Kroger 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-42

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

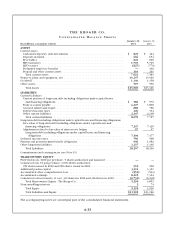

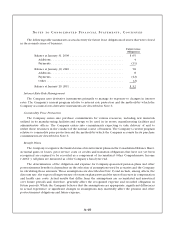

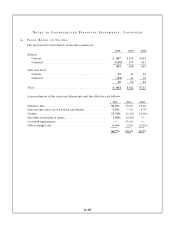

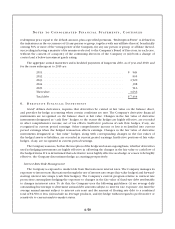

The following table summarizes the changes in the Company’s self-insurance liability through

January 29, 2011.

2010 2009 2008

Beginning balance ...................................... $ 485 $ 468 $ 470

Expense ............................................... 210 202 189

Claim payments ........................................ (181) (185) (191)

Ending balance ......................................... 514 485 468

Less current portion ..................................... (181) (182) (192)

Long-term portion ....................................... $ 333 $ 303 $ 276

The current portion of the self-insured liability is included in “Other current liabilities”, and the long-

term portion is included in “Other long-term liabilities” in the Consolidated Balance Sheets.

The Company is also similarly self-insured for property-related losses. The Company has purchased

stop-loss coverage to limit its exposure to losses in excess of $25 on a per claim basis, except in the case of

an earthquake, for which stop-loss coverage is in excess of $50 per claim, up to $200 per claim in California

and $300 outside of California.

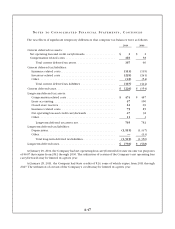

Revenue Recognition

Revenues from the sale of products are recognized at the point of sale. Discounts provided to

customers by the Company at the time of sale, including those provided in connection with loyalty cards,

are recognized as a reduction in sales as the products are sold. Discounts provided by vendors, usually in

the form of paper coupons, are not recognized as a reduction in sales provided the coupons are redeemable

at any retailer that accepts coupons. The Company records a receivable from the vendor for the difference

in sales price and cash received. Pharmacy sales are recorded when provided to the customer. Sales taxes

are recorded as other accrued liabilities and not as a component of sales. The Company does not recognize

a sale when it sells its own gift cards and gift certificates. Rather, it records a deferred liability equal to the

amount received. A sale is then recognized when the gift card or gift certificate is redeemed to purchase

the Company’s products. Gift card and certificate breakage is recognized when redemption is deemed

remote. The amount of breakage has not been material for the 2010, 2009 and 2008 years.

Merchandise Costs

The “Merchandise costs” line item of the Consolidated Statements of Operations includes product costs,

net of discounts and allowances; advertising costs (see separate discussion below); inbound freight charges;

warehousing costs, including receiving and inspection costs; transportation costs; and manufacturing

production and operational costs. Warehousing, transportation and manufacturing management salaries

are also included in the “Merchandise costs” line item; however, purchasing management salaries and

administration costs are included in the “Operating, general, and administrative” line item along with most

of the Company’s other managerial and administrative costs. Rent expense and depreciation expense are

shown separately in the Consolidated Statements of Operations.