Kroger 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

• amerger,consolidation,shareexchange,division,orotherreorganizationortransactionwithKroger

results in Kroger’s voting securities existing prior to that event representing less than 60% of the

combined voting power immediately after the event;

• Kroger’sshareholdersapproveaplanofcompleteliquidationorwindingupofKrogeroranagreement

for the sale or disposition of all or substantially all of Kroger’s assets; or

• duringanyperiodof24consecutivemonths,individualsatthebeginningoftheperiodwhoconstituted

Kroger’s Board of Directors cease for any reason to constitute at least a majority of the Board of

Directors.

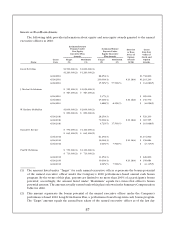

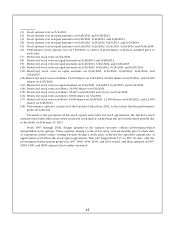

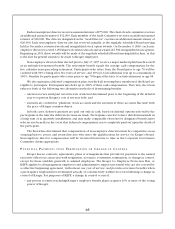

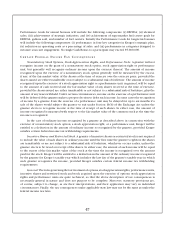

Assuming that a change in control occurred on the last day of Kroger’s fiscal year 2010, and the named

executive officers had their employment terminated, they would receive a maximum payment, or, in the

case of group term life insurance, a benefit having a cost to Kroger, in the amounts shown below:

Name

Severance

Benefit

Additional

Vacation and

Bonus

Accrued

and Banked

Vacation

Group Term

Life Insurance

Tuition

Reimbursement

Outplacement

Reimbursement

David B. Dillon . . . . . . . $4,620,000 $99,615 $678,462 $29 $5,000 $10,000

J. Michael Schlotman ... $1,955,000 $36,490 $328,462 $29 $5,000 $10,000

W. Rodney McMullen ... $3,180,000 $66,891 $479,231 $29 $5,000 $10,000

Donald E. Becker ...... $2,090,000 $38,430 $507,692 $29 $5,000 $10,000

Paul W. Heldman ...... $2,218,000 $39,212 $181,000 $29 $5,000 $10,000

Each of the named executive officers also is entitled to continuation of health care coverage for up

to 24 months at the same contribution rate as existed prior to the change in control. The cost to Kroger

cannot be calculated, as Kroger self insures the health care benefit and the cost is based on the health care

services utilized by the participant and eligible dependents.

Under KEPP benefits will be reduced, to the extent necessary, so that payments to an executive

officer will in no event exceed 2.99 times the officer’s average W-2 earnings over the preceding five years.

Kroger’s change in control benefits under KEPP and under stock option and restricted stock agreements

are discussed further in the Compensation Discussion and Analysis section under the “Retirement and

Other Benefits” heading.

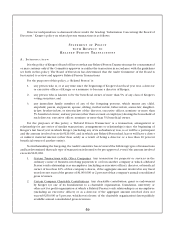

CO M P E N S A T I O N PO L I C I E S A S T H E Y RE L A T E T O RI S K MA N A G E M E N T

Kroger’s compensation policies and practices for its employees are designed to attract and retain

highly qualified and engaged employees, and to minimize risks that would have a material adverse effect

on Kroger. One of these policies, the executive compensation recoupment policy, is more particularly

described in the Compensation Discussion and Analysis. Kroger does not believe that its compensation

policies and practices create risks that are reasonably likely to have a material adverse effect on Kroger.