Kroger 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

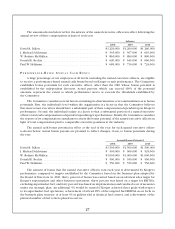

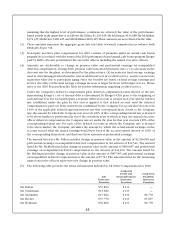

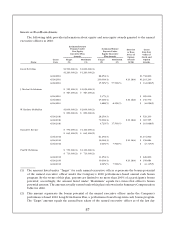

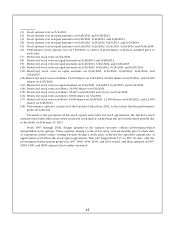

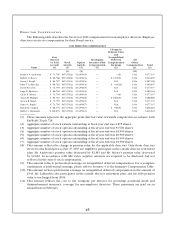

Assuming that the highest level of performance conditions are achieved, the value of the performance-

based awards at the grant date is as follows: Mr. Dillon: $1,229,925; Mr. Schlotman: $133,688; Mr. McMullen:

$374,325; Mr. Becker: $160,425; and Mr. Heldman: $160,425. These amounts are not reflected in the table.

(2) These amounts represent the aggregate grant date fair value of awards computed in accordance with

FASB ASC Topic 718.

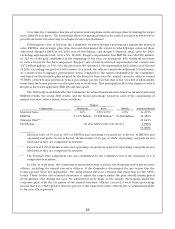

(3) Non-equity incentive plan compensation for 2010 consists of payments under an annual cash bonus

program. In accordance with the terms of the 2010 performance-based annual cash bonus program, Kroger

paid 53.868% of bonus potentials for the executive officers including the named executive officers.

(4) Amounts are attributable to change in pension value and preferential earnings on nonqualified

deferred compensation. During 2010, pension values increased primarily due to: (i) a decrease in the

discount rate for the plans, as determined by the plan actuary; (ii) increases in final average earnings

used in determining pension benefits; (iii) an additional year of credited service; and (iv) an increase

in present value due to participant aging. Since the benefits are based on final average earnings and

service, the effect of the final average earnings increase is larger for those with longer service. Please

refer to the 2010 Pension Benefits Table for further information regarding credited service.

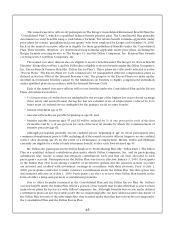

Under the Company’s deferred compensation plan, deferred compensation earns interest at the rate

representing Kroger’s cost of ten-year debt as determined by Kroger’s CEO prior to the beginning of

each deferral year. For each participant, a separate deferral account is created each year, and the interest

rate established under the plan for that year is applied to that deferral account until the deferred

compensation is paid out. If the interest rate established by the Company for a particular year exceeds

120% of the applicable federal long-term interest rate that corresponds most closely to the Company

rate, the amount by which the Company rate exceeds 120% of the corresponding federal rate is deemed

to be above-market or preferential. In ten of the seventeen years in which at least one named executive

officer deferred compensation, the Company rate set under the plan for that year exceeds 120% of the

corresponding federal rate. For each of the deferral accounts in which the Company rate is deemed

to be above-market, the Company calculates the amount by which the actual annual earnings on the

account exceed what the annual earnings would have been if the account earned interest at 120% of

the corresponding federal rate, and discloses those amounts as preferential earnings.

The amount listed for Mr. Dillon includes change in pension value in the amount of $2,146,081 and

preferential earnings on nonqualified deferred compensation in the amount of $10,544. The amount

listed for Mr. McMullen includes change in pension value in the amount of $909,667 and preferential

earnings on nonqualified deferred compensation in the amount of $43,492. The amount listed for

Mr. Heldman includes change in pension value in the amount of $867,905 and preferential earnings

on nonqualified deferred compensation in the amount of $7,741. The amounts listed for the remaining

named executive officers represent only change in pension value.

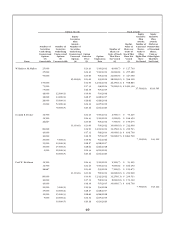

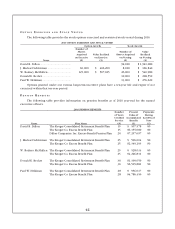

(5) The following table provides the items and amounts included in All Other Compensation for 2010:

Life

Insurance

Premium

Accidental

Death and

Dismemberment

Insurance

Premium

Long-Term

Disability

Insurance

Premium

Mr. Dillon $57,894 $133 —

Mr. Schlotman $13,682 $133 —

Mr. McMullen $17,964 $133 $2,778

Mr. Becker $37,750 $133 $3,007

Mr. Heldman $30,866 $133 $2,778