Kroger 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-44

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

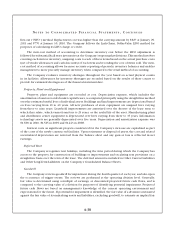

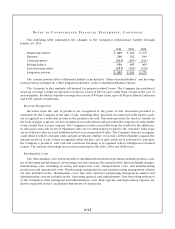

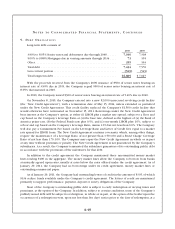

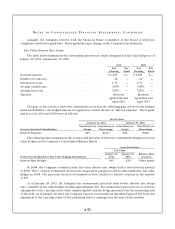

2. GO O D W I L L

The following table summarizes the changes in the Company’s net goodwill balance through

January 29, 2011.

2010 2009

Balance beginning of the year

Goodwill ................................................ $ 3,672 $ 3,672

Accumulated impairment losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,514) (1,401)

1,158 2,271

Activity during the year

Goodwill impairment charge ................................. (18) (1,113)

Balance end of year

Goodwill ................................................ 3,672 3,672

Accumulated impairment losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,532) (2,514)

$ 1,140 $ 1,158

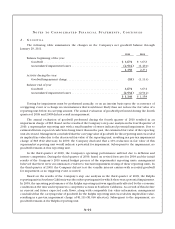

Testing for impairment must be performed annually, or on an interim basis upon the occurrence of

a triggering event or a change in circumstances that would more likely than not reduce the fair value of a

reporting unit below its carrying amount. The annual evaluation of goodwill performed during the fourth

quarter of 2009 and 2008 did not result in impairment.

The annual evaluation of goodwill performed during the fourth quarter of 2010 resulted in an

impairment charge of $18. Based on the results of the Company’s step one analysis in the fourth quarter of

2010, a supermarket reporting unit with a small number of stores indicated potential impairment. Due to

estimated future expected cash flows being lower than in the past, the estimated fair value of the reporting

unit decreased. Management concluded that the carrying value of goodwill for this reporting unit exceeded

its implied fair value due to the decreased fair value of the reporting unit, resulting in a pre-tax impairment

charge of $18 ($12 after-tax). In 2009, the Company disclosed that a 10% reduction in fair value of this

supermarket reporting unit would indicate a potential for impairment. Subsequent to the impairment, no

goodwill remains at this reporting unit.

In the third quarter of 2009, the Company’s operating performance suffered due to deflation and

intense competition. During the third quarter of 2009, based on revised forecasts for 2009 and the initial

results of the Company’s 2010 annual budget process of the supermarket reporting units, management

believed that there were circumstances evident to warrant impairment testing of these reporting units. In

the third quarter of 2009, the Company did not test the variable interest entities with recorded goodwill

for impairment as no triggering event occurred.

Based on the results of the Company’s step one analysis in the third quarter of 2009, the Ralphs

reporting unit in Southern California was the only reporting unit for which there was a potential impairment.

In 2009, the operating performance of the Ralphs reporting unit was significantly affected by the economic

conditions at the time and responses to competitive actions in Southern California. As a result of this decline

in current and future expected cash flows, along with comparable fair value information, management

concluded that the carrying value of goodwill for the Ralphs reporting unit exceeded its implied fair value,

resulting in a pre-tax impairment charge of $1,113 ($1,036 after-tax). Subsequent to the impairment, no

goodwill remains at the Ralphs reporting unit.