Kroger 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

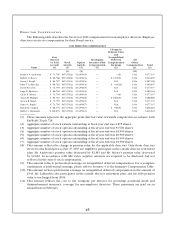

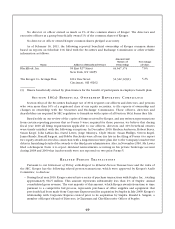

The assumptions used in calculating the present values are set forth in Note 13 to the consolidated

financial statements in Kroger’s Form 10-K for fiscal year 2010 ended January 29, 2011. The discount rate

used to determine the present values is 5.6%, which is the same rate used at the measurement date for

financial reporting purposes.

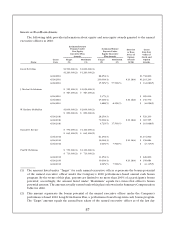

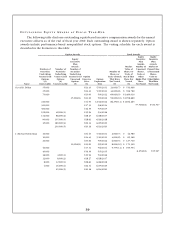

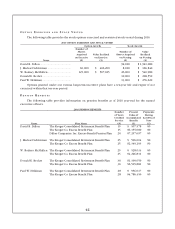

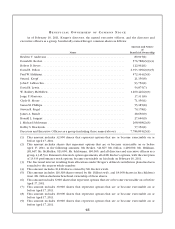

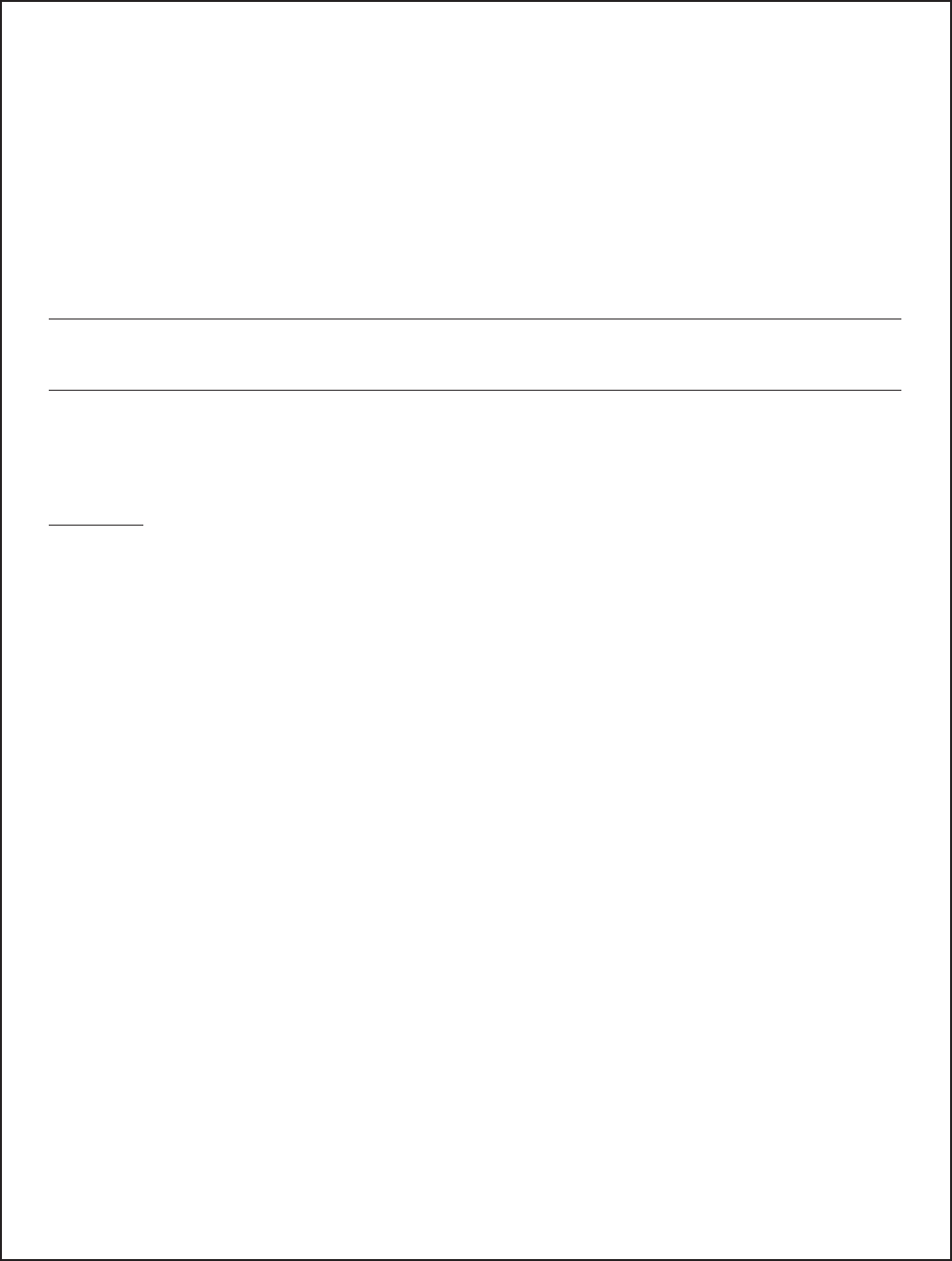

NO N Q UA L I F I E D DE F E R R E D CO M P E N S A T I O N

The following table provides information on nonqualified deferred compensation for the named

executive officers for 2010.

2010 NONQUALIFIED DEFERRED COMPENSATION

Name

Executive

Contributions

in Last FY

($)

Registrant

Contributions

in Last FY

($)

Aggregate

Earnings

in Last FY

($)

Aggregate

Withdrawals/

Distributions

($)

Aggregate

Balance at

Last FYE

($)

David B. Dillon ......................................... $ 80,000(1) $0 $ 56,595 $0 $ 846,428

J. Michael Schlotman ............................... $ 0 $0 $ 0 $0 $ 0

W. Rodney McMullen ............................... $ 76,900(1) $0 $339,144 $0 $5,073,371

Donald E. Becker ...................................... $ 0 $0 $ 0 $0 $ 0

Paul W. Heldman ...................................... $369,255(2) $0 $ 50,590 $0 $ 922,514

(1) These amounts represent the deferral of annual bonus earned in fiscal year 2009 and paid in

March 2010. These amounts are included in the Summary Compensation Table for 2009.

(2) This amount represents the deferral of long-term bonus earned in fiscal year 2009 and paid in

March 2010. This amount is included in the Summary Compensation Table for 2009.

Eligible participants may elect to defer up to 100% of the amount of their salary that exceeds the sum

of the FICA wage base and pre-tax insurance and other Internal Revenue Code Section 125 plan deductions,

as well as 100% of their annual and long-term bonus compensation. Deferral account amounts are credited

with interest at the rate representing Kroger’s cost of ten-year debt as determined by Kroger’s CEO prior

to the beginning of each deferral year. The interest rate established for deferral amounts for each deferral

year will be applied to those deferral amounts for all subsequent years until the deferred compensation is

paid out. Participants can elect to receive lump sum distributions or quarterly installments for periods up

to ten years. Participants also can elect between lump sum distributions and quarterly installments to be

received by designated beneficiaries if the participant dies before distribution of deferred compensation

is completed.