Kroger 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-49

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

5. DE B T OB L I G A T I O N S

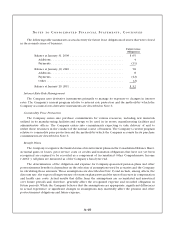

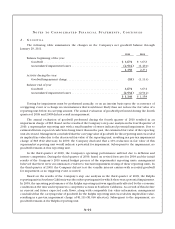

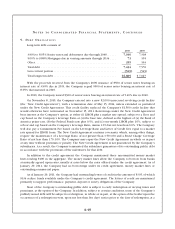

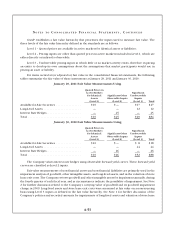

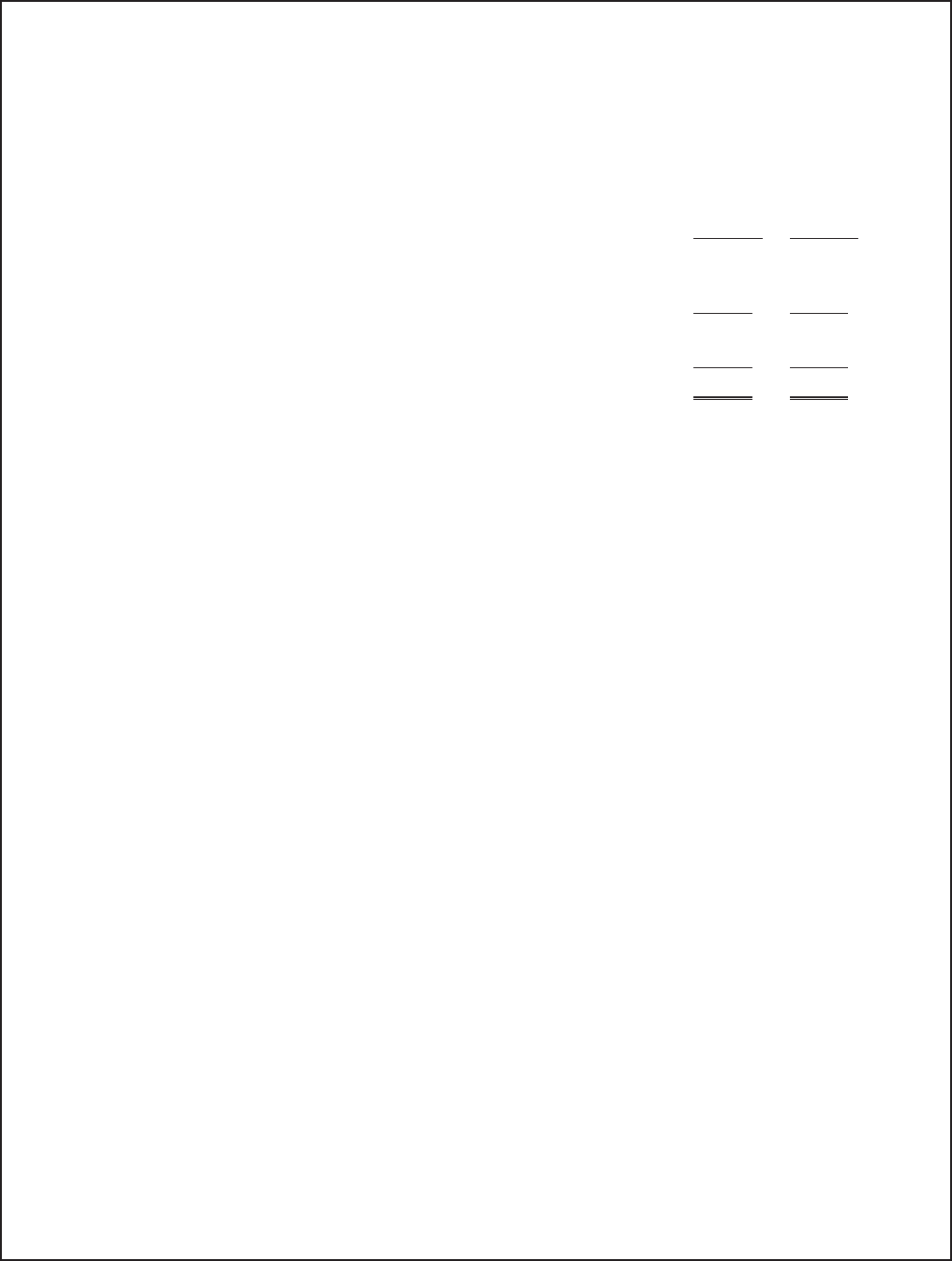

Long-term debt consists of:

2010 2009

3.90% to 8.05% Senior notes and debentures due through 2040 ...... 7,106 7,308

5.00% to 9.88% Mortgages due in varying amounts through 2034 . . . . 73 105

Other .................................................... 255 163

Total debt ................................................ 7,434 7,576

Less current portion ........................................ (549) (549)

Total long-term debt ........................................ $6,885 $ 7,027

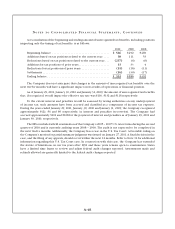

With the proceeds received from the Company’s 2009 issuance of $500 of senior notes bearing an

interest rate of 3.90% due in 2015, the Company repaid $500 of senior notes bearing an interest rate of

8.05% that matured in 2010.

In 2010, the Company issued $300 of senior notes bearing an interest rate of 5.40% due in 2040.

On November 8, 2010, the Company entered into a new $2,000 unsecured revolving credit facility

(the “New Credit Agreement”), with a termination date of May 15, 2014, unless extended as permitted

under the New Credit Agreement. This credit facility replaced the Company’s $2,500 credit facility that

would otherwise have terminated on November 15, 2011. Borrowings under the New Credit Agreement

bear interest at the Company’s option, at either (i) LIBOR plus a market rate spread, subject to a floor and

cap based on the Company’s Leverage Ratio or (ii) the base rate, defined as the highest of (a) the Bank of

America prime rate, (b) the Federal Funds rate plus 0.5%, and (c) one-month LIBOR plus 1.0%, subject to

a floor and cap based on the Company’s Leverage Ratio, minus 1.0% but not less than 0.0%. The Company

will also pay a Commitment Fee based on the Leverage Ratio and Letter of Credit fees equal to a market

rate spread for LIBOR loans. The New Credit Agreement contains covenants, which, among other things,

require the maintenance of a Leverage Ratio of not greater than 3.50:1.00 and a Fixed Charge Coverage

Ratio of not less than 1.70:1.00. The Company may repay the New Credit Agreement in whole or in part

at any time without premium or penalty. The New Credit Agreement is not guaranteed by the Company’s

subsidiaries. As a result, the Company terminated the subsidiary guarantees of its outstanding public debt

in accordance with the provisions of the indentures for that debt.

In addition to the credit agreement, the Company maintained three uncommitted money market

lines totaling $100 in the aggregate. The money market lines allow the Company to borrow from banks

at mutually agreed upon rates, usually at rates below the rates offered under the credit agreement. As of

January 29, 2011, the Company had no borrowings under its credit agreement, money market lines or

outstanding commercial paper.

As of January 29, 2011, the Company had outstanding letters of credit in the amount of $305, of which

$134 reduce funds available under the Company’s credit agreement. The letters of credit are maintained

primarily to support performance, payment, deposit or surety obligations of the Company.

Most of the Company’s outstanding public debt is subject to early redemption at varying times and

premiums, at the option of the Company. In addition, subject to certain conditions, some of the Company’s

publicly issued debt will be subject to redemption, in whole or in part, at the option of the holder upon the

occurrence of a redemption event, upon not less than five days’ notice prior to the date of redemption, at a