1,597 — 1,597

Preferred stock 9 — — 9

U.S. government and agency obligations — 100 — 100

Other government bonds — 5 — 5

Corporate bonds — 185 — 185

Mortgage-backed bonds — 197 — 197

Asset-backed bonds — 40 — 40

Commingled bond funds — 850 — 850

Commingled short-term investment funds — 76 — 76

Invested cash — 16 — 16

Total investment securities $1,231 $3,069 $— $4,300

Accrued income receivable 8

Fair value plan assets $4,308

The table above includes securities on loan as part of a securities lending arrangement of $92 million of

common stock and equivalents, $41 million of U.S. government and agency obligations and $34 million of

corporate bonds. All securities on loan are fully cash collateralized.

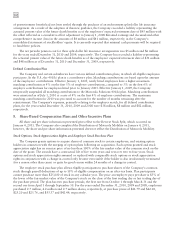

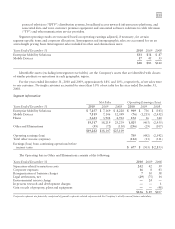

The following table summarizes the changes in fair value of the Regular Plan assets measured using Level 3

inputs:

2010

Balance at January 1 $7

Gain on assets held 1

Sales (1)

Transfers out, net (7)

Balance at December 31 $—

Officers’ Plan

December 31, 2010 Level 1 Level 2 Level 3 Total

U.S. government and agencies $— $ 9 $— $ 9

Corporate bonds — 1 — 1

Mortgage-backed bonds — 1 — 1

Commingled short-term investment funds — 1 — 1

Fair value plan assets $— $12 $— $12