Honeywell 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 that it had officially closed its investigation into possible collusion in the replacement auto filters industry.

Honeywell v. United Auto Workers ("UAW") et. al—In July 2011, Honeywell filed an action in federal court (District of New Jersey) against the

UAW and all former employees who retired under a series of Master Collective Bargaining Agreements ("MCBAs") between Honeywell and the UAW. The

Company is seeking a declaratory judgment that certain express limitations on its obligation to contribute toward the healthcare coverage of such retirees (the

"CAPS") set forth in the MCBAs may be implemented, effective January 1, 2012. In September 2011, the UAW and certain retiree defendants filed a motion

to dismiss the New Jersey action and filed suit in the Eastern District of Michigan alleging that the MCBAs do not provide for CAPS on the Company's

liability for healthcare coverage. The UAW and retiree plaintiffs subsequently filed a motion for class certification and a motion for partial summary judgment

in the Michigan action, seeking a ruling that retirees who retired prior to the initial inclusion of the CAPS in the 2003 MCBA are not covered by the CAPS as

a matter of law. In December 2011, the New Jersey action was dismissed on jurisdictional grounds. Honeywell has filed a motion for expedited review of the

New Jersey court's dismissal with the United States Court of Appeals for the Third Circuit and the parties are awaiting the court's instructions with respect to

how the Michigan action is to proceed. Honeywell is confident that the CAPS will be upheld and that its liability for healthcare coverage premiums with

respect to the putative class will be limited as negotiated and expressly set forth in the applicable MCBAs. In the event of an adverse ruling, however,

Honeywell's other postretirement benefits for pre-2003 retirees would increase by approximately $150 million, reflecting the estimated value of these CAPS.

Given the uncertainty inherent in litigation and investigations (including the specific matters referenced above), we do not believe it is possible to

develop estimates of reasonably possible loss in excess of current accruals for these matters. Considering our past experience and existing accruals, we do not

expect the outcome of these matters, either individually or in the aggregate, to have a material adverse effect on our consolidated financial position. Because

most contingencies are resolved over long periods of time, potential liabilities are subject to change due to new developments, changes in settlement strategy

or the impact of evidentiary requirements, which could cause us to pay damage awards or settlements (or become subject to equitable remedies) that could

have a material adverse effect on our results of operations or operating cash flows in the periods recognized or paid.

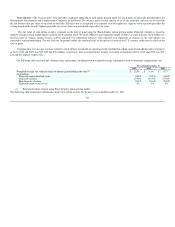

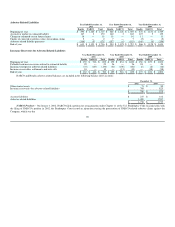

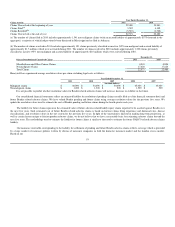

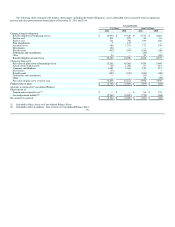

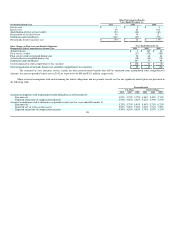

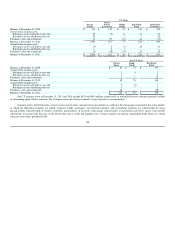

Warranties and Guarantees—We have issued or are a party to the following direct and indirect guarantees at December 31, 2011:

Maximum

Potential

Future

Payments

Operating lease residual values $ 43

Other third parties' financing 5

Unconsolidated affiliates' financing 12

Customer financing 13

$ 73

We do not expect that these guarantees will have a material adverse effect on our consolidated results of operations, financial position or liquidity.

In connection with the disposition of certain businesses and facilities we have indemnified the purchasers for the expected cost of remediation of

environmental contamination, if any, existing on the date of disposition. Such expected costs are accrued when environmental assessments are made or

remedial efforts are probable and the costs can be reasonably estimated.

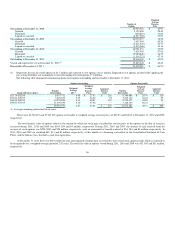

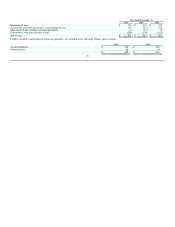

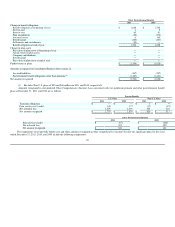

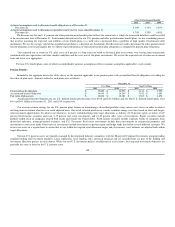

In the normal course of business we issue product warranties and product performance guarantees. We accrue for the estimated cost of product

warranties and performance guarantees based on contract terms and historical experience at the time of sale. Adjustments to initial obligations for warranties

and guarantees are made as changes in the obligations become reasonably estimable. The following table summarizes information concerning our recorded

obligations for product warranties and product performance guarantees:

95