Kroger 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

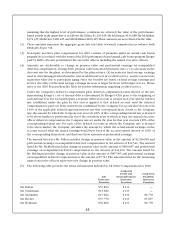

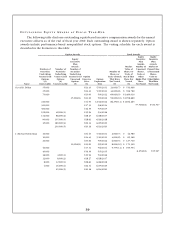

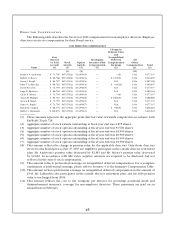

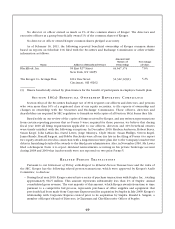

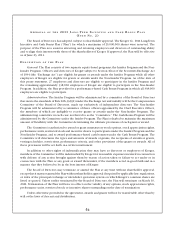

DI R E C T O R CO M P E N S A T I O N

The following table describes the fiscal year 2010 compensation for non-employee directors. Employee

directors receive no compensation for their Board service.

2010 DIRECTOR COMPENSATION

Name

Fees

Earned

or Paid

in Cash

($)

Stock

Awards

($)

Option

Awards

($)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($)

All

Other

Compensation

($)

Total

($)

(1) (1) (11)

Reuben V. Anderson .... $ 74,795 $67,470(2) $34,958(3) — —(8) $114 $177,337

Robert D. Beyer ....... $ 86,762 $67,470(2) $34,958(3) — $4,701(9) $114 $194,005

Susan J. Kropf .......... $ 84,767 $67,470(2) $34,958(4) — N/A $114 $187,309

John T. LaMacchia. . . . . . . $ 86,762 $67,470(2) $34,958(3) — $ 343(10) $114 $189,647

David B. Lewis . . . . . . . . . $ 74,795 $67,470(2) $34,958(5) — N/A $114 $177,337

Jorge P. Montoya ........ $ 86,762 $67,470(2) $34,958(4) — N/A $114 $189,304

Clyde R. Moore ......... $ 74,795 $67,470(2) $34,958(3) — —(8) $114 $177,337

Susan M. Phillips ........ $ 84,767 $67,470(2) $34,958(6) — $1,360(9) $114 $188,669

Steven R. Rogel ......... $ 74,795 $67,470(2) $34,958(3) — N/A $114 $177,337

James A. Runde ......... $ 74,795 $67,470(2) $34,958(7) — N/A $114 $177,337

Ronald L. Sargent . . . . . . . $ 96,734 $67,470(2) $34,958(7) — $ 940(9) $114 $200,216

Bobby S. Shackouls ...... $116,679 $67,470(2) $34,958(3) — N/A $114 $219,221

(1) These amounts represent the aggregate grant date fair value of awards computed in accordance with

FASB ASC Topic 718.

(2) Aggregate number of stock awards outstanding at fiscal year end was 4,875 shares.

(3) Aggregate number of stock options outstanding at fiscal year end was 51,500 shares.

(4) Aggregate number of stock options outstanding at fiscal year end was 24,500 shares.

(5) Aggregate number of stock options outstanding at fiscal year end was 49,500 shares.

(6) Aggregate number of stock options outstanding at fiscal year end was 39,500 shares.

(7) Aggregate number of stock options outstanding at fiscal year end was 29,500 shares.

(8) This amount reflects the change in pension value for the applicable directors. Only those directors

elected to the Board prior to July 17, 1997 are eligible to participate in the outside director retirement

plan. Mr. Anderson’s pension value decreased by $2,815 and Mr. Moore’s pension value decreased

by $2,692. In accordance with SEC rules, negative amounts are required to be disclosed, but not

reflected in the sum of total compensation.

(9) This amount reflects preferential earnings on nonqualified deferred compensation. For a complete

explanation of preferential earnings, please refer to footnote 4 to the Summary Compensation Table.

(10) This amount reflects preferential earnings on nonqualified deferred compensation in the amount of

$343. Mr. LaMacchia also participates in the outside director retirement plan, and his 2010 pension

value is unchanged from 2009.

(11) This amount reflects the cost to the Company per director for providing accidental death and

dismemberment insurance coverage for non-employee directors. These premiums are paid on an

annual basis in February.