Kroger 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-12

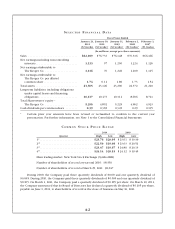

OG&Aexpenses,asapercentageofsales,were16.80%in2010,17.46%in2009and17.14%in2008.

ThegrowthinourretailfuelsalesreducesourOG&ArateduetotheverylowOG&Arateonretailfuelsales

ascomparedtonon-fuelsales.OG&Aexpenses,asapercentageofsalesexcludingfuel,decreased14basis

points in 2010, compared to 2009. The 2010 decrease, compared to 2009, resulted primarily from increased

supermarket identical sales growth, strong cost controls at the store level and reduced utility costs. These

improvements were partially offset by increases in pension and health care expenses and credit card fees.

OG&Aexpenses,asapercentageofsalesexcludingfuel,decreased3basispointsin2009,comparedto

2008. The 2009 decrease, compared to 2008, resulted primarily from increased supermarket identical

sales growth, a reduction in bag expense, lower incentive compensation, and reduced utility costs. These

improvements were partially offset by increases in credit card fees, health care costs, and wages.

Rent Expense

Rent expense was $651 million in 2010, as compared to $648 million in 2009 and $659 million in

2008. Rent expense, as a percentage of sales, was 0.79% in 2010, as compared to 0.84% in 2009 and 0.87%

in 2008. The continual decrease in rent expense, as a percentage of sales, reflects our continued emphasis

on owning rather than leasing, whenever possible, and the benefit of increased supermarket sales.

Depreciation and Amortization Expense

Depreciation and amortization expense was $1.6 billion in 2010, $1.5 billion in 2009 and $1.4 billion

in 2008. The increase in depreciation expense from 2010, compared to 2009, was the result of additional

depreciation on capital expenditures, including prior acquisitions and the prior purchase of leased facilities,

totaling $1.9 billion in 2010. The increase in depreciation expense from 2009, compared to 2008, was

the result of additional depreciation on capital expenditures, including prior acquisitions and the prior

purchase of leased facilities, totaling $2.4 billion in 2009. Depreciation and amortization expense, as a

percentage of sales, was 1.95% in 2010, 1.99% in 2009 and 1.89% in 2008. The decrease in depreciation

and amortization expense in 2010, compared to 2009, as a percentage of sales, is primarily the result of

increasing sales. The increase in our depreciation and amortization expense in 2009, compared to 2008, as

a percentage of sales, is primarily due to increased depreciation expense, and a slower growth rate in sales

due to heightened competitive activity, deflation and year-over-year decline in retail fuel prices.

Interest Expense

Net interest expense totaled $448 million in 2010, $502 million in 2009 and $485 million in 2008.

The decrease in interest expense in 2010, compared to 2009, resulted primarily from a lower weighted

average interest rate, an average lower debt balance for the year and an increase in our benefit from interest

rate swaps. The increase in interest expense in 2009, compared to 2008, resulted primarily from a higher

weighted average interest rate and a reduction in interest income, offset partially by our benefit from

interest rate swaps.

Income Taxes

Our effective income tax rate was 34.7% in 2010, 90.4% in 2009 and 36.5% in 2008. The 2010 effective

tax rate differed from the federal statutory rate primarily as a result of the favorable resolution of certain

tax issues, partially offset by the effect of state income taxes. The 2009 effective income tax rate differed

from the federal statutory rate primarily because the goodwill impairment charge incurred in that year was

mostly non-deductible for tax purposes. Excluding the non-cash impairment charges, our effective rate in