Kroger 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

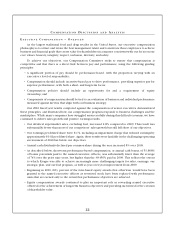

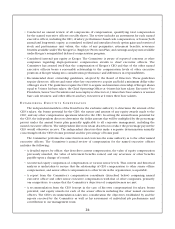

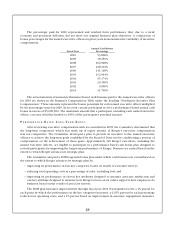

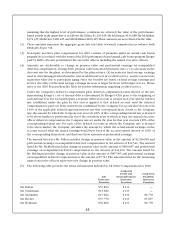

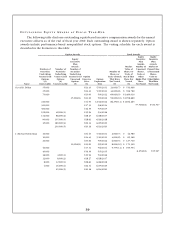

The percentage paid for 2010 represented and resulted from performance that, due to a weak

economy and persistent deflation, did not meet our original business plan objectives. A comparison of

bonus percentages for the named executive officers in prior years demonstrates the variability of incentive

compensation:

Fiscal Year

Annual Cash Bonus

Percentage

2010 53.868%

2009 38.450%

2008 104.948%

2007 128.104%

2006 141.118%

2005 132.094%

2004 55.174%

2003 24.100%

2002 9.900%

2001 31.760%

The actual amounts of annual performance-based cash bonuses paid to the named executive officers

for 2010 are shown in the Summary Compensation Table under the heading “Non-Equity Incentive Plan

Compensation.” These amounts represent the bonus potentials for each named executive officer multiplied

by the percentage earned in 2010. In no event can any participant receive a performance-based annual cash

bonus in excess of $5,000,000. The maximum amount that a participant, including each named executive

officer, can earn is further limited to 200% of the participant’s potential amount.

PE R F O R M A N C E -BA S E D LO N G -TE R M BO N U S

After reviewing executive compensation with its consultant in 2005, the Committee determined that

the long-term component, which was made up of equity awards, of Kroger’s executive compensation

was not competitive. The Committee developed a plan to provide an incentive to the named executive

officers to achieve the long-term goals established by the Board of Directors by conditioning a portion of

compensation on the achievement of those goals. Approximately 140 Kroger executives, including the

named executive officers, are eligible to participate in a performance-based cash bonus plan designed to

reward participants for improving the long-term performance of Kroger. Bonuses are earned based on the

extent to which Kroger advances its strategic plan.

The Committee adopted a 2008 long-term bonus plan under which cash bonuses are earned based on

the extent to which Kroger advances its strategic plan by:

• improvingitsperformanceinfourkeycategories,basedonresultsofcustomersurveys;

• reducingtotaloperatingcostsasapercentageofsales,excludingfuel;and

• improvingits performancein eleven key attributesdesignedtomeasure associatesatisfaction and

one key attribute designed to measure how Kroger’s focus on its values supports how employees do

business, based on the results of associate surveys.

The 2008 plan measures improvements through fiscal year 2011. Participants receive a 1% payout for

each point by which the performance in the key categories increases, a 0.25% payout for each percentage

reduction in operating costs, and a 1% payout based on improvement in associate engagement measures.