Kroger 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-45

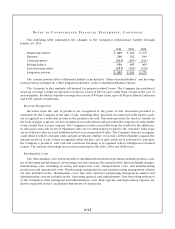

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

Based on current and future expected cash flows, the Company believes additional goodwill

impairments are not reasonably possible. A 10% reduction in fair value of the Company’s reporting units

would not indicate a potential for impairment of the Company’s remaining goodwill balance, except for

one non-supermarket reporting unit with recorded goodwill of $77. The fair value of this reporting unit

was estimated using discounted cash flows. The discounted cash flows assume long-term sales growth

rates comparable to historical performances and a discount rate of 12.5%.

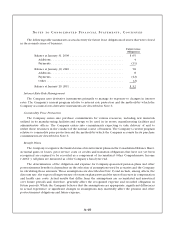

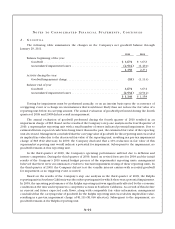

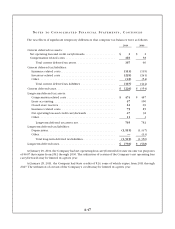

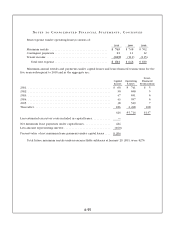

3. PR O P E R T Y , PL A N T A N D EQ U I P M E N T , NE T

Property, plant and equipment, net consists of:

2010 2009

Land ...................................................... $ 2,168 $ 2,058

Buildings and land improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,417 6,999

Equipment ................................................. 9,806 9,553

Leasehold improvements ..................................... 5,852 5,483

Construction-in-progress ..................................... 904 1,010

Leased property under capital leases and financing obligations ....... 569 570

Total property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . 26,716 25,673

Accumulated depreciation and amortization ...................... (12,569) (11,744)

Property, plant and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14,147 $ 13,929

Accumulated depreciation for leased property under capital leases was $317 at January 29, 2011, and

$299 at January 30, 2010.

Approximately $247 and $382, original cost, of Property, Plant and Equipment collateralized certain

mortgages at January 29, 2011 and January 30, 2010, respectively.