Kroger 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

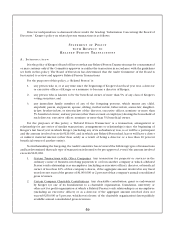

Tax Deductibility Cap. Section 162(m) of the Code provides that certain compensation received in

any year by a “covered employee” in excess of $1,000,000 is non-deductible by Kroger for federal income

tax purposes. Section 162(m) provides an exception, however, for “performance-based compensation.” To

the extent practicable under the circumstances, the Committee currently intends to structure grants and

awards made under the Plan to “covered employees” as performance-based compensation that is exempt

from Section 162(m).

This summary of the 2011 Long-Term Incentive and Cash Bonus Plan is qualified in its entirety by the

complete text of the Plan that is set forth in Appendix 1 of this Proxy Statement.

EX I S T I N G PL A N S

As of our fiscal year ended January 29, 2011, there were 12,241,518 shares remaining for future issuance

under existing equity compensation plans. Of these shares, 3,755,087 shares were available for awards

other than options or stock appreciation rights. Under some of these plans, this sublimit on full value

shares can be increased by decreasing by four the total number of shares issuable under the plan for each

such increased share.

TH E BO A R D O F DI R E C T O R S RE C O M M E N D S A VO T E F O R TH I S PR O P O S A L .

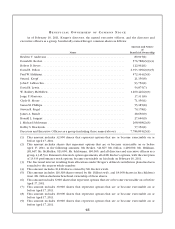

NE W PL A N BE N E F I T S

2011 Long-Term Incentive and Cash Bonus Plan

Name and Position (1) Dollar value ($) Number of Units

All Groups .................................... (1) (1)

(1) Awards, values and benefits not determinable for any Group.

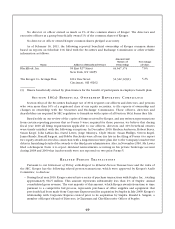

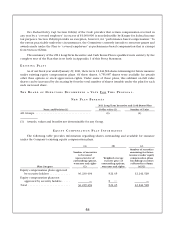

EQ U I T Y CO M P E N S A T I O N PL A N IN F O R M A T I O N

The following table provides information regarding shares outstanding and available for issuance

under the Company’s existing equity compensation plans.

(a) (b) (c)

Plan Category

Number of securities

to be issued

upon exercise of

outstanding options,

warrants and rights

(1)

Weighted-average

exercise price of

outstanding options,

warrants and rights

Number of securities

remaining for future

issuance under equity

compensation plans

(excluding securities

reflected in column

(a))(2)

Equity compensation plans approved

by security holders . . . . . . . . . . . . . 36,239,494 $21.45 12,241,518

Equity compensation plans not

approved by security holders . . . . . — $ ——

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . 36,239,494 $21.45 12,241,518