Kroger 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-60

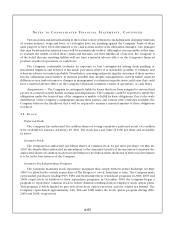

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

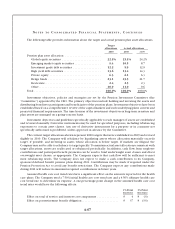

The principal contingencies are described below:

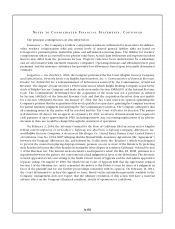

Insurance — The Company’s workers’ compensation risks are self-insured in most states. In addition,

other workers’ compensation risks and certain levels of insured general liability risks are based on

retrospective premium plans, deductible plans, and self-insured retention plans. The liability for workers’

compensation risks is accounted for on a present value basis. Actual claim settlements and expenses incident

thereto may differ from the provisions for loss. Property risks have been underwritten by a subsidiary

and are all reinsured with unrelated insurance companies. Operating divisions and subsidiaries have paid

premiums, and the insurance subsidiary has provided loss allowances, based upon actuarially determined

estimates.

Litigation — On October 6, 2006, the Company petitioned the Tax Court (Ralphs Grocery Company

and Subsidiaries, formerly known as Ralphs Supermarkets, Inc. v. Commissioner of Internal Revenue,

Docket No. 20364-06) for a redetermination of deficiencies asserted by the Commissioner of Internal

Revenue. The dispute at issue involves a 1992 transaction in which Ralphs Holding Company acquired the

stock of Ralphs Grocery Company and made an election under Section 338(h)(10) of the Internal Revenue

Code. The Commissioner determined that the acquisition of the stock was not a purchase as defined

by Section 338(h)(3) of the Internal Revenue Code and that the acquisition therefore does not qualify

for a Section 338(h)(10) election. On January 27, 2011, the Tax Court issued its opinion upholding the

Company’s position that the acquisition of the stock qualified as a purchase, granting the Company’s motion

for partial summary judgment and denying the Tax Commissioner’s motion. The Company anticipates that

all remaining issues in the matter will be resolved and the Tax Court will enter its decision. The parties

will then have 90 days to file an appeal. As of January 29, 2011, an adverse decision would have required a

cash payment of up to approximately $516, including interest. Any accounting implications of an adverse

decision in this case would be charged through the statement of operations.

On February 2, 2004, the Attorney General for the State of California filed an action in Los Angeles

federal court (California, ex rel Lockyer v. Safeway, Inc. dba Vons, a Safeway Company; Albertson’s, Inc.

and Ralphs Grocery Company, a division of The Kroger Co., United States District Court Central District

of California, Case No. CV04-0687) alleging that the Mutual Strike Assistance Agreement (the “Agreement”)

between the Company, Albertson’s, Inc. and Safeway Inc. (collectively, the “Retailers”), which was designed

to prevent the union from placing disproportionate pressure on one or more of the Retailers by picketing

such Retailer(s) but not the other Retailer(s) during the labor dispute in southern California, violated Section

1 of the Sherman Act. The lawsuit seeks declarative and injunctive relief. On May 28, 2008, pursuant to a

stipulation between the parties, the court entered a final judgment in favor of the defendants. The Attorney

General appealed a trial court ruling to the Ninth Circuit Court of Appeals and the defendants appealed a

separate ruling. On August 17, 2010, the Ninth Circuit Court of Appeals held that the Agreement violated

Section 1 of the Sherman Act, and it remanded the matter to the District Court for entry of a judgment in

favor of the plaintiff and for any further proceedings consistent with its opinion. On February 11, 2011,

the Court determined to re-hear the appeal en banc. Based on the information presently available to the

Company, management does not expect that the ultimate resolution of this action will have a material

adverse effect on the Company’s financial condition, results of operations or cash flows.