Kroger 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

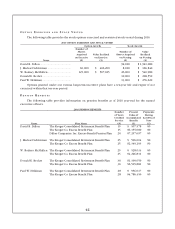

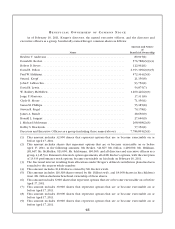

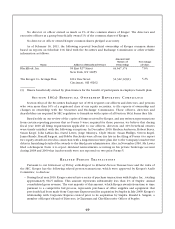

No director or officer owned as much as 1% of the common shares of Kroger. The directors and

executive officers as a group beneficially owned 1% of the common shares of Kroger.

No director or officer owned Kroger common shares pledged as security.

As of February 16, 2011, the following reported beneficial ownership of Kroger common shares

based on reports on Schedule 13G filed with the Securities and Exchange Commission or other reliable

information as follows:

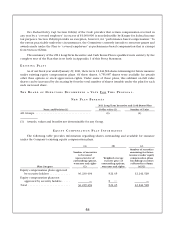

Name Address of Beneficial Owner

Amount and

Nature of

Ownership

Percentage

of Class

BlackRock, Inc.

The Kroger Co. Savings Plan

55 East 52nd Street

New York, NY 10055

1014 Vine Street

Cincinnati, OH 45202

44,647,374

32,322,323

(1)

7.0 %

5.2%

(1) Shares beneficially owned by plan trustees for the benefit of participants in employee benefit plan.

SE C T I O N 16(A) BE N E F I C I A L OW N E R S H I P RE P O R T I N G CO M P L I A N C E

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors, and persons

who own more than 10% of a registered class of our equity securities, to file reports of ownership and

changes in ownership with the Securities and Exchange Commission. Those officers, directors and

shareholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of forms received by Kroger, and any written representations

from certain reporting persons that no Forms 5 were required for those persons, we believe that during

fiscal year 2010 all filing requirements applicable to our officers, directors and 10% beneficial owners

were timely satisfied, with the following exceptions. In December 2010, Reuben Anderson, Robert Beyer,

Susan Kropf, John LaMacchia, David Lewis, Jorge Montoya, Clyde Moore, Susan Phillips, Steven Rogel,

James Runde, Ronald Sargent, and Bobby Shackouls were all one day late in the filing of Forms 4 to report

two equity awards received in connection with a long-term incentive plan due to the Company’s inadvertent

delay in furnishing details of the awards to the third party administrator. Also, in November 2010, Mr. Lewis

filed a delinquent Form 4 to report dividend reinvestments occurring in his private brokerage account

during 2008 and 2009 that inadvertently were not reported on two prior Forms 5.

RE L A T E D PE R S O N TR A N S A C T I O N S

Pursuant to our Statement of Policy with Respect to Related Person Transactions and the rules of

the SEC, Kroger has the following related person transactions, which were approved by Kroger’s Audit

Committee, to disclose:

• Duringfiscalyear2010,KrogerenteredintoaseriesofpurchasetransactionswithStaples,Inc.,totaling

approximately $14.5 million. This amount represents substantially less than 2% of Staples’ annual

consolidated gross revenue. The vast majority of this amount, which Kroger awards from time to time

pursuant to a competitive bid process, represents purchases of office supplies and equipment that

previously had been made from Corporate Express until its acquisition by Staples in July 2008. Kroger’s

relationship with Corporate Express existed prior to its acquisition by Staples. Ronald L. Sargent, a

member of Kroger’s Board of Directors, is Chairman and Chief Executive Officer of Staples.