Kroger 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

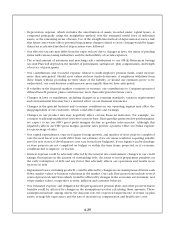

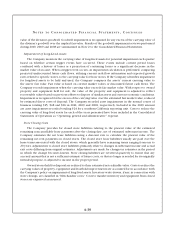

A-33

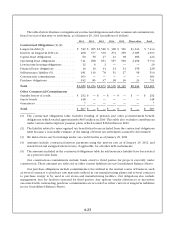

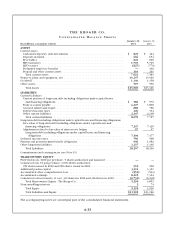

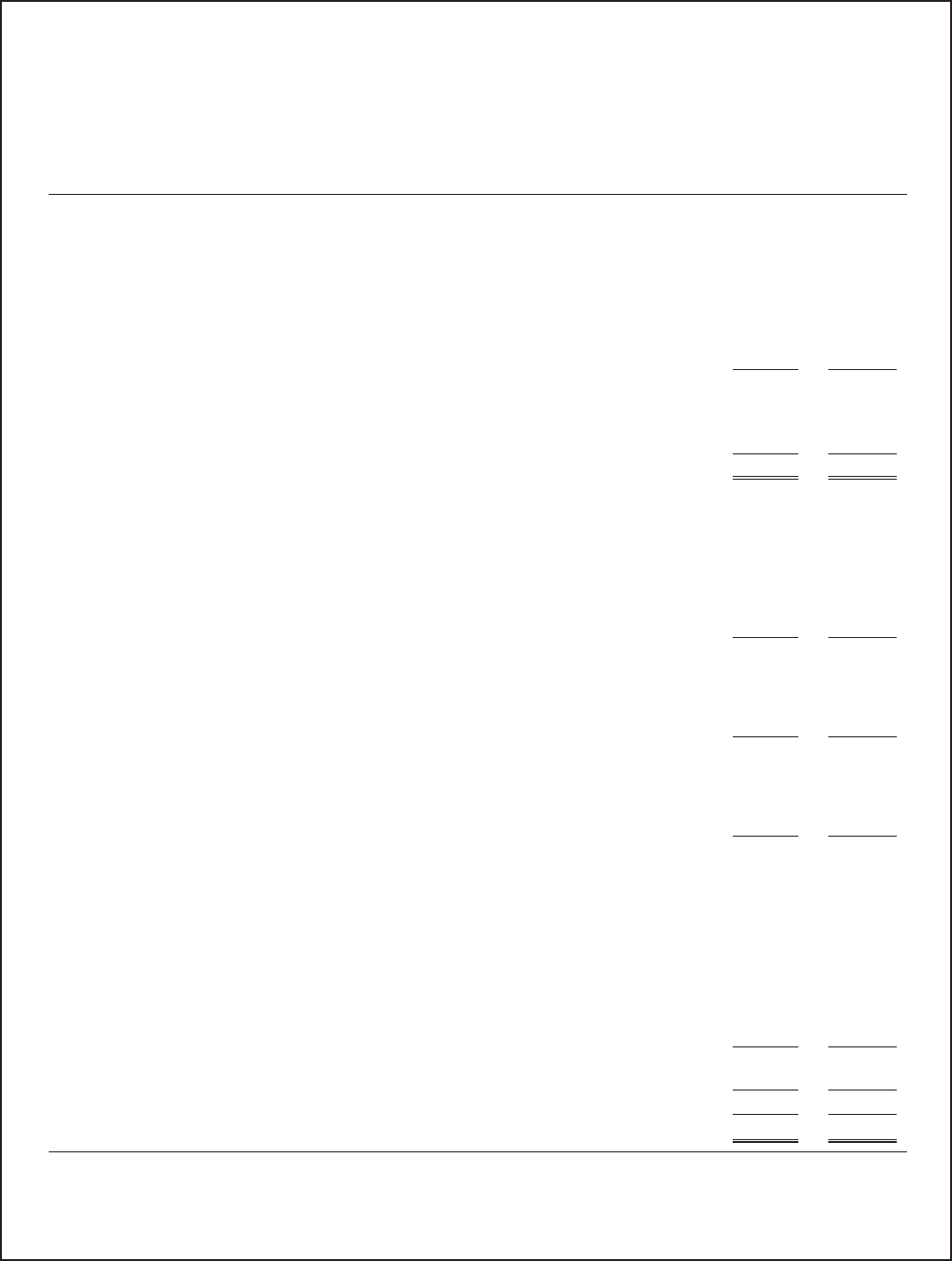

THE KROGER CO.

CO N S O L I D A T E D BA L A N C E SH E E T S

(In millions, except par values)

January 29,

2011

January 30,

2010

ASSETS

Current assets

Cash and temporary cash investments ..................................... $ 825 $ 424

Deposits in-transit ..................................................... 666 654

Receivables .......................................................... 845 909

FIFO inventory ........................................................ 5,793 5,705

LIFO reserve .......................................................... (827) (770)

Prefunded employee benefits ............................................ —300

Prepaid and other current assets .......................................... 319 261

Total current assets ................................................... 7,621 7,483

Property, plant and equipment, net ......................................... 14,147 13,929

Goodwill .............................................................. 1,140 1,158

Other assets ............................................................ 597 556

Total Assets ......................................................... $ 23,505 $ 23,126

LIABILITIES

Current liabilities

Current portion of long-term debt including obligations under capital leases

and financing obligations .............................................. $ 588 $ 579

Trade accounts payable ................................................. 4,227 3,890

Accrued salaries and wages .............................................. 888 786

Deferred income taxes .................................................. 220 354

Other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,147 2,118

Total current liabilities ................................................ 8,070 7,727

Long-term debt including obligations under capital leases and financing obligations

Face-value of long-term debt including obligations under capital leases and

financing obligations ................................................. 7,247 7,420

Adjustment related to fair-value of interest rate hedges ........................ 57 57

Long-term debt including obligations under capital leases and financing

obligations ........................................................ 7,304 7,477

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 750 568

Pension and postretirement benefit obligations ................................ 946 1,082

Other long-term liabilities ................................................. 1,137 1,346

Total Liabilities ...................................................... 18,207 18,200

Commitments and contingencies (see Note 11)

SHAREOWNERS’ EQUITY

Preferred stock, $100 par per share, 5 shares authorized and unissued ............. ——

Common stock, $1 par per share, 1,000 shares authorized;

959 shares issued in 2010 and 958 shares issued in 2009 ...................... 959 958

Additional paid-in capital ................................................. 3,394 3,361

Accumulated other comprehensive loss ...................................... (550) (593)

Accumulated earnings ................................................... 8,225 7,364

Common stock in treasury, at cost, 339 shares in 2010 and 316 shares in 2009 ....... (6,732) (6,238)

Total Shareowners’ Equity - The Kroger Co. ................................ 5,296 4,852

Noncontrolling interests .................................................. 274

Total Equity ......................................................... 5,298 4,926

Total Liabilities and Equity ............................................. $ 23,505 $ 23,126

The accompanying notes are an integral part of the consolidated financial statements.