Kroger 2010 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-73

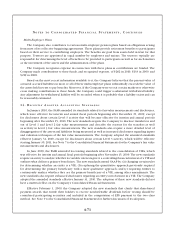

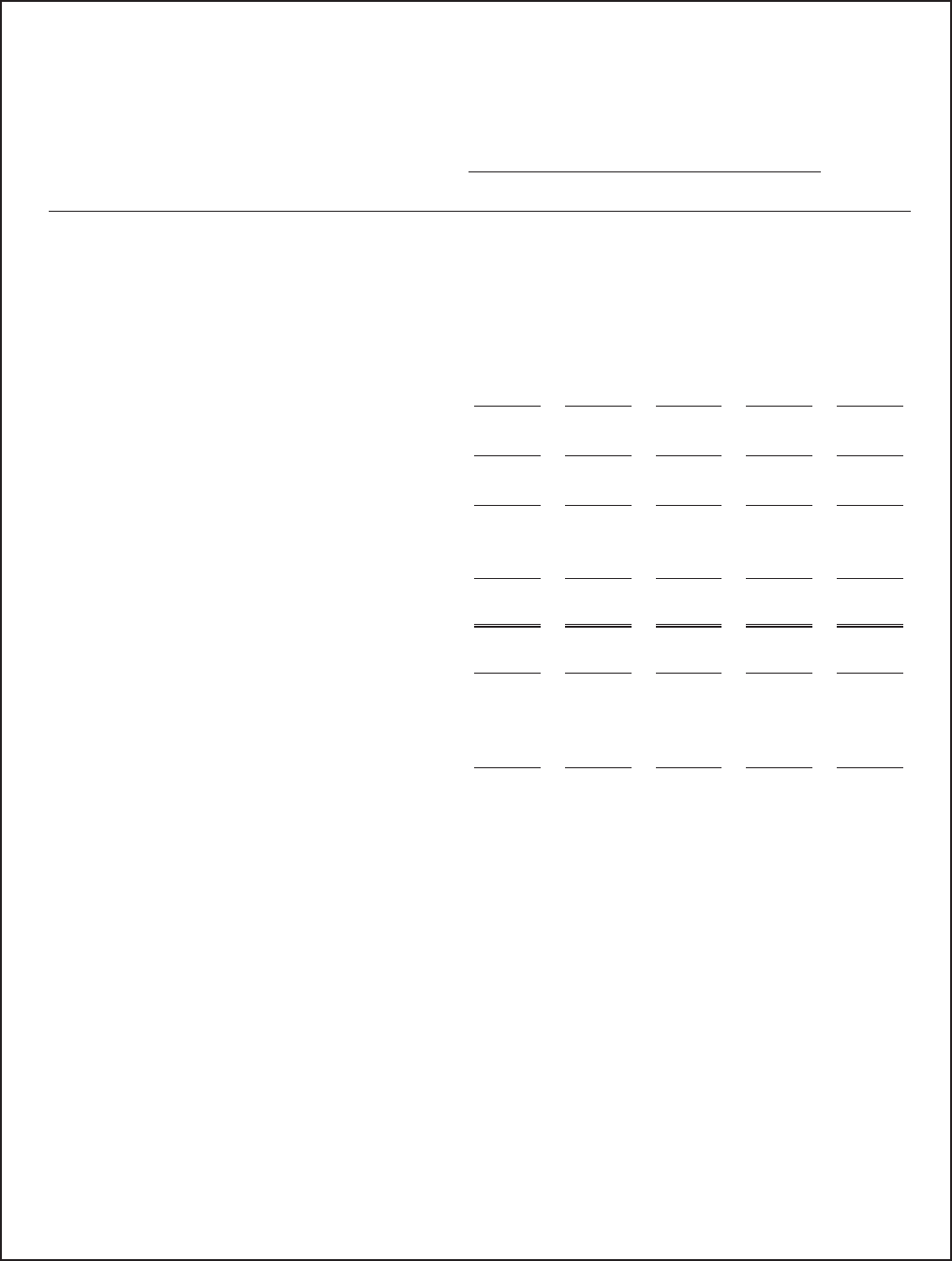

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N C L U D E D

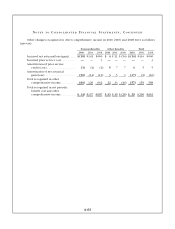

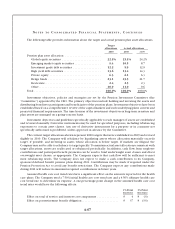

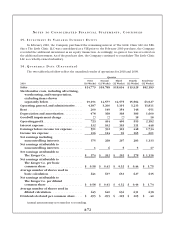

Quarter

2009

First

(16 Weeks)

Second

(12 Weeks)

Third

(12 Weeks)

Fourth

(12 Weeks)

Total Year

(52 Weeks)

Sales $22,789 $17,728 $17,662 $18,554 $76,733

Merchandise costs, including advertising,

warehousing, and transportation, excluding

items shown separately below . . . . . . . . . . . . . 17,266 13,646 13,662 14,384 58,958

Operating, general, and administrative . . . . . . . . . 4,026 3,085 3,137 3,150 13,398

Rent ..................................... 200 150 152 146 648

Depreciation and amortization ................ 453 348 356 368 1,525

Goodwill impairment charge ................. — — 1,113 —1,113

Operating profit (loss) . . . . . . . . . . . . . . . . . . . . . . 844 499 (758) 506 1,091

Interest expense ........................... 163 115 105 119 502

Earnings (loss) before income tax expense ...... 681 384 (863) 387 589

Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . 250 133 13 136 532

Net earnings (loss) including

noncontrolling interests . . . . . . . . . . . . . . . . . . 431 251 (876) 251 57

Net loss attributable to noncontrolling interests . . (4) (4) (1) (4) (13)

Net earnings (loss) attributable to

The Kroger Co. . . . . . . . . . . . . . . . . . . . . . . . . . $ 435 $ 255 $ (875) $ 255 $ 70

Net earnings (loss) attributable to

The Kroger Co. per basic common share ..... $ 0.67 $ 0.39 $ (1.35) $ 0.39 $ 0.11

Average number of shares used

in basic calculation . . . . . . . . . . . . . . . . . . . . . . 648 648 646 644 647

Net earnings (loss) attributable to

The Kroger Co. per diluted common share . . . $ 0.66 $ 0.39 $ (1.35) $ 0.39 $ 0.11

Average number of shares used in

diluted calculation ....................... 651 651 646 648 650

Dividends declared per common share . . . . . . . . . $ .09 $ .09 $ .095 $ .095 $ .37

Annual amounts may not sum due to rounding.

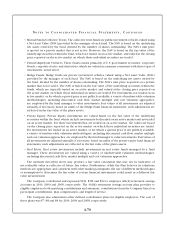

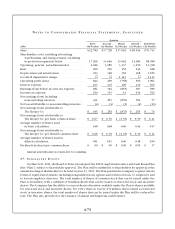

17. SU B S E Q U E N T EV E N T S

On March 10, 2011, the Board of Directors adopted the 2011 Long-Term Incentive and Cash Bonus Plan

(the “Plan”), subject to shareholder approval. The Plan will be submitted to shareholders for approval at the

annual meeting of shareholders to be held on June 23, 2011. The Plan permits the Company to grant various

forms of equity-based awards, including nonqualified stock options and restricted stock, to employees and

to its non-employee directors. The total number of shares of common stock that can be issued under the

Plan is 20 million, with a sublimit of 8 million shares that can be issued as restricted stock and incentive

shares. The Company has the ability to convert shares otherwise available under the Plan to shares available

for restricted stock and incentive shares. For every share in excess of 8 million that is issued as restricted

stock or incentive shares, the total number of shares that can be issued under the Plan will be reduced by

four. The Plan also provides for the issuance of annual and long-term cash bonuses.