Honeywell 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

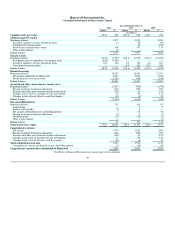

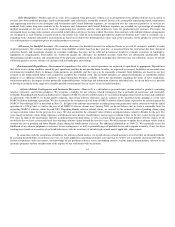

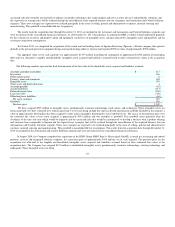

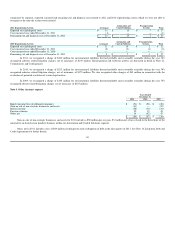

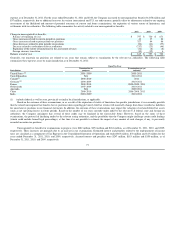

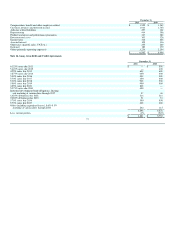

A summary of repositioning and other charges follows:

Years Ended December 31,

2011 2010 2009

Severance $ 246 $ 144 $ 197

Asset impairments 86 21 6

Exit costs 48 14 10

Reserve adjustments (26) (30) (53)

Total net repositioning charge 354 149 160

Asbestos related litigation charges, net of insurance 149 175 155

Probable and reasonably estimable environmental liabilities 240 212 145

Other — 62 7

Total net repositioning and other charges $ 743 $ 598 $ 467

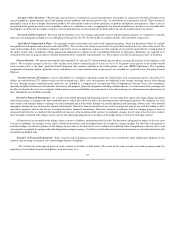

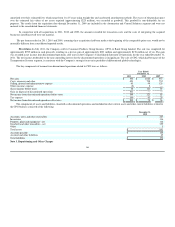

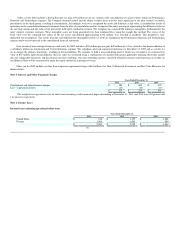

The following table summarizes the pretax distribution of total net repositioning and other charges by income statement classification:

Years Ended December 31,

2011 2010 2009

Cost of products and services sold $ 646 $ 558 $ 404

Selling, general and administrative expenses 97 40 63

$ 743 $ 598 $ 467

The following table summarizes the pretax impact of total net repositioning and other charges by segment:

Years Ended December 31,

2011 2010 2009

Aerospace $ 29 $ 32 $ 31

Automation and Control Solutions 191 79 70

Performance Materials and Technologies 41 18 9

Transportation Systems 228 178 162

Corporate 254 291 195

$ 743 $ 598 $ 467

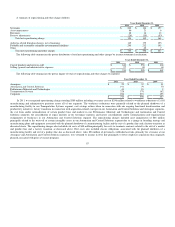

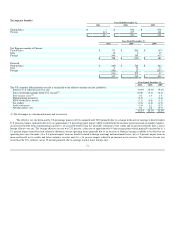

In 2011, we recognized repositioning charges totaling $380 million including severance costs of $246 million related to workforce reductions of 3,188

manufacturing and administrative positions across all of our segments. The workforce reductions were primarily related to the planned shutdown of a

manufacturing facility in our Transportation Systems segment, cost savings actions taken in connection with our ongoing functional transformation and

productivity initiatives, factory transitions in connection with acquisition-related synergies in our Automation and Control Solutions and Aerospace segments,

the exit from and/or rationalization of certain product lines and markets in our Performance Materials and Technologies and Automation and Control

Solutions segments, the consolidation of repair facilities in our Aerospace segment, and factory consolidations and/or rationalizations and organizational

realignments of businesses in our Automation and Control Solutions segment. The repositioning charges included asset impairments of $86 million

principally related to the write-off of certain intangible assets in our Automation and Control Solutions segment due to a change in branding strategy and

manufacturing plant and equipment associated with the planned shutdown of a manufacturing facility and the exit of a product line and a factory transition as

discussed above. The repositioning charges also included exit costs of $48 million principally for costs to terminate contracts related to the exit of a market

and product line and a factory transition as discussed above. Exit costs also included closure obligations associated with the planned shutdown of a

manufacturing facility and exit of a product line also as discussed above. Also, $26 million of previously established accruals, primarily for severance at our

Aerospace and Automation and Control Solutions segments, were returned to income in 2011 due principally to fewer employee separations than originally

planned associated with prior severance programs.

67