Honeywell 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

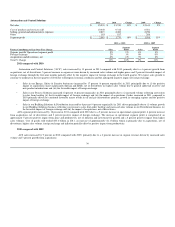

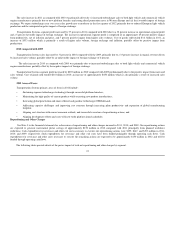

In February 2011, the Board of Directors authorized the repurchase of up to a total of $3 billion of Honeywell common stock. During 2011, the

Company repurchased $1,085 million of outstanding shares to offset the dilutive impact of employee stock based compensation plans, including future option

exercises, restricted unit vesting and matching contributions under our savings plans (see Part II, Item 5 for share repurchases in the fourth quarter of 2011).

In July 2011, the Company sold its Consumer Products Group business (CPG) to Rank Group Limited. The sale was completed for approximately $955

million in cash proceeds, resulting in a pre-tax gain of approximately $301 million and approximately $178 million net of tax. The gain was recorded in net

income from discontinued operations after taxes in the Company's Consolidated Statement of Operations for the year ended December 31, 2011. The net

income attributable to the non-controlling interest for the discontinued operations is insignificant. The sale of CPG, which had been part of the Transportation

Systems segment, is consistent with the Company's strategic focus on its portfolio of differentiated global technologies. See Acquisitions and Divestitures in

Note 2 to the financial statements for further discussion.

In August 2011, the Company completed the acquisition of EMS, a leading provider of connectivity solutions for mobile networking, rugged mobile

computers and satellite communications. The aggregate value, net of cash acquired, was approximately $513 million. See Acquisitions and Divestitures in

Note 2 to the financial statements for further discussion.

In December 2011, the Company acquired King's Safetywear Limited (KSW), a leading international provider of branded safety footwear. The

aggregate value, net of cash acquired, was approximately $331 million (including the assumption of debt of $33 million). See Acquisitions and Divestitures in

Note 2 to the financial statements for further discussion.

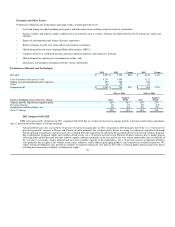

During 2011, the Company made voluntary cash contributions to its U.S. pension plans of $1,650 million to improve the funded status of our plans.

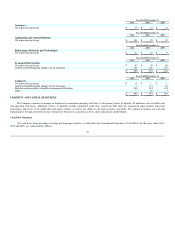

In addition to our normal operating cash requirements, our principal future cash requirements will be to fund capital expenditures, debt repayments,

dividends, employee benefit obligations, environmental remediation costs, asbestos claims, severance and exit costs related to repositioning actions, share

repurchases and any strategic acquisitions.

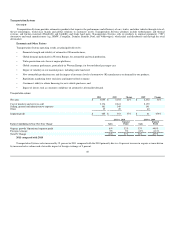

Specifically, we expect our primary cash requirements in 2012 to be as follows:

•Capital expenditures—we expect to spend approximately $1.1 billion for capital expenditures in 2012 primarily for growth, production and

capacity expansion, cost reduction, maintenance, and replacement.

•Share repurchases— Under the Company's previously reported $3 billion share repurchase program, $1.9 billion remained available as of

December 31, 2011 for additional share repurchases. Honeywell presently expects to repurchase outstanding shares from time to time during

2012 to offset the dilutive impact of employee stock based compensation plans, including future option exercises, restricted unit vesting and

matching contributions under our savings plans. The amount and timing of future repurchases may vary depending on market conditions and the

level of operating, financing and other investing activities.

•Dividends—we expect to pay approximately $1.2 billion in dividends on our common stock in 2012, reflecting the 12 percent increase in the

dividend rate effective with the fourth quarter 2011 dividend.

•Asbestos claims—we expect our cash spending for asbestos claims and our cash receipts for related insurance recoveries to be approximately

$240 and $75 million, respectively, in 2012. See Asbestos Matters in Note 21 to the financial statements for further discussion of possible

funding obligations in 2012 related to the Narco Trust.

•Pension contributions—In 2012, we plan to make cash contributions of $800 million to $1 billion ($250 million was made in January 2012) to

our plans to improve the funded status of the plans. These contributions principally consist of voluntary contributions to our U.S. plans. The

timing and amount of contributions may be impacted by a number of factors, including the funded status of the plans.

•Repositioning actions—we expect that cash spending for severance and other exit costs necessary to execute the previously announced

repositioning actions will approximate $150 million in 2012. 45