Kroger 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-48

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

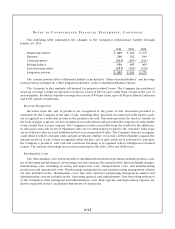

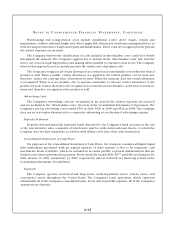

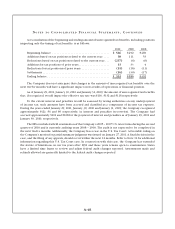

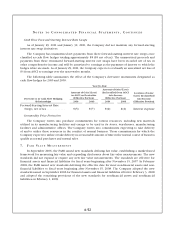

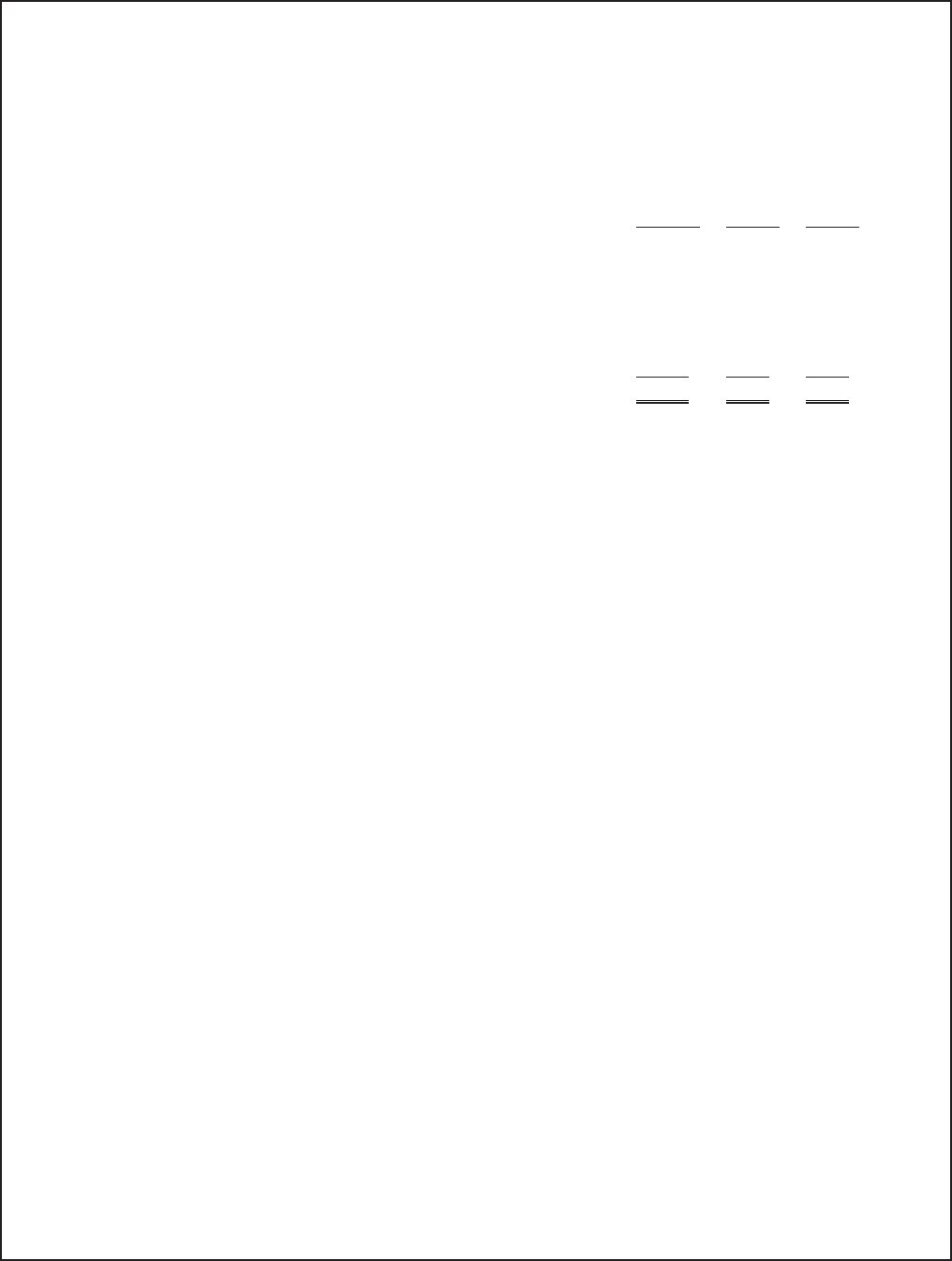

A reconciliation of the beginning and ending amount of unrecognized tax benefits, including positions

impacting only the timing of tax benefits, is as follows:

2010 2009 2008

Beginning balance ..................................... $ 586 $492 $469

Additions based on tax positions related to the current year . . . . 38 111 53

Reductions based on tax positions related to the current year . . . (237) (4) (6)

Additions for tax positions of prior years .................... 13 33 4

Reductions for tax positions of prior years . . . . . . . . . . . . . . . . . . (51) (16) (11)

Settlements ........................................... (16) (30) (17)

Ending balance ........................................ $ 333 $586 $492

The Company does not anticipate that changes in the amount of unrecognized tax benefits over the

next twelve months will have a significant impact on its results of operations or financial position.

As of January 29, 2011, January 30, 2010 and January 31, 2009, the amount of unrecognized tax benefits

that, if recognized, would impact the effective tax rate was $116, $132 and $116 respectively.

To the extent interest and penalties would be assessed by taxing authorities on any underpayment

of income tax, such amounts have been accrued and classified as a component of income tax expense.

During the years ended January 29, 2011, January 30, 2010 and January 31, 2009, the Company recognized

approximately $(2), $4 and $6 respectively, in interest and penalties (recoveries). The Company had

accrued approximately $101 and $108 for the payment of interest and penalties as of January 29, 2011 and

January 30, 2010, respectively.

The IRS concluded a field examination of the Company’s 2005 – 2007 U.S. tax returns during the second

quarter of 2010 and is currently auditing years 2008 – 2009. The audit is not expected to be completed in

the next twelve months. Additionally, the Company has a case in the U.S. Tax Court. A favorable ruling on

the Company’s motion for partial summary judgment was issued on January 27, 2011. A final decision in the

case, and the filing of any appeals, should occur within the next 12 months. Refer to Note 11 for additional

information regarding this U.S. Tax Court case. In connection with this case, the Company has extended

the statute of limitations on our tax years after 1991 and those years remain open to examination. States

have a limited time frame to review and adjust federal audit changes reported. Assessments made and

refunds allowed are generally limited to the federal audit changes reported.