Kroger 2010 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-71

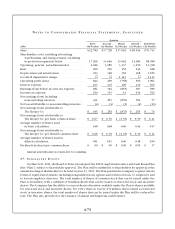

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

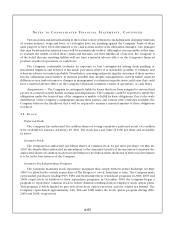

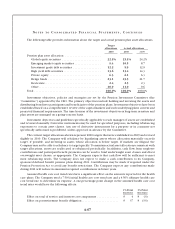

Multi-Employer Plans

The Company also contributes to various multi-employer pension plans based on obligations arising

from most of its collective bargaining agreements. These plans provide retirement benefits to participants

based on their service to contributing employers. The benefits are paid from assets held in trust for that

purpose. Trustees are appointed in equal number by employers and unions. The trustees typically are

responsible for determining the level of benefits to be provided to participants as well as for such matters

as the investment of the assets and the administration of the plans.

The Company recognizes expense in connection with these plans as contributions are funded. The

Company made contributions to these funds, and recognized expense, of $262 in 2010, $233 in 2009, and

$219 in 2008.

Based on the most recent information available to it, the Company believes that the present value of

actuarial accrued liabilities in most or all of these multi-employer plans substantially exceeds the value of

the assets held in trust to pay benefits. Moreover, if the Company were to exit certain markets or otherwise

cease making contributions to these funds, the Company could trigger a substantial withdrawal liability.

Any adjustment for withdrawal liability will be recorded when it is probable that a liability exists and can

be reasonably estimated.

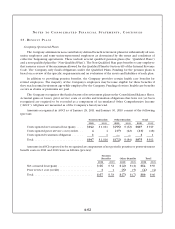

14. R E C E N T L Y AD O P T E D AC C O U N T I N G ST A N D A R D S

In January 2010, the FASB amended its standards related to fair value measurements and disclosures,

which were effective for interim and annual fiscal periods beginning after December 15, 2009, except

for disclosures about certain Level 3 activity that will become effective for interim and annual periods

beginning after December 15, 2010. The new standards require the Company to disclose transfers in and

out of Level 1 and Level 2 fair value measurements and describe the reasons for the transfers as well

as activity in Level 3 fair value measurements. The new standards also require a more detailed level of

disaggregation of the assets and liabilities being measured as well as increased disclosures regarding inputs

and valuation techniques of the fair value measurements. The Company adopted the amended standards

effective January 31, 2010, except for disclosures about certain Level 3 activity, which will be effective

starting January 30, 2011. See Note 7 to the Consolidated Financial Statements for the Company’s fair value

measurements and disclosures.

In June 2009, the FASB amended its existing standards related to the consolidation of VIEs, which

was effective for interim and annual fiscal periods beginning after November 15, 2009. The new standards

require an entity to analyze whether its variable interests give it a controlling financial interest of a VIE and

outlines what defines a primary beneficiary. The new standards amend GAAP by: (a) changing certain rules

for determining whether an entity is a VIE; (b) replacing the quantitative approach previously required

for determining the primary beneficiary with a more qualitative approach; and (c) requiring entities to

continuously analyze whether they are the primary beneficiary of a VIE, among other amendments. The

new standards also require enhanced disclosures regarding an entity’s involvement in a VIE. The Company

adopted the amended standards effective January 31, 2010. The adoption of these new standards did not

have a material effect on the Company’s Consolidated Financial Statements.

Effective February 1, 2009, the Company adopted the new standards that clarify that share-based

payment awards that entitle their holders to receive nonforfeitable dividends before vesting should be

considered participating securities and included in the computation of EPS pursuant to the two-class

method. See Note 9 to the Consolidated Financial Statements for further discussion of its adoption.