Kroger 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-36

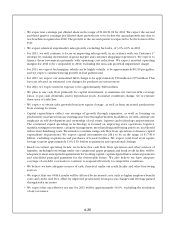

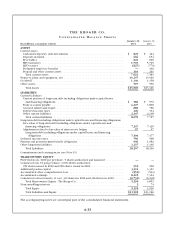

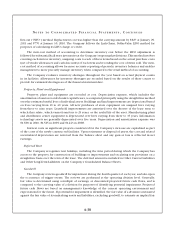

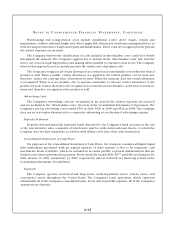

THE KROGER CO.

CO N S O L I D A T E D ST A T E M E N T O F CH A N G E S I N SH A R E O W N E R S ’ EQ U I T Y

Years Ended January 29, 2011, January 30, 2010 and January 31, 2009

(In millions, except per share amounts)

Common Stock Additional

Paid-In

Capital

Treasury Stock

Accumulated

Other

Comprehensive

Gain (Loss)

Accumulated

Earnings

Noncontrolling

Interest TotalShares Amount Shares Amount

Balances at February 2, 2008 ........................ 947 $ 947 $3,031 284 $ (5,422) $(122) $ 6,528 $ 7 $ 4,969

Issuance of common stock:

Stock options exercised .......................... 8 8 162 — 3 — — — 173

Restricted stock issued ........................... — — (46) (1) 30 — — — (16)

Treasury stock activity:

Treasury stock purchases, at cost ................... — — — 16 (448) — — — (448)

Stock options exchanged ......................... — — — 7 (189) — — — (189)

Tax benefits from exercise of stock options ............ — — 15 — — — — — 15

Share-based employee compensation.................. — — 91 — — — — — 91

Other comprehensive loss net of income tax of $(224) ... — — — — — (373) — — (373)

Purchase of non-wholly owned entity ................. — — — — — — — 101 101

Other ........................................... — — 13 —(13) — (2)(14)(16)

Cash dividends declared ($0.36 per common share) ..... — — — — — — (237) — (237)

Net earnings including noncontrolling interests......... — — — — — — 1,249 1 1,250

Balances at January 31, 2009......................... 955 $ 955 $ 3,266 306 $ (6,039) $ (495) $ 7,538 $ 95 $ 5,320

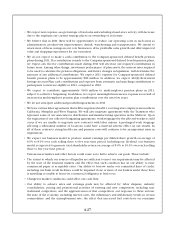

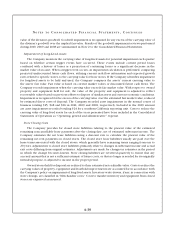

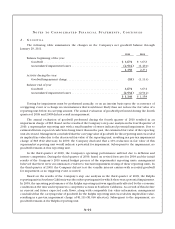

Issuance of common stock:

Stock options exercised .......................... 3 3 54 — (6) — — — 51

Restricted stock issued ........................... — — (59) (1) 42 — — — (17)

Treasury stock activity:

Treasury stock purchases, at cost ................... — — — 8 (156) — — — (156)

Stock options exchanged ......................... — — — 3 (62) — — — (62)

Tax detriments from exercise of stock options .......... — — (2) — — — — — (2)

Share-based employee compensation.................. — — 83 — — — — — 83

Other comprehensive loss net of income tax of $(58) .... — — — — — (98) — — (98)

Other ........................................... — — 19 — (17) — (3) (8) (9)

Cash dividends declared ($0.37 per common share) ..... — — — — — — (241) — (241)

Net earnings (loss) including noncontrolling interests.... — — — — — — 70 (13) 57

Balances at January 30, 2010......................... 958 $ 958 $ 3,361 316 $(6,238) $(593) $ 7,364 $ 74 $ 4,926

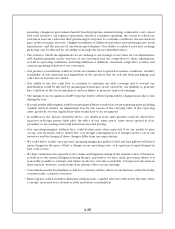

Issuance of common stock:

Stock options exercised .......................... 1 1 9 (1)19 — — — 29

Restricted stock issued ........................... — — (54) (1) 37 — — — (17)

Treasury stock activity:

Treasury stock purchases, at cost ................... — — — 24 (505) — — — (505)

Stock options exchanged ......................... — — — 1 (40) — — — (40)

Investment in the remaining interest of a variable

interest entity net of income tax of $(14) ............ — — (8) — — — — (67) (75)

Share-based employee compensation.................. — — 79 — — — — — 79

Other comprehensive gain net of income tax of $26 ..... — — — — — 43 — — 43

Other ........................................... — — 7 — (5) — — (22) (20)

Cash dividends declared ($0.40 per common share) ..... — — — — — — (255) — (255)

Net earnings including noncontrolling interests......... — — — — — — 1,116 17 1,133

Balances at January 29, 2011......................... 959 $ 959 $ 3,394 339 $(6,732) $(550) $ 8,225 $ 2 $ 5,298

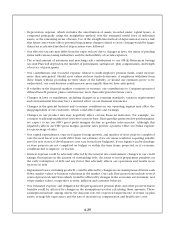

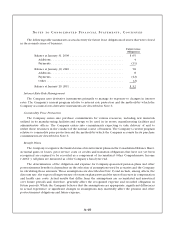

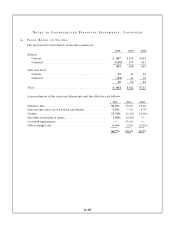

Comprehensive income:

2010 2009 2008

Net earnings including noncontrolling interests .......... $1,133 $ 57 $1,250

Unrealized gain on hedging activities, net of

income tax of $2 in 2008 ......................... — — 3

Unrealized gain on available for sale securities, net of

income tax of $4 in 2010 ......................... 5 — —

Amortization of unrealized gains and losses on hedging

activities, net of income tax of $1 in 2010

and $1 in 2009 ................................. 2 2 1

Change in pension and other postretirement

defined benefit plans, net of income tax of

$21 in 2010, $(59) in 2009 and $(227) in 2008 ........ 36 (100) (377)

Comprehensive income (loss) ........................ 1,176 (41) 877

Comprehensive income (loss) attributable to

noncontrolling interests .......................... 17 (13) 1

Comprehensive income (loss) attributable to

The Kroger Co. ................................. $1,159 $ (28) $ 876

The accompanying notes are an integral part of the consolidated financial statements.