Kroger 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-57

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

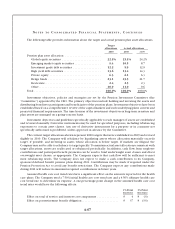

Stock options typically expire 10 years from the date of grant. Stock options vest between one and

five years from the date of grant, or for certain stock options, the earlier of the Company’s stock reaching

certain pre-determined and appreciated market prices or nine years and six months from the date of grant.

At January 29, 2011, approximately eight million shares of common stock were available for future option

grants under these plans.

In addition to the stock options described above, the Company awards restricted stock to employees

under various plans. The restrictions on these awards generally lapse between one and five years from

the date of the awards. The Company records expense for restricted stock awards in an amount equal to

the fair market value of the underlying stock on the grant date of the award, over the period the awards

lapse. As of January 29, 2011, approximately four million shares of common stock were available for future

restricted stock awards under the 2005 and 2008 Long-Term Incentive Plans (the “Plans”). The Company

has the ability to convert shares available for stock options under the Plans to shares available for restricted

stock awards. Four shares available for common stock option awards can be converted into one share

available for restricted stock awards.

All awards become immediately exercisable upon certain changes of control of the Company.

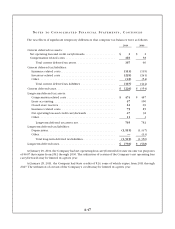

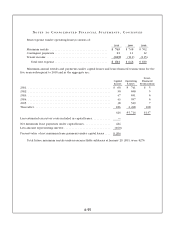

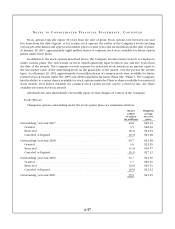

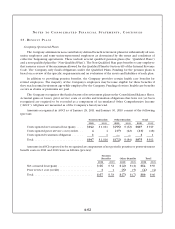

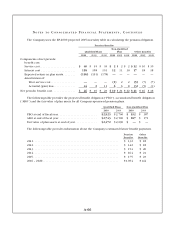

Stock Options

Changes in options outstanding under the stock option plans are summarized below:

Shares

subject

to option

(in millions)

Weighted-

average

exercise

price

Outstanding, year-end 2007 ......................................... 44.8 $20.94

Granted ...................................................... 3.5 $28.49

Exercised ..................................................... (8.3) $21.04

Canceled or Expired ............................................ (0.3) $23.08

Outstanding, year-end 2008 ......................................... 39.7 $21.58

Granted ...................................................... 3.6 $22.25

Exercised ..................................................... (3.4) $16.57

Canceled or Expired ............................................ (5.2) $27.12

Outstanding, year-end 2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34.7 $21.30

Granted ...................................................... 3.7 $20.23

Exercised ..................................................... (2.0) $16.31

Canceled or Expired ............................................ (0.5) $22.12

Outstanding, year-end 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.9 $21.45