Kroger 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

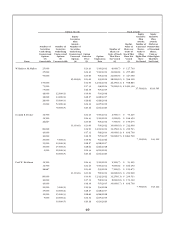

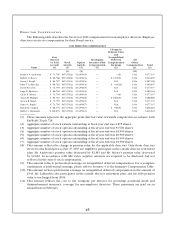

38

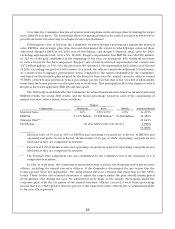

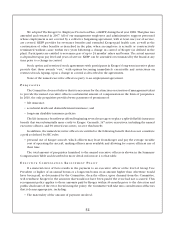

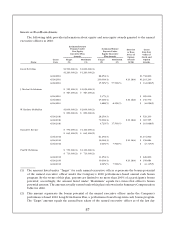

of fiscal year 2009. Bonuses are determined upon completion of the performance period as of fiscal

year ending 2012. The “Target” amount is also the “Maximum” amount payable under this program, as

participants can earn no more than 100% of their bonus potentials.

(3) This amount represents the number of restricted shares awarded under one of the Company’s long-

term incentive plans.

(4) This amount represents the number of stock options granted under one of the Company’s long-term

incentive plans. Options are granted at fair market value of Kroger common shares on the date of the

grant. Fair market value is defined as the closing price of Kroger shares on the date of the grant.

(5) Performance units were granted under one of the Company’s long-term incentive plans. The “Maximum”

amount represents the maximum number of common shares that can be earned by the named executive

officer under the grant. Because the target amount of common shares is not determinable, the amount

listed under “Target” reflects a representative amount based on the previous year’s performance. This

performance unit award is subject to performance conditions; accordingly the dollar amount listed

in the grant date fair value column is the value at the grant date based on the probable outcome of

these conditions. This amount is consistent with the estimate of aggregate compensation cost to be

recognized by the Company over the three-year service period determined as of the grant date under

FASB ASC Topic 718, excluding the effect of estimated forfeitures.

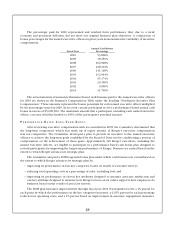

The Compensation Committee of the Board of Directors, and the independent members of the Board in

the case of the CEO, established bonus potentials, shown in this table as “target” amounts, for the performance-

based annual and long-term cash bonus awards for the named executive officers. Amounts were payable

to the extent that performance met specific objectives established at the beginning of the performance period.

As described in the Compensation Discussion and Analysis, actual earnings under the annual cash bonus can

exceed the target amounts if performance exceeds the thresholds. The Compensation Committee of the Board

of Directors, and the independent members of the Board in the case of the CEO, also determined the number

of performance units to be awarded to each named executive officer, under which common shares are

earned to the extent performance meets objectives established at the beginning of the performance period.

The performance units are more particularly described in the Compensation Discussion and Analysis.

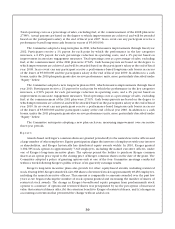

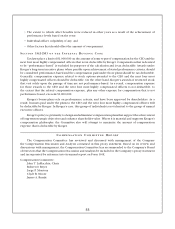

Restrictions on restricted stock awards made to the named executive officers normally lapse, as long as

the officer is then in our employ, in equal amounts on each of the five anniversaries of the date the award is

made, except that: restrictions on 30,000 shares awarded to Mr. Becker in 2008 would have lapsed in 2011,

and 50,000 shares awarded to Mr. Becker in 2010 would have lapsed as follows: 16,667 on 6/24/2011 and

33,333 on 6/24/2012. By the express terms of the restricted stock agreements, all of Mr. Becker’s restrictions

lapsed on his death on February 16, 2011. 70,000 shares awarded to Mr. McMullen in 2009 vest as follows:

15,000 shares on 6/25/2012, 20,000 shares on 6/25/2013, and 35,000 shares on 6/25/2014; 8,000 shares

awarded to Mr. Heldman in 2006 vest on 5/4/2011; and 30,000 shares awarded to Mr. Heldman in 2008 vest

as follows: 6,000 shares on 6/26/2011, 12,000 shares on 6/26/2012, and 12,000 shares on 6/26/2013. Any

dividends declared on Kroger common shares are payable on restricted stock. Nonqualified stock options

granted to the named executive officers normally vest in equal amounts on each of the five anniversaries

of the date of grant. Those options were granted at the fair market value of Kroger common shares on the

date of the grant. By the express terms of the stock option agreement, all of Mr. Becker’s options vested on

his death on February 16, 2011. Options are granted only on one of the four dates of regularly scheduled

Compensation Committee meetings conducted shortly following Kroger’s public release of its quarterly

earnings results.