Kroger 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

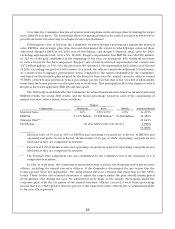

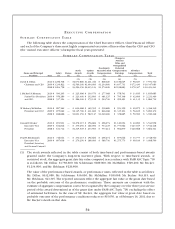

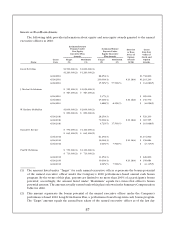

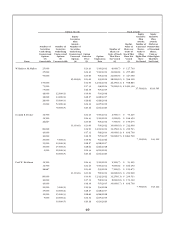

EX E C U T I V E CO M P E N S A T I O N

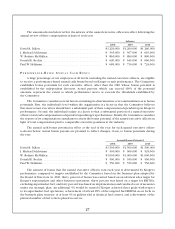

SU M M A R Y CO M P E N S A T I O N TA B L E

The following table shows the compensation of the Chief Executive Officer, Chief Financial Officer

and each of the Company’s three most highly compensated executive officers other than the CEO and CFO

(the “named executive officers”) during the fiscal years presented:

SU M M A R Y CO M P E N S A T I O N TA B L E

Name and Principal

Position Year

Salary

($)

Bonus

($)

Stock

Awards

($)

Option

Awards

($)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)

Total

($)

(1) (2) (3) (4) (5)

David B. Dillon

Chairman and CEO

2010

2009

2008

$

$

$

1,256,548

1,239,822

1,204,758

—

—

—

$

$

$

2,070,880

2,569,100

3,290,150

$

$

$

1,201,240

1,494,000

2,015,123

$

$

$

808,020

1,234,000

1,574,220

$

$

$

2,156,625

3,637,731

2,198,683

$

$

$

58,027

172,430

170,307

$

$

$

7,551,340

10,347,083

10,453,241

J. Michael Schlotman

Senior Vice President

and CFO

2010

2009

2008

$

$

$

590,295

556,280

537,124

—

—

—

$

$

$

225,096

223,400

286,100

$

$

$

130,570

132,800

179,122

$

$

$

277,368

461,125

524,740

$

$

$

578,541

795,146

292,491

$

$

$

13,815

42,609

41,135

$

$

$

1,815,685

2,211,360

1,860,712

W. Rodney McMullen

President and COO

2010

2009

2008

$

$

$

887,562

875,062

848,686

—

—

—

$

$

$

630,268

2,345,700

1,001,350

$

$

$

365,595

431,600

582,147

$

$

$

538,680

846,368

1,049,480

$

$

$

953,159

1,335,103

378,685

$

$

$

20,875

56,639

59,900

$

$

$

3,396,139

5,890,472

3,920,248

Donald E. Becker

Executive Vice

President

2010

2009

2008

$

$

$

651,901

632,816

611,712

—

—

—

$

$

$

1,278,115

279,250

1,215,925

$

$

$

156,684

166,000

233,903

$

$

$

296,274

534,125

577,214

$

$

$

1,120,094

1,773,062

902,879

$

$

$

40,890

127,165

120,668

$

$

$

3,543,958

3,512,418

3,662,301

Paul W. Heldman(6)

Executive Vice

President, Secretary

and General Counsel

2010

2009

$

$

716,044

697,638

—

—

$

$

270,115

279,250

$

$

156,684

166,000

$

$

296,274

580,730

$

$

875,646

1,275,773

$

$

33,777

99,199

$

$

2,348,540

3,098,590

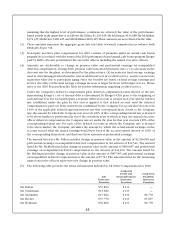

(1) The stock awards reflected in the table consist of both time-based and performance-based awards

granted under the Company’s long-term incentive plans. With respect to time-based awards, or

restricted stock, the aggregate grant date fair value computed in accordance with FASB ASC Topic 718

is as follows: Mr. Dillon: $1,738,800; Mr. Schlotman: $189,000; Mr. McMullen: $529,200; Mr. Becker:

$1,234,800; and Mr. Heldman: $226,800.

The value of the performance-based awards, or performance units, reflected in the table is as follows:

Mr. Dillon: $332,080; Mr. Schlotman: $36,096; Mr. McMullen: $101,068; Mr. Becker: $43,315; and

Mr. Heldman: $43,315. The reported amounts reflect the aggregate fair value at the grant date based

on the probable outcome of the performance conditions. These amounts are consistent with the

estimate of aggregate compensation cost to be recognized by the Company over the three-year service

period of the award determined as of the grant date under FASB ASC Topic 718, excluding the effect

of estimated forfeitures. In the case of Mr. Becker, the aggregate fair value at grant date based on

probable outcome of the performance conditions reduces to $15,056, as of February 16, 2011, due to

Mr. Becker’s death on that date.