Kroger 2010 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-52

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

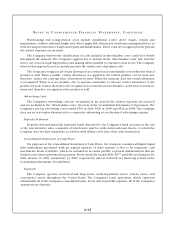

Cash Flow Forward-Starting Interest Rate Swaps

As of January 29, 2011 and January 30, 2010, the Company did not maintain any forward-starting

interest rate swap derivatives.

The Company has unamortized net payments from three forward-starting interest rate swaps once

classified as cash flow hedges totaling approximately $8 ($5 net of tax). The unamortized proceeds and

payments from these terminated forward-starting interest rate swaps have been recorded net of tax in

other comprehensive income and will be amortized to earnings as the payments of interest to which the

hedges relate are made. As of January 29, 2011, the Company expects to reclassify an unrealized net loss of

$3 from AOCI to earnings over the next twelve months.

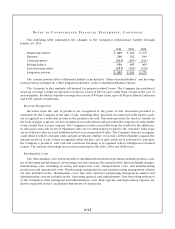

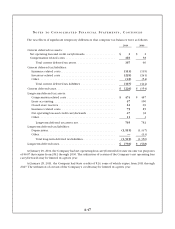

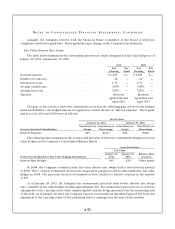

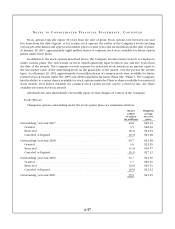

The following table summarizes the effect of the Company’s derivative instruments designated as

cash flow hedges for 2010 and 2009:

Year-To-Date

Derivatives in Cash Flow Hedging

Relationships

Amount of Gain/(Loss)

in AOCI on Derivative

(Effective Portion)

Amount of Gain/(Loss)

Reclassified from AOCI

into Income

(Effective Portion)

Location of Gain/

(Loss) Reclassified

into Income

(Effective Portion)2010 2009 2010 2009

Forward-Starting Interest Rate

Swaps, net of tax . . . . . . . . . . . . $(5) $(7) $(2) $(2) Interest expense

Commodity Price Protection

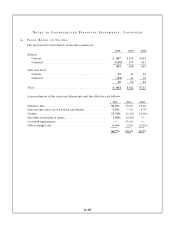

The Company enters into purchase commitments for various resources, including raw materials

utilized in its manufacturing facilities and energy to be used in its stores, warehouses, manufacturing

facilities and administrative offices. The Company enters into commitments expecting to take delivery

of and to utilize those resources in the conduct of normal business. Those commitments for which the

Company expects to utilize or take delivery in a reasonable amount of time in the normal course of business

qualify as normal purchases and normal sales.

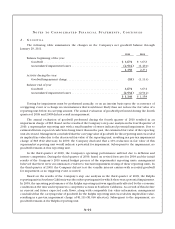

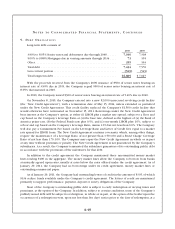

7. FA I R VA L U E ME A S U R E M E N T S

In September 2006, the FASB issued new standards defining fair value, establishing a market-based

framework for measuring fair value and expanding disclosures about fair value measurements. The new

standards did not expand or require any new fair value measurements. The standards are effective for

financial assets and financial liabilities for fiscal years beginning after November 15, 2007. In February

2008, the FASB issued new standards deferring the effective date for most non-financial assets and non-

financial liabilities to fiscal years beginning after November 15, 2008. The Company adopted the new

standards issued in September 2006 for financial assets and financial liabilities effective February 3, 2008

and adopted the remaining provisions of the new standards for nonfinancial assets and nonfinancial

liabilities on February 1, 2009.