Kroger 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

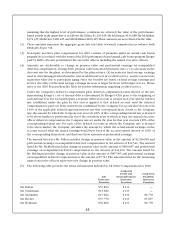

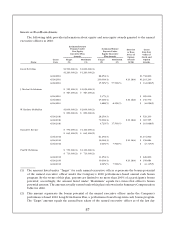

Beginning in 2010, as a part of the 2010 long-term plan, the Committee also awarded performance

units to the same individuals that receive the long-term performance-based cash bonus described in the

previous section. During 2010, Kroger awarded 355,525 performance units to 136 employees, including the

named executive officers. The number of shares of restricted stock that participants otherwise would have

received was reduced by 50% in order to make a larger share of the participants’ equity compensation be

tied to Kroger performance. Under the 2010 plan, participants receive a 1% payout for each point by which

the performance in the key categories increases, a 0.25% payout for each percentage reduction in operating

costs, and a 2% payout based on improvement in associate engagement measures. Total operating costs as

a percentage of sales, excluding fuel, at the commencement of the 2010 plan were 27.62%. Actual payouts

are based on the degree to which improvements are achieved, will be earned in Kroger common shares,

and cannot exceed 100% of the number of performance units awarded. In addition to shares earned under

performance units, participants receive a cash payment equal to the cash dividends that would have been

earned on that number of shares had the participant owned the shares during the performance period.

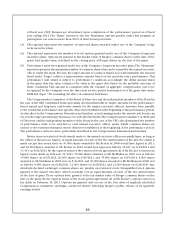

The Committee considers several factors in determining the amount of options, restricted shares, and

performance units awarded to the named executive officers or, in the case of the CEO, recommending to

the independent directors the amount awarded. These factors include:

• The compensation consultant’s benchmarking report regarding equity-based and other long-term

compensation awarded by our competitors;

• The officer’s level in the organization and the internal relationship of equity-based awards within

Kroger;

• Individualperformance;and

• TherecommendationoftheCEO,forallnamedexecutiveofficersotherthaninthecaseoftheCEO.

The Committee has long recognized that the amount of compensation provided to the named executive

officers through equity-based pay is often below the amount paid by our competitors. Lower equity-based

awards for the named executive officers and other senior management permit a broader base of Kroger

employees to participate in equity awards.

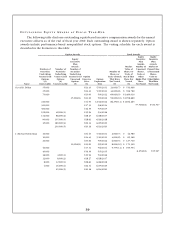

Amounts of equity awards issued and outstanding for the named executive officers are set forth in the

tables that follow this discussion and analysis.

RE T I R E M E N T A N D OT H E R BE N E F I T S

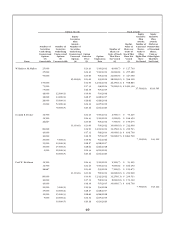

Kroger maintains a defined benefit and several defined contribution retirement plans for its employees.

The named executive officers participate in one or more of these plans, as well as one or more excess plans

designed to make up the shortfall in retirement benefits created by limitations under the Internal Revenue

Code on benefits to highly compensated individuals under qualified plans. Additional details regarding

retirement benefits available to the named executive officers can be found in the 2010 Pension Benefits

table and the accompanying narrative description that follows this discussion and analysis.

Kroger also maintains an executive deferred compensation plan in which some of the named executive

officers participate. This plan is a nonqualified plan under which participants can elect to defer up to 100%

of their cash compensation each year. Compensation deferred bears interest, until paid out, at the rate

representing Kroger’s cost of ten-year debt in the year the rate is set, as determined by Kroger’s CEO prior

to the beginning of each deferral year. In 2010, that rate was 6.32%. Deferred amounts are paid out only

in cash, in accordance with a deferral option selected by the participant at the time the deferral election

is made.