Kroger 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-17

The determination of our obligation and expense for Company-sponsored pension plans and other

post-retirement benefits is dependent upon our selection of assumptions used by actuaries in calculating

those amounts. Those assumptions are described in Note 13 to the Consolidated Financial Statements and

include, among others, the discount rate, the expected long-term rate of return on plan assets, average life

expectancy and the rate of increases in compensation and health care costs. Actual results that differ from

our assumptions are accumulated and amortized over future periods and, therefore, generally affect our

recognized expense and recorded obligation in future periods. While we believe that our assumptions are

appropriate, significant differences in our actual experience or significant changes in our assumptions,

including the discount rate used and the expected return on plan assets, may materially affect our pension

and other post-retirement obligations and our future expense. Note 13 to the Consolidated Financial

Statements discusses the effect of a 1% change in the assumed health care cost trend rate on other post-

retirement benefit costs and the related liability.

The objective of our discount rate assumptions was intended to reflect the rates at which the pension

benefits could be effectively settled. In making this determination, we take into account the timing and

amount of benefits that would be available under the plans. Our methodology for selecting the discount rates

as of year-end 2010 was to match the plan’s cash flows to that of a yield curve that provides the equivalent

yields on zero-coupon corporate bonds for each maturity. Benefit cash flows due in a particular year can

theoretically be “settled” by “investing” them in the zero-coupon bond that matures in the same year. The

discount rates are the single rates that produce the same present value of cash flows. The selection of the

5.60% and 5.40% discount rates as of year-end 2010 for pension and other benefits, respectively, represent

the equivalent single rates constructed under a broad-market AA yield curve. We utilized a discount rate of

6.00% and 5.80% for year-end 2009 for pension and other benefits, respectively. A 100 basis point increase

in the discount rate would decrease the projected pension benefit obligation as of January 29, 2011, by

approximately $342 million.

To determine the expected rate of return on pension plan assets, we consider current and forecasted

plan asset allocations as well as historical and forecasted rates of return on various asset categories. For

2010 and 2009, we assumed a pension plan investment return rate of 8.5%. Our pension plan’s average rate

of return was 6.6% for the 10 calendar years ended December 31, 2010, net of all investment management

fees and expenses. The value of all investments in our Company-sponsored defined benefit pension plans

during the calendar year ending December 31, 2010, net of investment management fees and expenses,

increased 15.0%, primarily due to the strength of the market in 2010. For the past 20 years, our average

annualrateofreturnhasbeen10.7%.TheaverageannualreturnfortheS&P500overthesameperiod

of time has been 9.9%. Based on the above information and forward looking assumptions for investments

made in a manner consistent with our target allocations, we believe an 8.5% rate of return assumption

is reasonable. See Note 13 to the Consolidated Financial Statements for more information on the asset

allocations of pension plan assets.

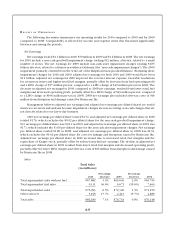

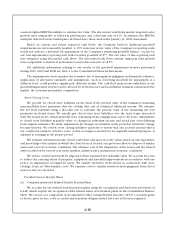

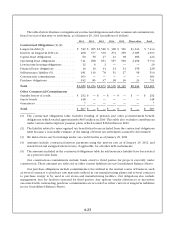

Sensitivity to changes in the major assumptions used in the calculation of Kroger’s pension plan

liabilities for the qualified plans is illustrated below (in millions).

Percentage

Point Change

Projected Benefit

Obligation

Decrease/(Increase)

Expense

Decrease/(Increase)

Discount Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . +/- 1.0% $342/(414) $28/($33)

Expected Return on Assets .................. +/- 1.0% — $23/($23)

We contributed $141 million in 2010, $265 million in 2009 and $20 million in 2008 to our Company-

sponsored defined benefit pension plans. We do not expect to make a cash contribution to our Company-

sponsored defined benefit pension plans in 2011. Contributions may be made if required under the Pension