Kroger 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-53

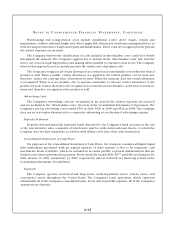

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

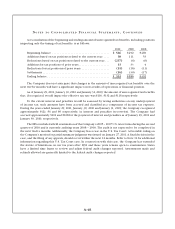

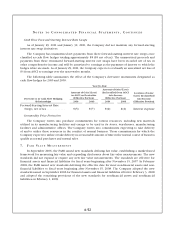

GAAP establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The

three levels of the fair value hierarchy defined in the standards are as follows:

Level 1 – Quoted prices are available in active markets for identical assets or liabilities;

Level 2 – Pricing inputs are other than quoted prices in active markets included in Level 1, which are

either directly or indirectly observable;

Level 3 – Unobservable pricing inputs in which little or no market activity exists, therefore requiring

an entity to develop its own assumptions about the assumptions that market participants would use in

pricing an asset or liability.

For items carried at (or adjusted to) fair value in the consolidated financial statements, the following

tables summarize the fair value of these instruments at January 29, 2011 and January 30, 2010:

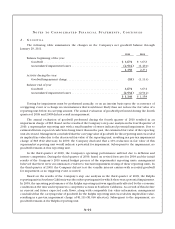

January 29, 2011 Fair Value Measurements Using

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

Available-for-Sale Securities . . . . . . . . . . . . . . . . $10 $ — $17 $27

Long-Lived Assets . . . . . . . . . . . . . . . . . . . . . . . . — — 12 12

Interest Rate Hedges ...................... — 45 — 45

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10 $45 $29 $84

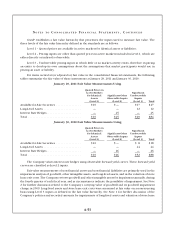

January 30, 2010 Fair Value Measurements Using

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

Available-for-Sale Securities . . . . . . . . . . . . . . . . $10 $ — $ 8 $18

Long-Lived Assets . . . . . . . . . . . . . . . . . . . . . . . . — — 44 44

Interest Rate Hedges ...................... — 26 — 26

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10 $26 $52 $88

The Company values interest rate hedges using observable forward yield curves. These forward yield

curves are classified as Level 2 inputs.

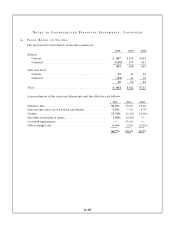

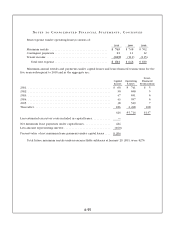

Fair value measurements of non-financial assets and non-financial liabilities are primarily used in the

impairment analysis of goodwill, other intangible assets, and long-lived assets, and in the valuation of store

lease exit costs. The Company reviews goodwill and other intangible assets for impairment annually, during

the fourth quarter of each fiscal year, and as circumstances indicate the possibility of impairment. See Note

2 for further discussion related to the Company’s carrying value of goodwill and its goodwill impairment

charge in 2009. Long-lived assets and store lease exit costs were measured at fair value on a nonrecurring

basis using Level 3 inputs as defined in the fair value hierarchy. See Note 1 for further discussion of the

Company’s policies and recorded amounts for impairments of long-lived assets and valuation of store lease