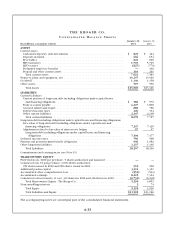

Kroger 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-35

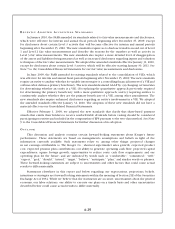

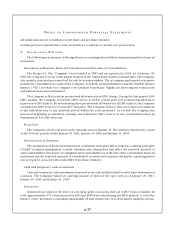

THE KROGER CO.

CO N S O L I D A T E D ST A T E M E N T S O F CA S H FL O W S

Years Ended January 29, 2011, January 30, 2010 and January 31, 2009

(In millions)

2010

(52 weeks)

2009

(52 weeks)

2008

(52 weeks)

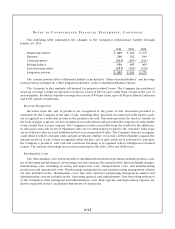

Cash Flows From Operating Activities:

Net earnings including noncontrolling interests .................................. $ 1,133 $ 57 $ 1,250

Adjustments to reconcile net earnings to net cash provided by operating activities:

Depreciation and amortization............................................ 1,600 1,525 1,443

Goodwill impairment charge ............................................. 18 1,113 —

Asset impairment charge ................................................ 25 48 26

LIFO charge .......................................................... 57 49 196

Stock-based employee compensation ...................................... 79 83 91

Expense for Company-sponsored pension plans .............................. 65 31 44

Deferred income taxes.................................................. 37 222 341

Other ............................................................... 853 (63)

Changes in operating assets and liabilities net of effects from acquisitions of

businesses:

Store deposits in-transit ............................................... (12) (23) 45

Inventories ......................................................... (88) (45) (193)

Receivables......................................................... (11) (21) (28)

Prepaid expenses .................................................... 290 (51) 47

Trade accounts payable ............................................... 315 54 (53)

Accrued expenses ................................................... 71 (46) (33)

Income taxes receivable and payable..................................... 133 49 (206)

Contribution to Company-sponsored pension plans ......................... (141) (265) (20)

Other ............................................................. (213) 89 9

Net cash provided by operating activities ................................... 3,366 2,922 2,896

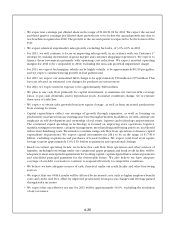

Cash Flows From Investing Activities:

Payments for capital expenditures ........................................... (1,919) (2,297) (2,149)

Proceeds from sale of assets................................................ 55 20 59

Payments for acquisitions.................................................. (7) (36) (80 )

Other ................................................................. (90) (14) (9)

Net cash used by investing activities ....................................... (1,961) (2,327) (2,179)

Cash Flows From Financing Activities:

Proceeds from issuance of long-term debt..................................... 381 511 1,377

Payments on long-term debt ............................................... (553) (432) (1,048)

Payments on credit facility ................................................. —(129) (441)

Proceeds from issuance of capital stock ...................................... 29 51 172

Treasury stock purchases .................................................. (545) (218) (637)

Dividends paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (250) (238) (227)

Increase in book overdrafts ................................................ 22 14 2

Investment in the remaining interest of a variable interest entity ................... (86) — —

Other ................................................................. (2) 7 33

Net cash used by financing activities ....................................... (1,004) (434) (769)

Net increase (decrease) in cash and temporary cash investments ..................... 401 161 (52)

Cash from Consolidated Variable Interest Entity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —— 73

Cash and temporary cash investments:

Beginning of year ........................................................ 424 263 242

End of year ............................................................. $ 825 $ 424 $ 263

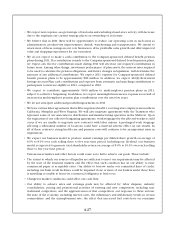

Reconciliation of capital expenditures:

Payments for capital expenditures ............................................. $(1,919) $(2,297) $(2,149)

Changes in construction-in-progress payables .................................... 22 (18) (4)

Total capital expenditures ................................................. $(1,897) $(2,315) $(2,153)

Disclosure of cash flow information:

Cash paid during the year for interest ........................................ $ 486 $ 542 $ 485

Cash paid during the year for income taxes.................................... $ 664 $ 130 $ 641

The accompanying notes are an integral part of the consolidated financial statements.