Kroger 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PR O X Y

NO T I C E O F AN N U A L ME E T I N G O F SH A R E H O L D E R S

PR O X Y ST A T E M E N T

A N D

2010 AN N U A L RE P O R T

Table of contents

-

Page 1

PROX Y NOTICE OF ANNUAL MEETING OF SHAREHOLDERS PROX Y STATEMENT AND 2 010 A N N UA L R E P O R T -

Page 2

Kroger Qu ality & Value Si nce 1919 Bring it all home. Convenience Stores Jewelry Stores Services COVER PRINTED ON RECYCLED PAPER -

Page 3

... 2010: Private Selection, our premium brands; Banner Brands like Kroger, Ralphs and King Soopers, which represent the majority of our own Corporate Brands; and Value brand items, aimed at our most price-sensitive Customers. Kroger's 40 manufacturing plants supplied about 40 percent of the Corporate... -

Page 4

... loyalty data, we are able to offer unparalleled personalized marketing plans that reward our most loyal Customers with greater value for the products they like and buy regularly. In 2010, our number of loyal households continued to increase, as did the number of their store visits. Total households... -

Page 5

... reward shareholders by placing our customers' needs first. Kroger's return to our Shareholders has been strong. Our total payout to Shareholders during the past five years (combining dividends and share repurchases) has averaged nearly 70 percent of net income. In fiscal 2010, for example, Kroger... -

Page 6

..., Kroger significantly reduced employee accidents, improved management of product shrink and operating costs, and instituted process changes that have allowed the Company to invest in our Customer 1st Strategy. Della Wall, Group Vice President for Human Resources, retired after 39 years with Kroger... -

Page 7

Best in Class Retailer - Long-Term Goals Our objective is to create value for Shareholders at industry leadership levels. More specifically, our goals are to: •฀ Continue฀to฀grow฀sales฀and฀loyal฀households฀through฀execution฀of฀our฀Customer฀1st฀strategy; •฀ Expand฀... -

Page 8

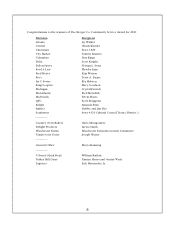

... of The Kroger Co. Community Service Award for 2010: Division Atlanta Central Cincinnati City Market Columbus Delta Dillon Stores Food 4 Less Fred Meyer Fry's Jay C Stores King Soopers Michigan Mid-Atlantic Mid-South QFC Ralphs Smith's Southwest _____ Country Oven Bakery Delight Products Winchester... -

Page 9

...of future advisory votes on executive compensation; To consider and act upon a proposal to ratify the selection of independent public accountants for the year 2011; To act upon a shareholder proposal, if properly presented at the annual meeting; and To transact such other business as may properly be... -

Page 10

... principal executive offices of The Kroger Co. are located at 1014 Vine Street, Cincinnati, Ohio 45202-1100. Our telephone number is 513-762-4000. This Proxy Statement and Annual Report, and the accompanying proxy, were first furnished to shareholders on May 13, 2011. As of the close of business on... -

Page 11

...฀of฀AT&T฀Inc.,฀and฀ during the past five years was a director of BellSouth Corporation and Trustmark Corporation. He is a member of the Corporate Governance and Public Responsibilities Committees. Mr. Anderson has extensive litigation experience, and he served as the first African-American... -

Page 12

... in managing compensation programs makes him a valued member of the Compensation Committee. His abilities and service as a director were recognized by his peers, who selected Mr. Beyer as an Outstanding Director in 2008 as part of the Outstanding Directors Program of the Financial Times. 1999... -

Page 13

... in manufacturing, marketing, supply chain operations, customer service, and product development, all of which assist her in her role as a member of Kroger's Board. Ms. Kropf has a strong financial background, and has served on compensation, audit, and corporate governance committees of other boards... -

Page 14

...years with Kroger. He has a strong financial background and played a major role as architect of Kroger's strategic plan. Mr. McMullen is actively involved in the day-to-day operations of Kroger. His service on the compensation, executive, and investment committees of Cincinnati Financial Corporation... -

Page 15

... provider of facility and maintenance repair services. He is a director of First Service Networks. Mr. Moore is a member of the Compensation and Corporate Governance Committees. Mr. Moore has over 25 years of general management experience in public and private companies. He has sound experience as... -

Page 16

... Chief Operating Officer of Willamette Industries, Inc. until October 1995 and, before that time, as an executive and group vice president for more than five years. Mr. Rogel is a director of Union Pacific Corporation and EnergySolutions, Inc. He is a member of the Corporate Governance and Financial... -

Page 17

... and Financial Policy Committees. Mr. Runde brings to Kroger's Board a strong financial background, having led a major financial services provider. He has served on the compensation committee of a major corporation. 2006 Ronald L. Sargent Mr. Sargent is Chairman and Chief Executive Officer of... -

Page 18

... resources company, coupled with his corporate governance expertise, forms the foundation of his leadership role on Kroger's Board. 1999 (1) Except as noted, each of the directors has been employed by his or her present employer (or a subsidiary) in an executive capacity for at least five years... -

Page 19

...programs. Additional information on the Compensation Committee's processes and procedures for consideration of executive compensation are addressed in the Compensation Discussion and Analysis below. The Corporate Governance Committee develops criteria for selecting and retaining members of the Board... -

Page 20

... as defined by applicable SEC regulations and that all members of the Audit Committee are "financially literate" as that term is used in the NYSE listing standards. CODE OF ETHICS The Board of Directors has adopted The Kroger Co. Policy on Business Ethics, applicable to all officers, employees and... -

Page 21

... of compensation for executive officers. In 2010, Kroger paid that consultant $230,156 for work performed for the Committee. Kroger, on management's recommendation, retained the parent and affiliated companies of Mercer Human Resource Consulting to provide other services for Kroger in 2010, for... -

Page 22

...audit, compensation, corporate governance, financial policy, and public responsibilities. Each of the Board committees is composed solely of independent directors, each with a different independent director serving as committee chair. We believe that the mix of experienced independent and management... -

Page 23

... obtained while serving as a Kroger director, his corporate governance knowledge acquired during his tenure as a member of our Corporate Governance Committee, his previous experience on other boards, and his prior experience as a CEO of a Fortune 500 company. With respect to the roles of Chairman... -

Page 24

... executive officers, was substantially lower than the average of 74% over the prior nine years, but higher than the 38.450% paid in 2009. This reflects the extent to which Kroger was able to achieve increasingly more challenging targets for sales, earnings, our strategic plan, and our fuel program... -

Page 25

... the annual business plan targets established by the Board, and (b) to ensure that the officers achieve Kroger's long-term strategic objectives. In developing compensation programs and amounts to meet these objectives, the Committee exercises judgment to ensure that executive officer compensation is... -

Page 26

... Kroger's nonqualified deferred compensation program. •฀ Considered฀ internal฀ pay฀ equity฀ at฀ Kroger.฀ The฀ Committee฀ is฀ aware฀ of฀ reported฀ concerns฀ at฀ other฀ companies regarding disproportionate compensation awards to chief executive officers. The Committee... -

Page 27

... of major publicly-traded companies. These data are reference points, particularly for senior staff positions where competition for talent extends beyond the retail sector. In 2009, the Committee directly engaged an additional compensation consultant to conduct a review of฀ Kroger's฀ executive... -

Page 28

... paid by competitors for comparable positions and to provide an annual bonus potential to our executive officers that, if annual business plan objectives are achieved, would cause their total cash compensation to be meaningfully above the median. COMPONENTS OF EXECUTIVE COMPENSATION AT KROGER... -

Page 29

... the named executive officers earn each year is determined by Kroger's performance compared to targets established by the Committee based on the business plan adopted by the Board of Directors. In 2010, thirty percent of bonus was earned based on an identical sales target for Kroger's supermarkets... -

Page 30

...2010, exceeding our goal of 1,000 centers. As a result, the officers earned the additional 5% fuel bonus. As a result of the Company's performance when compared to the targets established by the Committee, and based on the business plan adopted by the Board of Directors, the named executive officers... -

Page 31

... made up of equity awards, of Kroger's executive compensation was not competitive. The Committee developed a plan to provide an incentive to the named executive officers to achieve the long-term goals established by the Board of Directors by conditioning a portion of compensation on the achievement... -

Page 32

... the named executive officers, under one of Kroger's long-term incentive plans. The options permit the holder to purchase Kroger common shares at an option price equal to the closing price of Kroger common shares on the date of the grant. The Committee adopted a policy of granting options only at... -

Page 33

... plan, the Committee also awarded performance units to the same individuals that receive the long-term performance-based cash bonus described in the previous section. During 2010, Kroger awarded 355,525 performance units to 136 employees, including the named executive officers. The number of shares... -

Page 34

... pay of up to 24 months' salary and bonus. The actual amount is dependent upon pay level and years of service. KEPP can be amended or terminated by the Board at any time prior to a change in control. Stock option and restricted stock agreements with participants in Kroger's long-term incentive plans... -

Page 35

... of named executive officers. Kroger's policy is, primarily, to design and administer compensation plans that support the achievement of long-term strategic objectives and enhance shareholder value. Where it is material and supports Kroger's compensation philosophy, the Committee also will attempt... -

Page 36

... Change in Pension Value and Nonqualified Non-Equity Deferred Incentive Plan Compensation All Other Compensation Earnings Compensation 3) (4) (5) Name and Principal Position Year Salary ($) Bonus ($) Stock Awards ($) (1) Option Awards ($) (2) Total ($) David B. Dillon Chairman and CEO 2010... -

Page 37

... aggregate grant date fair value of awards computed in accordance with FASB ASC Topic 718. Non-equity incentive plan compensation for 2010 consists of payments under an annual cash bonus program. In accordance with the terms of the 2010 performance-based annual cash bonus program, Kroger paid 53.868... -

Page 38

...average variable cost associated with the operation of the aircraft on such flights in accordance with a time-sharing arrangement consistent with FAA regulations. (6) Mr. Heldman was not a named executive officer in 2008. In accordance with applicable reporting requirements, compensation information... -

Page 39

... Compensation Table for 2010. This amount represents the bonus potential of the named executive officer under the Company's performance-based 2010 Long-Term Bonus Plan, a performance-based long-term cash bonus program. The "Target" amount equals the annual base salary of the named executive officer... -

Page 40

...Fair market value is defined as the closing price of Kroger shares on the date of the grant. Performance units were granted under one of the Company's long-term incentive plans.The "Maximum" amount represents the maximum number of common shares that can be earned by the named executive officer under... -

Page 41

... executive officers as of the end of fiscal year 2010. Each outstanding award is shown separately. Option awards include performance-based nonqualified stock options. The vesting schedule for each award is described in the footnotes to this table. Option Awards Equity Incentive Plan Awards: Number... -

Page 42

... Option Expiration Date Stock Awards Equity Equity Incentive Incentive Plan Plan Awards: Awards: Market Number of Market or Value of Unearned Payout Value Number of Shares or Shares, of Unearned Shares or Units of Units or Shares, Units of Stock Stock That Other Units or That Have Have Not Rights... -

Page 43

...executive officers performance-based nonqualified stock options. These options, having a term of ten years, vest six months prior to their date of expiration unless earlier vesting because Kroger's stock price achieved the specified annual rate of appreciation set forth in the stock option agreement... -

Page 44

...information on pension benefits as of 2010 year-end for the named executive officers. 2010 PENSION BENEFITS Number Present Payments of Years Value of During Credited Accumulated Last Fiscal Service Benefit Year (#) ($) ($) Name Plan Name David B. Dillon The Kroger Consolidated Retirement Benefit... -

Page 45

... on benefits to highly compensated individuals under qualified plans in accordance with the Internal Revenue Code. Each of the named executive officers will receive benefits under the Consolidated Plan and the Excess Plans, determined as follows: •฀ 1½%฀times฀years฀of฀credited฀service... -

Page 46

... 13 to the consolidated financial statements in Kroger's Form 10-K for fiscal year 2010 ended January 29, 2011. The discount rate used to determine the present values is 5.6%, which is the same rate used at the measurement date for financial reporting purposes. NONQUALIFIED DEFERRED COMPENSATION The... -

Page 47

... Aggregate number of stock options outstanding at fiscal year end was 29,500 shares. This amount reflects the change in pension value for the applicable directors. Only those directors elected to the Board prior to July 17, 1997 are eligible to participate in the outside director retirement plan. Mr... -

Page 48

... qualifications for service on Kroger's Board. Non-employee director compensation will be reviewed from time to time as the Corporate Governance Committee deems appropriate. P O T E N T I A L PAY M E N T S UPON TE R M I NAT ION OR CHANGE IN CONTROL Kroger has no contracts, agreements, plans or... -

Page 49

... to an executive officer will in no event exceed 2.99 times the officer's average W-2 earnings over the preceding five years. Kroger's change in control benefits under KEPP and under stock option and restricted stock agreements are discussed further in the Compensation Discussion and Analysis... -

Page 50

BENEFICIAL OWNERSHIP OF COMMON STOCK As of February 16, 2011, Kroger's directors, the named executive officers, and the directors and executive officers as a group, beneficially owned Kroger common shares as follows: Amount and Nature of Beneficial Ownership Name Reuben V. Anderson ...Donald E.... -

Page 51

... Statement of Policy with Respect to Related Person Transactions and the rules of the SEC, Kroger has the following related person transactions, which were approved by Kroger's Audit Committee, to disclose: •฀ During฀fiscal฀year฀2010,฀Kroger฀entered฀into฀a฀series฀of฀purchase... -

Page 52

... the Audit Committee of the Board is best suited to review and approve Related Person Transactions. For the purposes of this policy, a "Related Person" is: 1. 2. 3. any person who is, or at any time since the beginning of Kroger's last fiscal year was, a director or executive officer of Kroger or... -

Page 53

... officer is not an immediate family member of a Related Person and the Compensation Committee approved (or recommended that the Board approve) the executive officer's compensation, and (c) any compensation paid to a director if the compensation is required to be reported in Kroger's proxy statement... -

Page 54

... and independent public accountants; and the preparation of this report that SEC rules require be included in the Company's annual proxy statement. The Audit Committee performs this work pursuant to a written charter approved by the Board of Directors. The Audit Committee charter most recently... -

Page 55

... upon the review and discussions described in this report, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended January 29, 2011, as filed with the SEC. This report is... -

Page 56

... of Rule 16b-3(d)(1) under the Exchange Act and initially will be the Compensation Committee of the Board of Directors, made up exclusively of independent directors. The Non-Insider Program will be administered by a committee of three officers appointed by the Chief Executive Officer, the members of... -

Page 57

... value of such number of shares at the time of grant, or, in the case of a related right, the exercise price provided in the related option. To the extent required to comply with the requirements of Rule 16b-3 under the Exchange Act or otherwise provided in an agreement under the Plan, the Committee... -

Page 58

... from operations; (v) operating profit or income; (vi) net income; (vii) operating margin; (viii) net income margin; (ix) return on net assets; (x) economic value added; (xi) return on total assets; (xii) return on common equity; (xiii) return on total capital; (xiv) total shareholder return; (xv... -

Page 59

... taxable year in which such grantee recognizes the income, provided Kroger satisfies certain federal income tax withholding requirements. General. The rules governing the tax treatment of options, stock appreciation rights, performance units, incentive shares and restricted stock and stock acquired... -

Page 60

...NEW PLAN BENEFITS 2011 Long-Term Incentive and Cash Bonus Plan Name and Position (1) Dollar value ($) (1) Number of Units (1) All Groups ...(1) Awards, values and benefits not determinable for any Group. EQUITY COMPENSATION PLAN INFORMATION The following table provides information regarding shares... -

Page 61

..., the vote relates to the compensation of our named executive officers as described in this proxy statement. The vote is advisory. This means that the vote is not binding on Kroger. The Compensation Committee of our Board of Directors is responsible for establishing executive compensation. In so... -

Page 62

... S EXECUTIVE COMPENSATION. SELECTION OF AUDITORS (ITEM NO. 5) The Audit Committee of the Board of Directors is responsible for the appointment, compensation and retention of Kroger's independent auditor, as required by law and by applicable NYSE rules. On March 9, 2011, the Audit Committee appointed... -

Page 63

...January 29, 2011 and January 30, 2010, respectively, were for professional services rendered for the audits of Kroger's consolidated financial statements, the issuance of comfort letters to underwriters, consents, and assistance with the review of documents filed with the SEC. Audit-Related Fees for... -

Page 64

..., and Whereas, we believe violations of human rights in Kroger's supply chain can lead to negative publicity, public protests, and a loss of consumer confidence that can have a negative impact on shareholder value, and Whereas, Kroger's current vendor Code of Conduct is based heavily on compliance... -

Page 65

... basic human rights are respected by those seeking to do business with us. Kroger has in place a comprehensive code of conduct that is applicable to those that furnish goods or services to us, as well as their contractors. That code of conduct has been published and is available on our website at... -

Page 66

...of that report is available to shareholders on request by writing to: Scott M. Henderson, Treasurer, The Kroger Co., 1014 Vine Street, Cincinnati, Ohio 45202-1100 or by calling 1-513-762-1220. Our SEC filings are available to the public from the SEC's web site at www.sec.gov. The management knows of... -

Page 67

...accordance with the terms of Article 9. 1.9 "Date of Grant" means the date on which an Option, Right or Performance Unit is granted or Restricted Stock or Incentive Shares are awarded by the Committee. 1.10 "Director" means a non-Employee member of the Board of the Company. 1.11 "Employee" means any... -

Page 68

... from operations; (v) operating profit or income; (vi) net income; (vii) operating margin; (viii) net income margin; (ix) return on net assets; (x) economic value added; (xi) return on total assets; (xii) return on common equity; (xiii) return on total capital; (xiv) total shareholder return; (xv... -

Page 69

..., of the Company, or a reacquired previously issued common share. 1.34 "Stock Option Committee" means a committee of three or more members appointed by the Chief Executive Officer of the Company to administer the Non-Insider Program, each of whom is ineligible to receive grants or awards under the... -

Page 70

... awarded as Restricted Stock or Incentive Shares; (d) for the payment of the Option Price upon the exercise by an Employee or Director of an Option otherwise than in cash, including without limitation by delivery of Common Shares (other than Restricted Stock) valued at Fair Market Value on the Date... -

Page 71

...ten years from the Date of Grant. 6.3 The maximum number of Shares with respect to which Options may be granted to any Employee or Director under this Plan during its term is 3,750,000 Shares. In no event will the Option Price of an Option be less than the Fair Market Value of a Share at the time of... -

Page 72

... the number of Shares subject to the Related Right equal to the number of Shares with respect to which the Related Option is exercised. 7.6 Rights granted under the Plan, to the extent determined by the Committee, will comply with the requirements of Rule 16b-3 under the Exchange Act during the term... -

Page 73

... equal to the number of Shares with respect to which the Related Option is exercised. 8.7 Performance Units granted under the Plan, to the extent determined by the Committee, will comply with the requirements of Rule 16b-3 under the Exchange Act during the term of this Plan. Should any additional... -

Page 74

...only when the Related Option is transferable and only with the Related Option and under the same conditions. 11. Restricted Stock Awards 11.1 The Committee is hereby authorized to award Shares of Restricted Stock to Employees and Directors. 11.2 Restricted Stock awards under the Plan will consist of... -

Page 75

... forth the terms and conditions governing such awards. Each such agreement will contain the following: (a) prohibitions against the sale, assignment, transfer, exchange, pledge, hypothecation, or other encumbrance of (i) the Shares awarded as Restricted Stock under the Plan, (ii) the right to vote... -

Page 76

... the Agreement relating thereto. 12.3 The maximum number of Shares of Incentive Shares that may be awarded to any Employee or Director under this Plan during its term is 3,750,000 Shares. 13. Capital Adjustments The number and class of Shares subject to each outstanding Option, Right or Performance... -

Page 77

...Shares awarded will be forfeited if such shareholder approval is not obtained. 18. Term of the Plan Unless sooner terminated by the Board pursuant to Article 14, the Plan will terminate on the date ten years after its adoption by the Board, and no Options, Rights, Performance Units, Restricted Stock... -

Page 78

... hereunder, will not give an Employee or Director any right to be retained in the service of the Company or any Subsidiary. 20.3 The Company and its Subsidiaries may assume options, warrants, or rights to purchase stock issued or granted by other corporations whose stock or assets are acquired by... -

Page 79

2010 ANNUAL REPORT -

Page 80

-

Page 81

...the Company's website at www.thekrogerco.com. The Kroger Co. Policy on Business Ethics addresses, among other things, the necessity of ensuring open communication within the Company; potential conflicts of interests; compliance with all domestic and foreign laws, including those related to financial... -

Page 82

... 19.39 $ 20.51 $ 20.13 $ 19.45 Main trading market: New York Stock Exchange (Symbol KR) Number of shareholders of record at year-end 2010: 38,350 Number of shareholders of record at March 25, 2011: 38,047 During 2009, the Company paid three quarterly dividends of $0.09 and one quarterly dividend of... -

Page 83

... forth below is a line graph comparing the five-year cumulative total shareholder return on Kroger's common stock, based on the market price of the common stock and assuming reinvestment of dividends, with฀the฀cumulative฀total฀return฀of฀companies฀in฀the฀Standard฀&฀Poor's฀500... -

Page 84

...฀ Tea฀ Company,฀ Inc.,฀ Koninklijke฀ Ahold฀ NV฀ (ADR),฀ Safeway,฀ Inc.,฀ Supervalu฀ Inc.,฀ Target Corp., Tesco plc, Wal-Mart Stores Inc., Walgreen Co., Whole Foods Market Inc. and Winn-Dixie Stores, Inc. Albertson's, Inc. was a member of the peer group in prior years but was... -

Page 85

... our employee stock option and long-term incentive plans, which program is limited to proceeds received from exercises of stock options and the tax benefits associated therewith. The programs have no expiration date but may be terminated by the Board of Directors at any time. Total shares purchased... -

Page 86

... on annual sales. The Company also manufactures and processes some of the food for sale in its supermarkets. The Company's principal executive offices are located at 1014 Vine Street, Cincinnati, Ohio 45202, and its telephone number is (513) 762-4000. The Company maintains a web site (www.kroger.com... -

Page 87

..., profit and losses, and total assets are shown in the Company's Consolidated Financial Statements set forth in Item 8 below. M ERCHANDISING AND M A N U FAC T U R I NG Corporate brand products play an important role in the Company's merchandising strategy. Our supermarkets, on average, stock... -

Page 88

..., City Market, Dillons, Jay C, Food 4 Less, Fred Meyer, Fry's, King Soopers, QFC, Ralphs and Smith's. Of these stores, 1,014 have fuel centers. We also operate 784 convenience stores and 361 fine jewelry stores. Kroger operates 40 manufacturing plants, primarily bakeries and dairies, which supply... -

Page 89

... margins and decreased operating profit, partially offset by lower LIFO charges and after-tax costs of $16 million from disruption and damage caused by Hurricane Ike in 2008. Sales Total Sales (in millions) 2010 Percentage Increase 2009 Percentage Increase 2008 Total supermarket sales without fuel... -

Page 90

(1) Other sales primarily relate to sales at convenience stores, including fuel; jewelry stores; manufacturing plants to outside customers; variable interest entities; and an in-store health clinic. The increase in total sales for 2010 compared to 2009 was primarily the result of our identical ... -

Page 91

... by management to evaluate merchandising and operational effectiveness. Our FIFO gross margin rates, as a percentage of sales, were 22.29% in 2010, 23.23% in 2009 and 23.38% in 2008. Our retail fuel sales reduce our FIFO gross margin rate due to the very low FIFO gross margin on retail fuel sales as... -

Page 92

... and year-over-year decline in retail fuel prices. Interest Expense Net interest expense totaled $448 million in 2010, $502 million in 2009 and $485 million in 2008. The decrease in interest expense in 2010, compared to 2009, resulted primarily from a lower weighted average interest rate, an average... -

Page 93

... of state income taxes. COMMON STOCK REPURCHASE PROGRAM We maintain stock repurchase programs that comply with Securities Exchange Act Rule 10b5-1 and allow for the orderly repurchase of our common stock, from time to time. We made open market purchases of Kroger stock totaling $505 million in 2010... -

Page 94

... history of losses or a projection of continuing losses or a significant decrease in the market value of an asset. When a trigger event occurs, we perform an impairment calculation, comparing projected undiscounted cash flows, utilizing current cash flow information and expected growth rates related... -

Page 95

..., the operating performance of the Ralphs reporting unit was significantly affected by the economic conditions at the time and responses to competitive actions in Southern California. As a result of this decline in current and future expected cash flows, along with comparable fair value information... -

Page 96

...flows assume long-term sales growth rates comparable to historical performances and a discount rate of 12.5%. For additional information relating to our results of the goodwill impairment reviews performed during 2010, 2009 and 2008 see Note 2 to the Consolidated Financial Statements. The impairment... -

Page 97

... target allocations, we believe an 8.5% rate of return assumption is reasonable. See Note 13 to the Consolidated Financial Statements for more information on the asset allocations of pension plan assets. Sensitivity to changes in the major assumptions used in the calculation of Kroger's pension plan... -

Page 98

... from most of our collective bargaining agreements. These plans provide retirement benefits to participants based on their service to contributing employers. The benefits are paid from assets held in trust for that purpose. Trustees are appointed in equal number by employers and unions. The trustees... -

Page 99

...Internal Revenue Service covered the years 2005 through 2007. The assessment of our tax position relies on the judgment of management to estimate the exposures associated with our various filing positions. Share-Based Compensation Expense We account for stock options under the fair value recognition... -

Page 100

...These amounts are also net of cash contributions to our Company-sponsored defined benefit pension plans totaling $141 million in 2010, $265 million in 2009 and $20 million in 2008. The amount of cash paid for income taxes increased in 2010, compared to 2009, due to reversals of temporary differences... -

Page 101

... of Kroger stock in 2010 compared to $218 million in 2009 and $637 million in 2008. We paid dividends totaling $250 million in 2010, $238 million in 2009 and $227 million in 2008. Debt Management Total debt, including both the current and long-term portions of capital leases and lease-financing... -

Page 102

...an adjustment for unusual gains and losses including our non-cash asset impairment charges related to goodwill in 2010 and 2009. Our credit agreement is more fully described in Note 5 to the Consolidated Financial Statements. We were in compliance with our financial covenants at year-end 2010. A-22 -

Page 103

...): 2011 2012 2013 2014 2015 Thereafter Total Contractual Obligations (1) (2) Long-term debt (3) ...$ 549 $ 905 $1,520 $ 308 $ 516 Interest on long-term debt (4)...408 377 330 274 259 Capital lease obligations ...60 50 47 43 38 Operating lease obligations ...741 698 651 597 529 Low-income housing... -

Page 104

... out of agreements to provide services to Kroger; indemnities related to the sale of our securities; indemnities of directors, officers and employees in connection with the performance of their work; and indemnities of individuals serving as fiduciaries on benefit plans. While Kroger's aggregate... -

Page 105

... light of the information currently available. Such statements relate to, among other things: projected changes in net earnings attributable to The Kroger Co.; identical supermarket sales growth; expected product cost; expected pension plan contributions; our ability to generate operating cash flow... -

Page 106

...2011,฀we฀expect฀interest฀expense฀to฀be฀approximately฀$460฀million. •฀ We฀plan฀to฀use฀cash฀flow฀primarily฀for฀capital฀investments,฀to฀maintain฀our฀current฀debt฀coverage฀ ratios, to pay cash dividends, and to repurchase stock. As market conditions... -

Page 107

... years. Among other things, investment performance of plan assets, the interest rates required to be used to calculate the pension obligations, and future changes in legislation, will determine the amounts of any additional contributions. We expect 2011 expense for Company-sponsored defined benefit... -

Page 108

spending; changes in government-funded benefit programs; manufacturing commodity costs; diesel fuel costs related to our logistics operations; trends in consumer spending; the extent to which our customers exercise caution in their purchasing in response to economic conditions; the inconsistent pace... -

Page 109

... Plan will depend on the number of participants, savings rate, plan compensation, and length of service of participants. •฀ Our฀ contributions฀ and฀ recorded฀ expense฀ related฀ to฀ multi-employer฀ pension฀ funds฀ could฀ increase฀ more than anticipated. Should asset values... -

Page 110

... decrease customer demand for certain products. Increases in demand for certain commodities could also increase the cost our suppliers charge for their products. Additionally, increases in the cost of inputs, such as utility costs or raw material costs, could negatively affect financial ratios and... -

Page 111

...the Shareowners and Board of Directors of The Kroger Co. In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of operations, cash flows and changes in shareowners' equity present fairly, in all material respects, the financial position of The Kroger Co... -

Page 112

...misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Cincinnati, Ohio March 29, 2011 A-32 -

Page 113

... ...Prefunded employee benefits ...Prepaid and other current assets ...Total current assets ...Property, plant and equipment, net ...Goodwill ...Other assets ...Total Assets ...LIABILITIES Current liabilities Current portion of long-term debt including obligations under capital leases and financing... -

Page 114

THE K ROGER CO. CONSOLIDATED STATEMENTS OF OPER ATIONS Years Ended January 29, 2011, January 30, 2010 and January 31, 2009 (In millions, except per share amounts) 2010 2009 2008 (52 weeks) (52 weeks) (52 weeks) Sales ...$82,189 Merchandise costs, including advertising, warehousing, and ... -

Page 115

... impairment charge ...Asset impairment charge ...LIFO charge ...Stock-based employee compensation ...Expense for Company-sponsored pension plans ...Deferred income taxes ...Other ...Changes in operating assets and liabilities net of effects from acquisitions of businesses: Store deposits in-transit... -

Page 116

... 2008 ...Issuance of common stock: Stock options exercised ...Restricted stock issued ...Treasury stock activity: Treasury stock purchases, at cost ...Stock options exchanged ...Tax benefits from exercise of stock options ...Share-based employee compensation...Other comprehensive loss net of income... -

Page 117

... conform to current year presentation. 1. ACCOUNTING POLICIES The following is a summary of the significant accounting policies followed in preparing these financial statements. Description of Business, Basis of Presentation and Principles of Consolidation The Kroger Co. (the "Company") was founded... -

Page 118

... Other Long-Term Liabilities on the Company's Consolidated Balance Sheets. Goodwill The Company reviews goodwill for impairment during the fourth quarter of each year, and also upon the occurrence of trigger events. The reviews are performed at the operating division level. Generally, fair value is... -

Page 119

...and current economic conditions. Impairment is recognized for the excess of the carrying value over the estimated fair market value, reduced by estimated direct costs of disposal. The Company recorded asset impairments in the normal course of business totaling $25, $48 and $26 in 2010, 2009 and 2008... -

Page 120

...resources in the conduct of the normal course of business. The Company's current program relative to commodity price protection and the methods by which the Company accounts for its purchase commitments are described in Note 6. Benefit Plans The Company recognizes the funded status of its retirement... -

Page 121

... for financial reporting is classified according to the expected reversal date. Uncertain Tax Positions The Company reviews the tax positions taken or expected to be taken on tax returns to determine whether and to what extent a benefit can be recognized in its consolidated financial statements... -

Page 122

...the Company's products. Gift card and certificate breakage is recognized when redemption is deemed remote. The amount of breakage has not been material for the 2010, 2009 and 2008 years. Merchandise Costs The "Merchandise costs" line item of the Consolidated Statements of Operations includes product... -

Page 123

... allowances for co-operative advertising as a reduction of advertising expense. Deposits In-Transit Deposits in-transit generally represent funds deposited to the Company's bank accounts at the end of the year related to sales, a majority of which were paid for with credit cards and checks, to which... -

Page 124

..., the operating performance of the Ralphs reporting unit was significantly affected by the economic conditions at the time and responses to competitive actions in Southern California. As a result of this decline in current and future expected cash flows, along with comparable fair value information... -

Page 125

... the Company's remaining goodwill balance, except for one non-supermarket reporting unit with recorded goodwill of $77. The fair value of this reporting unit was estimated using discounted cash flows. The discounted cash flows assume long-term sales growth rates comparable to historical performances... -

Page 126

... Current ...Deferred ...Total ... $ 697 (136) 561 95 (55) 40 $ 601 $ 193 275 468 41 23 64 $ 532 $ 304 331 635 46 36 82 $ 717 A reconciliation of the statutory federal rate and the effective rate follows: 2010 2009 2008 Statutory rate...State income taxes, net of federal tax benefit ...Credits... -

Page 127

...tax liabilities: Insurance related costs ...Inventory related costs ...Other...Total current deferred tax liabilities ...Current deferred taxes...Long-term deferred tax assets: Compensation related costs ...Lease accounting...Closed store reserves ...Insurance related costs ...Net operating loss and... -

Page 128

...of the Company's 2005 - 2007 U.S. tax returns during the second quarter of 2010 and is currently auditing years 2008 - 2009. The audit is not expected to be completed in the next twelve months. Additionally, the Company has a case in the U.S. Tax Court. A favorable ruling on the Company's motion for... -

Page 129

... the Company's option, at either (i) LIBOR plus a market rate spread, subject to a floor and cap based on the Company's Leverage Ratio or (ii) the base rate, defined as the highest of (a) the Bank of America prime rate, (b) the Federal Funds rate plus 0.5%, and (c) one-month LIBOR plus 1.0%, subject... -

Page 130

... directors of the Company or (iii) both a change of control and a below investment grade rating. The aggregate annual maturities and scheduled payments of long-term debt, as of year-end 2010, and for the years subsequent to 2010 are: 2011 ...2012 ...2013 ...2014 ...2015 ...Thereafter ...Total... -

Page 131

NOTES TO CONSOLIDATED FINA NCI A L STATEMENTS, CONTINUED Annually, the Company reviews with the Financial Policy Committee of the Board of Directors compliance with these guidelines. These guidelines may change as the Company's needs dictate. Fair Value Interest Rate Swaps The table below ... -

Page 132

... Hedging Relationships Location of Gain/ (Loss) Reclassified into Income (Effective Portion) Forward-Starting Interest Rate Swaps, net of tax ...Commodity Price Protection $(5) $(7) $(2) $(2) Interest expense The Company enters into purchase commitments for various resources, including raw... -

Page 133

...to) fair value in the consolidated financial statements, the following tables summarize the fair value of these instruments at January 29, 2011 and January 30, 2010: January 29, 2011 Fair Value Measurements Using Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Unobservable... -

Page 134

...At January 29, 2011 and January 30, 2010, the carrying and fair value of long-term investments for which fair value is determinable were $69 and $60, respectively. 8. LEASES AND L E A SE-FI NA NCED TR A NSAC T IONS While the Company's current strategy emphasizes ownership of store real estate, the... -

Page 135

... 648 $ 762 12 (115) $ 659 Minimum annual rentals and payments under capital leases and lease-financed transactions for the five years subsequent to 2010 and in the aggregate are: Capital Leases Operating Leases LeaseFinanced Transactions 2011 ...2012 ...2013 ...2014 ...2015 ...Thereafter ... $ 60... -

Page 136

... A N S The Company grants options for common stock ("stock options") to employees, as well as to its nonemployee directors, under various plans at an option price equal to the fair market value of the stock at the date of grant. The Company accounts for stock options under the fair value recognition... -

Page 137

... market prices or nine years and six months from the date of grant. At January 29, 2011, approximately eight million shares of common stock were available for future option grants under these plans. In addition to the stock options described above, the Company awards restricted stock to employees... -

Page 138

... utilizes extensive judgment and financial estimates, including the term employees are expected to retain their stock options before exercising them, the volatility of the Company's stock price over that expected term, the dividend yield over the term and the number of awards expected to be A-58 -

Page 139

...record stock-based compensation expense in the Consolidated Statements of Operations. The decrease in the fair value of the stock options granted during 2010 and 2009, compared to 2008, resulted primarily from a decrease in the Company's stock price. The following table reflects the weighted-average... -

Page 140

... with unrelated insurance companies. Operating divisions and subsidiaries have paid premiums, and the insurance subsidiary has provided loss allowances, based upon actuarially determined estimates. Litigation - On October 6, 2006, the Company petitioned the Tax Court (Ralphs Grocery Company and... -

Page 141

... the best interest of the Company. Common Stock Repurchase Program The Company maintains stock repurchase programs that comply with Securities Exchange Act Rule 10b5-1 to allow for the orderly repurchase of The Kroger Co. stock, from time to time. The Company made open market purchases totaling $505... -

Page 142

... the Qualified Plans. Funding for the pension plans is based on a review of the specific requirements and on evaluation of the assets and liabilities of each plan. In addition to providing pension benefits, the Company provides certain health care benefits for retired employees. The majority of the... -

Page 143

NOTES TO CONSOLIDATED FINA NCI A L STATEMENTS, CONTINUED Other changes recognized in other comprehensive income in 2010, 2009, and 2008 were as follows (pre-tax): Pension Benefits 2010 2009 2008 Other Benefits 2010 2009 2008 2010 Total 2009 2008 Incurred net actuarial loss (gain) ...$ (18) $ 142... -

Page 144

NOTES TO CONSOLIDATED FINA NCI A L STATEMENTS, CONTINUED Information with respect to change in benefit obligation, change in plan assets, the funded status of the plans recorded in the Consolidated Balance Sheets, net amounts recognized at end of fiscal years, weighted average assumptions and ... -

Page 145

... TO CONSOLIDATED FINA NCI A L STATEMENTS, CONTINUED As of January 29, 2011 and January 30, 2010, pension plan assets included no shares of The Kroger Co. common stock. Weighted average assumptions 2010 Pension Benefits 2009 2008 2010 Other Benefits 2009 2008 Discount rate - Benefit obligation... -

Page 146

...of fiscal year...Fair value of plan assets at end of year ... $2,923 $2,743 $2,472 $ 2,706 $ 2,506 $ 2,096 $ 192 $ 187 $ - $ 187 $ 172 $ - The following table provides information about the Company's estimated future benefit payments. Pension Benefits Other Benefits 2011 ...2012 ...2013 ...2014... -

Page 147

... benefits to participants and beneficiaries of the pension plans. Investment objectives have been established based on a comprehensive review of the capital markets and each underlying plan's current and projected financial requirements. The time horizon of the investment objectives is long-term... -

Page 148

... Inputs (Level 2) (Level 3) Quoted Prices in Active Markets for Identical Assets (Level 1) Total Cash and cash equivalents ...Corporate Stocks ...Corporate Bonds ...U.S. Government Securities ...Mutual Funds/Collective Trusts ...Partnerships/Joint Ventures ...Hedge Funds ...Private Equity ...Real... -

Page 149

... securities฀ are฀ valued฀ at฀ the฀ closing฀ price฀ reported in the active market in which the security is traded. Other U.S. government securities are valued based on yields currently available on comparable securities of issuers with similar credit ratings. When quoted prices are not... -

Page 150

...trust฀funds฀are฀public฀investment฀vehicles฀valued฀using฀ a Net Asset Value (NAV) provided by the manager of each fund. The NAV is based on the underlying net assets owned by the fund, divided by the number of shares outstanding. The NAV's unit price is quoted on a private market that... -

Page 151

... CONSOLIDATED FINA NCI A L STATEMENTS, CONTINUED Multi-Employer Plans The Company also contributes to various multi-employer pension plans based on obligations arising from most of its collective bargaining agreements. These plans provide retirement benefits to participants based on their service... -

Page 152

...) (12 Weeks) Total Year (52 Weeks) 2010 Sales ...Merchandise costs, including advertising, warehousing, and transportation, excluding items shown separately below ...Operating, general, and administrative ...Rent ...Depreciation and amortization ...Goodwill impairment charge ...Operating profit... -

Page 153

... at the annual meeting of shareholders to be held on June 23, 2011. The Plan permits the Company to grant various forms of equity-based awards, including nonqualified stock options and restricted stock, to employees and to its non-employee directors. The total number of shares of common stock that... -

Page 154

...sell shares they have purchased through this plan, they should contact: The Bank of New York Mellon Employee Investment Plans Division P. O. Box 7090 Troy, MI 48007-7090 Toll Free 1-800-872-3307 Questions regarding Kroger's 401(k) plans should be directed to the employee's Human Resources Department... -

Page 155

... Ralphs Michael L. Ellis Fred Meyer Stores Peter M. Engel Fred Meyer Jewelers Jon C. Flora Fry's Donna Giordano QFC Rick Going Michigan Division Joseph A. Grieshaber, Jr. Dillon Stores John P. Hackett Mid-South Division James Hallsey Smith's Bryan H. Kaltenbach Food 4 Less Bruce A. Lucia Atlanta... -

Page 156

Th e ฀K ro ge r ฀C o .฀•฀1014฀V i n e ฀S T r e e T ฀•฀C i nC i n naT i ,฀o h io ฀45202฀•฀(513)฀762- 4000