Kroger 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-69

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

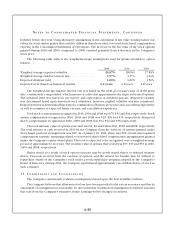

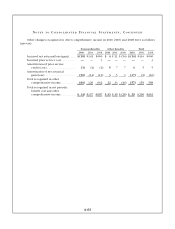

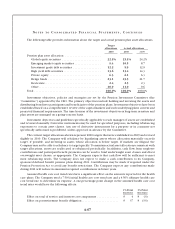

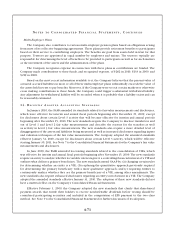

For measurements using significant unobservable inputs (Level 3) during 2010 and 2009, a

reconciliation of the beginning and ending balances is as follows:

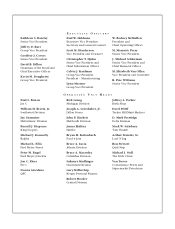

Hedge Funds Private Equity Real Estate

Beginning balance, February 1, 2009 ....................... $347 $140 $ 49

Contributions into Fund ................................. 24 12 17

Realized gains (losses) .................................. — — (4)

Unrealized gains (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84 (11) (12)

Distributions .......................................... — (7) (1)

Other ................................................ — (6) —

Ending balance, January 30, 2010 .......................... 455 128 49

Contributions into Fund ................................. 80 20 12

Realized gains (losses) .................................. — 7 1

Unrealized gains (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45 18 4

Distributions .......................................... — (20) (4)

Other ................................................ — (3) —

Ending balance, January 31, 2011 .......................... $580 $150 $ 62

See Note 7 for a discussion of the levels of the fair value hierarchy. The assets’ fair value measurement

level above is based on the lowest level of any input that is significant to the fair value measurement.

The following is a description of the valuation methods used for the plan’s assets measured at fair

value in the above two tables:

• Cash:Thecarryingvalueapproximatesfairvalue.

• Corporate Stocks: The fair values of these securities are based on observable market quotations

for identical assets and are valued at the closing price reported on the active market on which the

individual securities are traded.

• Corporate Bonds: The fair values of these securities are primarily based on observable market

quotations for similar bonds, valued at the closing price reported on the active market on which the

individual securities are traded. When such quoted prices are not available, the bonds are valued

using a discounted cash flows approach using current yields on similar instruments of issuers with

similar credit ratings, including adjustments for certain risks that may not be observable, such as

credit and liquidity risks.

• U.S. Government Securities: Certain U.S. Government securities are valued at the closing price

reported in the active market in which the security is traded. Other U.S. government securities are

valued based on yields currently available on comparable securities of issuers with similar credit

ratings. When quoted prices are not available for similar securities, the security is valued under a

discounted cash flows approach that maximizes observable inputs, such as current yields of similar

instruments, but includes adjustments for certain risks that may not be observable, such as credit and

liquidity risks.