Kroger 2010 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-72

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

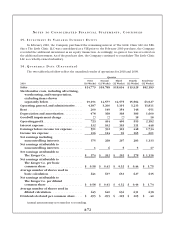

15. I N V E S T M E N T IN VA R I A B L E IN T E R E S T EN T I T Y

In February 2010, the Company purchased the remaining interest of The Little Clinic LLC for $86.

Since The Little Clinic LLC was consolidated as a VIE prior to the February 2010 purchase, the Company

recorded the additional investment as an equity transaction. Accordingly, no gain or loss was recorded on

the additional investment. As of the purchase date, the Company continued to consolidate The Little Clinic

LLC as a wholly-owned subsidiary.

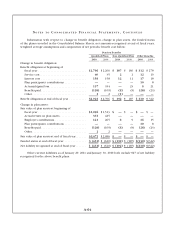

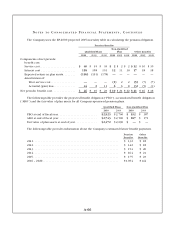

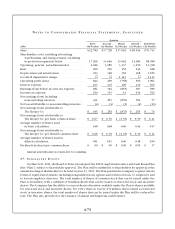

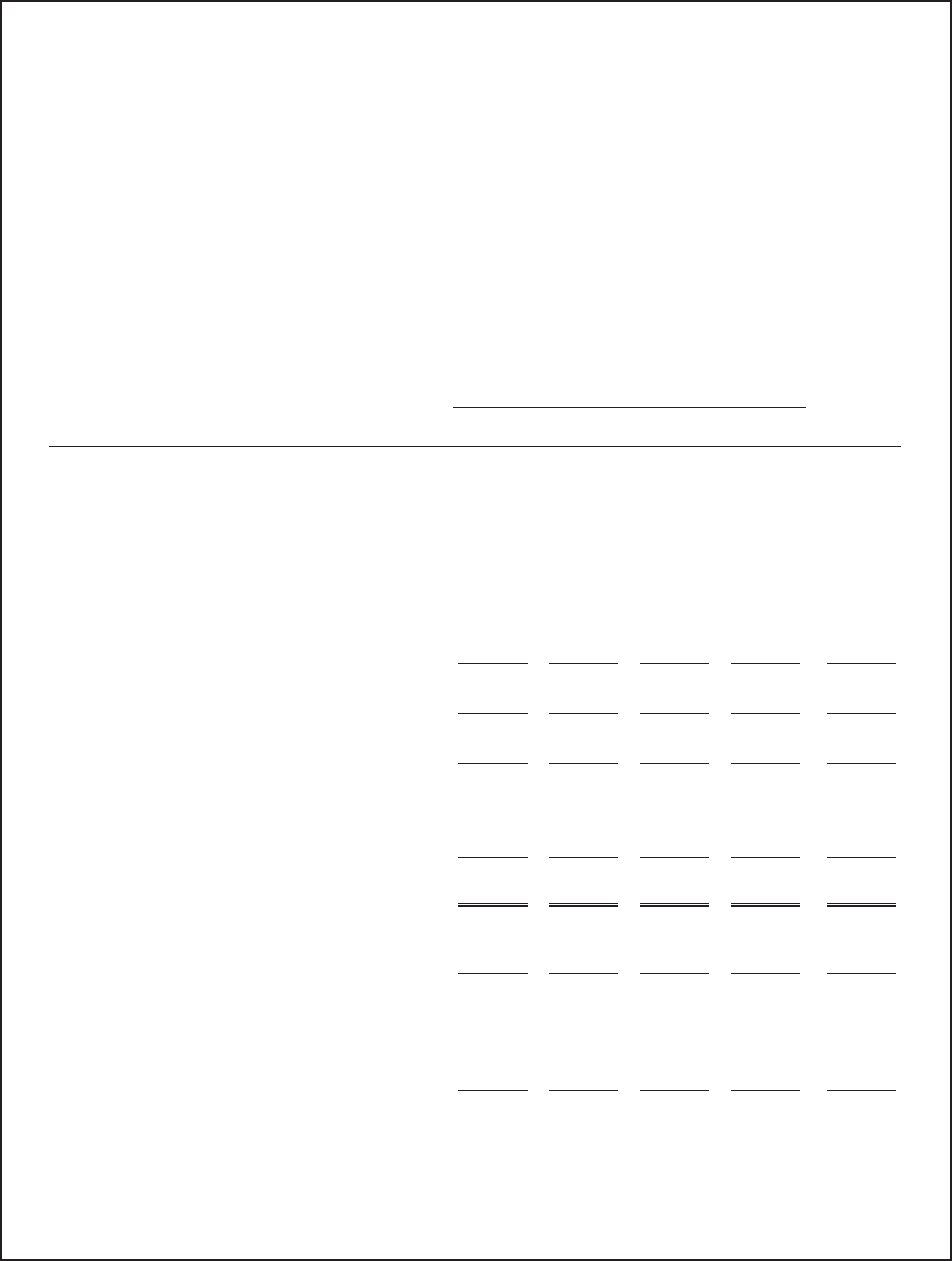

16. QU A R T E R L Y DA T A (UN A U D I T E D )

The two tables that follow reflect the unaudited results of operations for 2010 and 2009.

Quarter

2010

First

(16 Weeks)

Second

(12 Weeks)

Third

(12 Weeks)

Fourth

(12 Weeks)

Total Year

(52 Weeks)

Sales ................................... $24,779 $18,788 $18,694 $19,928 $82,189

Merchandise costs, including advertising,

warehousing, and transportation,

excluding items shown

separately below ...................... 19,191 14,577 14,575 15,584 63,927

Operating, general, and administrative ..... 4,187 3,200 3,191 3,233 13,811

Rent ................................... 200 149 154 148 651

Depreciation and amortization ............ 478 368 368 386 1,600

Goodwill impairment charge ............. ———18 18

Operating profit ......................... 723 494 406 559 2,182

Interest expense ......................... 132 102 103 111 448

Earnings before income tax expense ....... 591 392 303 448 1,734

Income tax expense ..................... 216 124 96 165 601

Net earnings including

noncontrolling interests ............... 375 268 207 283 1,133

Net earnings attributable to

noncontrolling interests ............... 1 6 5 5 17

Net earnings attributable to

The Kroger Co. ....................... $ 374 $ 262 $ 202 $ 278 $ 1,116

Net earnings attributable to

The Kroger Co. per basic

common share ....................... $ 0.58 $ 0.41 $ 0.32 $ 0.44 $ 1.75

Average number of shares used in

basic calculation ...................... 641 637 633 627 635

Net earnings attributable to

The Kroger Co. per diluted

common share ....................... $ 0.58 $ 0.41 $ 0.32 $ 0.44 $ 1.74

Average number of shares used in

diluted calculation .................... 645 640 636 631 638

Dividends declared per common share ..... $ .095 $ .095 $ .105 $ .105 $ .40

Annual amounts may not sum due to rounding.