Honeywell 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

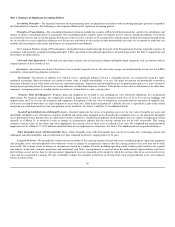

In June 2011, the FASB issued amendments to disclosure requirements for presentation of comprehensive income. This guidance, effective

retrospectively for the interim and annual periods beginning on or after December 15, 2011 (early adoption is permitted), requires presentation of total

comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of

comprehensive income or in two separate but consecutive statements. In December 2011, the FASB issued an amendment to defer the presentation on the face

of the financial statements the effects of reclassifications out of accumulated other comprehensive income on the components of net income and other

comprehensive income for annual and interim financial statements. The implementation of the two aforementioned amendments is not expected to have a

material impact on our consolidated financial position and results of operations.

In September 2011, the FASB issued amendments to the goodwill impairment guidance which provides an option for companies to use a qualitative

approach to test goodwill for impairment if certain conditions are met. The amendments are effective for annual and interim goodwill impairment tests

performed for fiscal years beginning after December 15, 2011 (early adoption is permitted). The implementation of amended accounting guidance is not

expected to have a material impact on our consolidated financial position and results of operations.

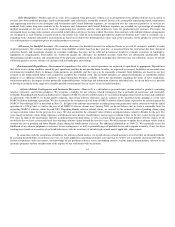

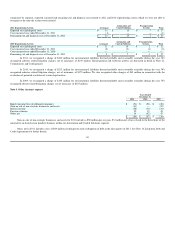

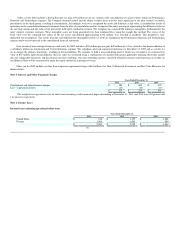

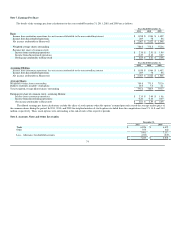

Note 2. Acquisitions and Divestitures

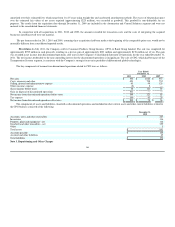

Acquisitions – We acquired businesses for an aggregate cost of $973, $1,303, and $468 million in 2011 2010 and 2009, respectively. For all of our

acquisitions the acquired businesses were recorded at their estimated fair values at the dates of acquisition. Significant acquisitions made in these years are

discussed below.

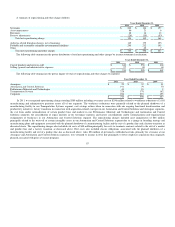

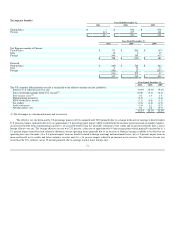

In December 2011, the Company acquired King's Safetywear Limited (KSW), a leading international provider of branded safety footwear. The

aggregate value, net of cash acquired, was approximately $331 million (including the assumption of debt of $33 million) and was allocated to tangible and

identifiable intangible assets acquired and liabilities assumed based on their estimated fair values at the acquisition date. On a preliminary basis, the Company

has assigned approximately $178 million to identifiable intangible assets, predominantly trademarks, technology, and customer relationships. The definite

lived intangible assets are being amortized over their estimated lives, using straight-line and accelerated amortization methods. The value assigned to

trademarks of approximately $91 million is classified as indefinite lived intangibles. The excess of the purchase price over the estimated fair values of net

assets acquired (approximately $163 million), was recorded as goodwill. This goodwill arises primarily from the avoidance of the time and costs which would

be required (and the associated risks that would be encountered) to enhance our product offerings to key target markets and serve as entry into new and

profitable segments, and the expected cost synergies that will be realized through the consolidation of the acquired business into our Automation and Control

Solutions segment. Their cost synergies are expected to be realized principally in the areas of selling, general and administrative expenses, material sourcing

and manufacturing. This goodwill is non–deductible for tax purposes.

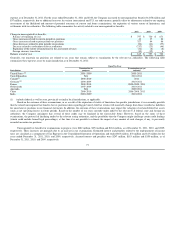

The results from the acquisition date through December 31, 2011 are included in the Automation and Control Solutions segment and were not material

to the consolidated financial statements. As of December 31, 2011, the purchase accounting for KSW is subject to final adjustment primarily for the valuation

of inventory, property, plant and equipment, useful lives of intangible assets, amounts allocated to intangible assets and goodwill, tax balances, and for certain

pre-acquisition contingencies.

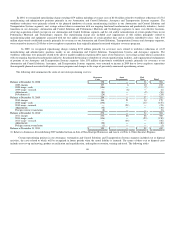

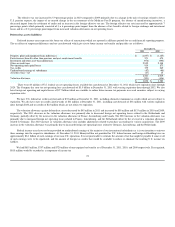

In August 2011, the Company acquired 100 percent of the issued and outstanding shares of EMS Technologies, Inc. (EMS), a leading provider of

connectivity solutions for mobile networking, rugged mobile computers and satellite communications. EMS had reported 2010 revenues of approximately

$355 million.

The aggregate value, net of cash acquired, was approximately $513 million and was allocated to tangible and identifiable intangible assets acquired and

liabilities assumed based on their estimated fair values at the acquisition date. On a preliminary basis, the Company has assigned approximately $119 million

to identifiable intangible assets, of which approximately $89 million and approximately $30 million were recorded within the Aerospace and Automation and

Control segments, respectively. The intangible assets are predominantly customer relationships, existing technology and trademarks. These intangible assets

are being amortized over their estimated lives, using straight-line and accelerated amortization methods. The excess of the purchase price over the estimated

fair values of net assets acquired (approximating $326 million), was recorded as goodwill. This goodwill arises primarily from the avoidance of the time and

costs which would be required (and the

64