Kroger 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-47

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

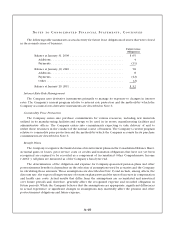

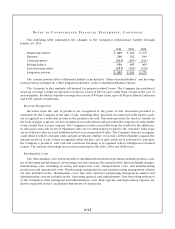

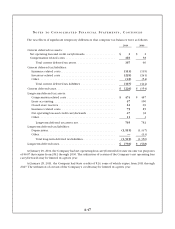

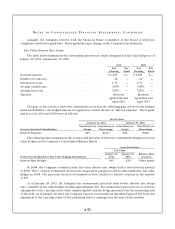

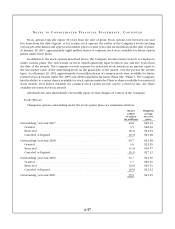

The tax effects of significant temporary differences that comprise tax balances were as follows:

2010 2009

Current deferred tax assets:

Net operating loss and credit carryforwards.................... $ 2 $ 2

Compensation related costs ................................ 165 58

Total current deferred tax assets ......................... 167 60

Current deferred tax liabilities:

Insurance related costs ................................... (113) (119)

Inventory related costs ................................... (229) (241)

Other................................................. (45) (54)

Total current deferred tax liabilities ...................... (387) (414)

Current deferred taxes...................................... $ (220) $ (354)

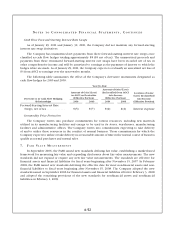

Long-term deferred tax assets:

Compensation related costs ............................... $ 474 $ 487

Lease accounting........................................ 97 100

Closed store reserves .................................... 61 69

Insurance related costs .................................. 75 85

Net operating loss and credit carryforwards .................. 47 38

Other................................................. 11 3

Long-term deferred tax assets, net........................ 765 782

Long-term deferred tax liabilities:

Depreciation ........................................... (1,515) (1,337)

Other................................................. — (13)

Total long-term deferred tax liabilities..................... (1,515) (1,350)

Long-term deferred taxes.................................... $ (750) $ (568)

At January 29, 2011, the Company had net operating loss carryforwards for state income tax purposes

of $607 that expire from 2012 through 2030. The utilization of certain of the Company’s net operating loss

carryforwards may be limited in a given year.

At January 29, 2011, the Company had State credits of $24, some of which expire from 2011 through

2027. The utilization of certain of the Company’s credits may be limited in a given year.