Honeywell 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

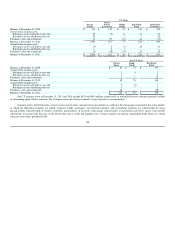

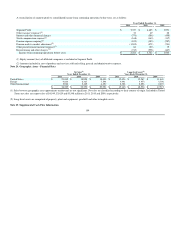

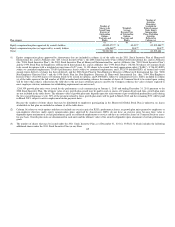

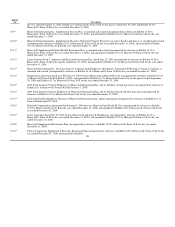

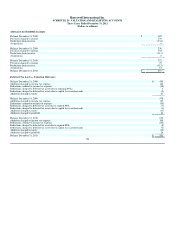

Plan category

Number of

Shares to be

Issued Upon

Exercise of

Outstanding

Options,

Warrants and

Rights

Weighted-

Average

Exercise Price

of Outstanding

Options,

Warrants and

Rights

Number of

Securities

Remaining

Available for

Future Issuance

Under Equity

Compensation

Plans (Excluding

Securities

Reflected in

Column (a))

(a) (b) (c)

Equity compensation plans approved by security holders 49,895,073(1) $ 43.01(2) 42,195,484(3)

Equity compensation plans not approved by security holders 626,868(4) N/A(5) N/A(6)

Total 50,521,941 43.01 42,195,484

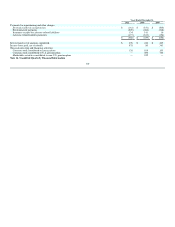

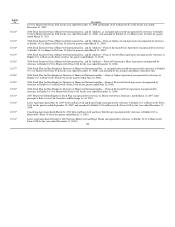

(1) Equity compensation plans approved by shareowners that are included in column (a) of the table are the 2011 Stock Incentive Plan of Honeywell

International Inc. and its Affiliates (the "2011 Stock Incentive Plan"), the 2006 Stock Incentive Plan of Honeywell International Inc. and its Affiliates

(the "2006 Stock Incentive Plan"), the 2003 Stock Incentive Plan of Honeywell International Inc. and its Affiliates (the "2003 Stock Incentive Plan")

and the 1993 Stock Plan for Employees of Honeywell International Inc. and its Affiliates (the "1993 Stock Plan") (38,562,720 shares of Common Stock

to be issued for options with a weighted average term of 6.27 years; 31,150 shares to be issued for stock appreciation rights ("SARs"); 9,746,433 RSUs

subject to continued employment; 130,891 performance shares subject to continued employment; and 1,092,879 deferred RSUs of earned and vested

awards where delivery of shares has been deferred); and the 2006 Stock Plan for Non-Employee Directors of Honeywell International Inc. (the "2006

Non-Employee Director Plan") and the 1994 Stock Plan for Non-Employee Directors of Honeywell International Inc. (the "1994 Non-Employee

Director Plan") (322,000 shares of Common Stock to be issued for options; and 9,000 RSUs subject to continued services). RSUs included in column

(a) of the table represent the full number of RSUs awarded and outstanding whereas the number of shares of Common Stock to be issued upon vesting

will be lower than what is reflected on the table due to the net share settlement process used by the Company (whereas the value of shares required to

meet employee statutory minimum tax withholding requirements are not issued).

1,266,309 growth plan units were issued for the performance cycle commencing on January 1, 2010 and ending December 31, 2011 pursuant to the

2006 Stock Incentive Plan. The ultimate value of any growth plan award may be paid in cash or shares of Common Stock and, thus, growth plan units

are not included in the table above. The ultimate value of growth plan units depends upon the achievement of pre-established performance goals during

the two-year performance cycle. 50% of the payment related to these growth plan units will be paid in March 2012 and the remaining 50% will be paid

in March 2013, subject to active employment on the payment dates.

Because the number of future shares that may be distributed to employees participating in the Honeywell Global Stock Plan is unknown, no shares

attributable to that plan are included in column (a) of the table above.

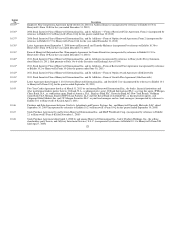

(2) Column (b) relates to stock options and does not include any exercise price for RSUs, performance shares, or growth plan units granted to employees or

non-employee directors under equity compensation plans approved by shareowners. RSUs do not have an exercise price because their value is

dependent upon attainment of certain performance goals or continued employment or service and they are settled for shares of Common Stock on a one-

for-one basis. Growth plan units are denominated in cash units and the ultimate value of the award is dependent upon attainment of certain performance

goals.

(3) The number of shares that may be issued under the 2011 Stock Incentive Plan as of December 31, 2011 is 39,582,132 which includes the following

additional shares under the 2011 Stock Incentive Plan (or any Prior 115