Kroger 2010 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-51

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

Annually, the Company reviews with the Financial Policy Committee of the Board of Directors

compliance with these guidelines. These guidelines may change as the Company’s needs dictate.

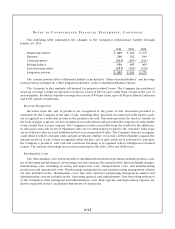

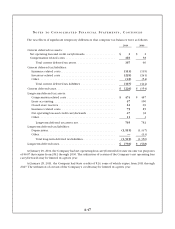

Fair Value Interest Rate Swaps

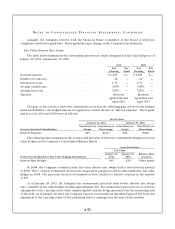

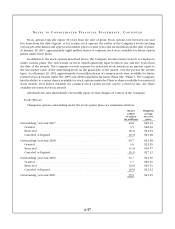

The table below summarizes the outstanding interest rate swaps designated as fair value hedges as of

January 29, 2011, and January 30, 2010.

2010 2009

Pay

Floating

Pay

Fixed

Pay

Floating

Pay

Fixed

Notional amount ....................................... $ 1,625 $— $ 1,625 $—

Number of contracts .................................... 18 — 18 —

Duration in years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.74 — 2.74 —

Average variable rate .................................... 3.83% — 3.80% —

Average fixed rate ...................................... 5.87% — 5.87% —

Maturity .............................................. Between

April 2012 and

April 2013

Between

April 2012 and

April 2013

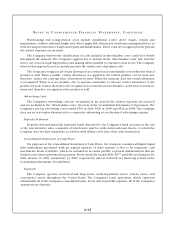

The gain or loss on these derivative instruments as well as the offsetting gain or loss on the hedged

items attributable to the hedged risk are recognized in current income as “Interest expense.” These gains

and losses for 2010 and 2009 were as follows:

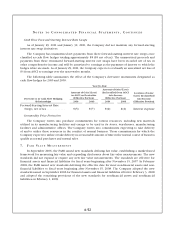

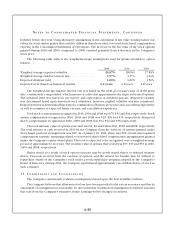

Year-To-Date

January 29, 2011 January 30, 2010

Income Statement Classification

Gain/(Loss) on

Swaps

Gain/(Loss) on

Borrowings

Gain/(Loss) on

Swaps

Gain/(Loss) on

Borrowings

Interest Expense ...................... $45 $(41) $26 $(28)

The following table summarizes the location and fair value of derivative instruments designated as fair

value hedges on the Company’s Consolidated Balance Sheets:

Asset Derivatives

Fair Value

Derivatives Designated as Fair Value Hedging Instruments

January 29,

2011

January 30,

2010

Balance Sheet

Location

Interest Rate Hedges ................................... $45 $26 Other Assets

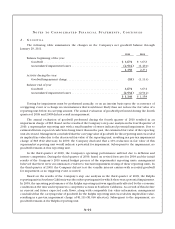

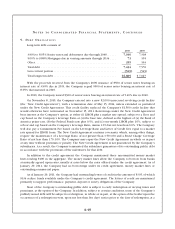

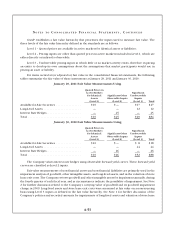

In 2008, the Company terminated nine fair value interest rate swaps with a total notional amount

of $900. Three of these terminated interest rate swaps were purchased and became ineffective fair value

hedges in 2008. The proceeds received at termination were credited to interest expense in the amount

of $15.

As of January 29, 2011, the Company has unamortized proceeds from twelve interest rate swaps

once classified as fair value hedges totaling approximately $16. The unamortized proceeds are recorded as

adjustments to the carrying values of the underlying debt and are being amortized over the remaining term

of the debt. As of January 29, 2011, the Company expects to reclassify an unrealized gain of $10 from this

adjustment to the carrying values of the underlying debt to earnings over the next twelve months.