Kroger 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

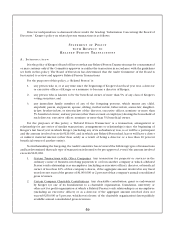

Performance Goals for annual bonuses will include the following components: (i) EBITDA; (ii) identical

sales; (iii) achievement of strategic initiatives; and (iv) achievement of supermarket fuel center goals for

EBITDA, gallons sold, and number of fuel centers. Initially the Performance Goals for long-term bonuses

will include the following components: (i) performance in four key categories in Kroger’s strategic plan,

(ii) reduction in operating costs as a percentage of sales, and (iii) performance in categories designed to

measure associate engagement. No single Cash Bonus to a participant may exceed $5,000,000.

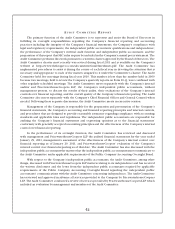

CE R T A I N FE D E R A L IN C O M E TA X CO N S E Q U E N C E S

Nonstatutory Stock Options, Stock Appreciation Rights, and Performance Units. A grantee will not

recognize income on the grant of a nonstatutory stock option, stock appreciation right or performance

unit, but generally will recognize ordinary income upon the exercise thereof. The amount of income

recognized upon the exercise of a nonstatutory stock option generally will be measured by the excess,

if any, of the fair market value of the shares at the time of exercise over the exercise price, provided the

shares issued are either transferable or not subject to a substantial risk of forfeiture. The amount of income

recognized upon the exercise of a stock appreciation right or a performance unit, in general, will be equal

to the amount of cash received and the fair market value of any shares received at the time of exercise,

provided the shares issued are either transferable or not subject to a substantial risk of forfeiture, plus the

amount of any taxes withheld. Under certain circumstances, income on the exercise of a performance unit

will be deferred if the grantee makes a proper election to defer such income. In some cases the recognition

of income by a grantee from the exercise of a performance unit may be delayed for up to six months if a

sale of the shares would subject the grantee to suit under Section 16(b) of the Exchange Act unless the

grantee elects to recognize income at the time of receipt of such shares. In either case, the amount of

income recognized is measured with respect to the fair market value of the common stock at the time the

income is recognized.

In the case of ordinary income recognized by a grantee as described above in connection with the

exercise of a nonstatutory stock option, a stock appreciation right, or a performance unit, Kroger will be

entitled to a deduction in the amount of ordinary income so recognized by the grantee, provided Kroger

satisfies certain federal income tax withholding requirements.

Incentive Shares and Restricted Stock. A grantee of incentive shares or restricted stock is not required

to include the value of such shares in ordinary income until the first time the grantee’s rights in the shares

are transferable or are not subject to a substantial risk of forfeiture, whichever occurs earlier, unless the

grantee elects to be taxed on receipt of the shares. In either case, the amount of such income will be equal

to the excess of the fair market value of the stock at the time the income is recognized over the amount

paid for the stock. Kroger will be entitled to a deduction in the amount of the ordinary income recognized

by the grantee for Kroger’s taxable year which includes the last day of the grantee’s taxable year in which

such grantee recognizes the income, provided Kroger satisfies certain federal income tax withholding

requirements.

General. The rules governing the tax treatment of options, stock appreciation rights, performance units,

incentive shares and restricted stock and stock acquired upon the exercise of options, stock appreciation

rights and performance units are quite technical, so that the above description of tax consequences is

necessarily general in nature and does not purport to be complete. Moreover, statutory provisions are,

of course, subject to change, as are their interpretations, and their application may vary in individual

circumstances. Finally, the tax consequences under applicable state law may not be the same as under the

federal income tax laws.