Honeywell 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

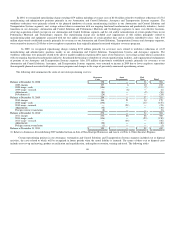

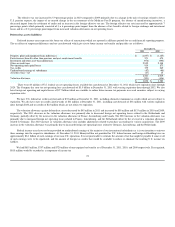

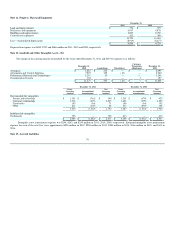

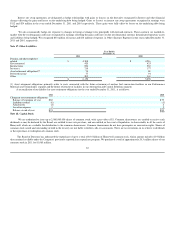

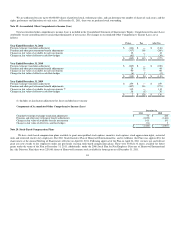

The schedule of principal payments on long term debt is as follows:

December 31,

2011

2012 $ 15

2013 628

2014 613

2015 1

2016 455

Thereafter 5,184

6,896

Less-current portion (15)

$ 6,881

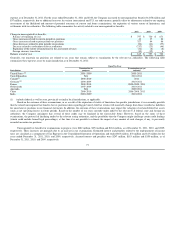

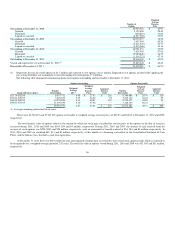

In February 2011, the Company issued $800 million 4.25 percent Senior Notes due 2021 and $600 million 5.375 percent Senior Notes due 2041

(collectively, the "Notes"). The Notes are senior unsecured and unsubordinated obligations of Honeywell and rank equally with all of Honeywell's existing

and future senior unsecured debt and senior to all of Honeywell's subordinated debt. The offering resulted in gross proceeds of $1,400 million, offset by $19

million in discount and closing costs related to the offering.

In the first quarter of 2011, the Company repurchased the entire outstanding principal amount of its $400 million 5.625 percent Notes due 2012 via a

cash tender offer and a subsequent optional redemption. The cost relating to the early redemption of the Notes, including the "make-whole premium", was $29

million.

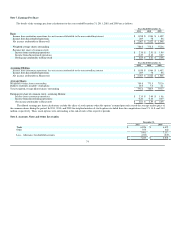

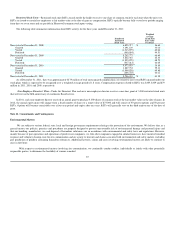

In March 2011, the Company entered into a $2,800 million Five Year Credit Agreement ("Credit Agreement") with a syndicate of banks. Commitments

under the Credit Agreement can be increased pursuant to the terms of the Credit Agreement to an aggregate amount not to exceed $3,500 million. The Credit

Agreement contains a $700 million sub-limit for the issuance of letters of credit. The Credit Agreement is maintained for general corporate purposes,

including support for the issuance of commercial paper, and replaces the previous $2,800 million five year credit agreement dated May 14, 2007 ("Prior

Agreement"). There have been no borrowings under the Credit Agreement or the Prior Agreement.

The Credit Agreement does not restrict our ability to pay dividends and contains no financial covenants. The failure to comply with customary

conditions or the occurrence of customary events of default contained in the credit agreement would prevent any further borrowings and would generally

require the repayment of any outstanding borrowings under the credit agreement. Such events of default include: (a) non-payment of credit agreement debt,

interest or fees; (b) non-compliance with the terms of the credit agreement covenants; (c) cross-default to other debt in certain circumstances; (d) bankruptcy;

and (e) defaults upon obligations under Employee Retirement Income Security Act. Additionally, each of the banks has the right to terminate its commitment

to lend additional funds or issue letters of credit under the agreement if any person or group acquires beneficial ownership of 30 percent or more of our voting

stock, or, during any 12-month period, individuals who were directors of Honeywell at the beginning of the period cease to constitute a majority of the Board

of Directors.

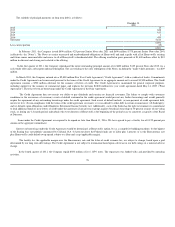

Loans under the Credit Agreement are required to be repaid no later than March 31, 2016. We have agreed to pay a facility fee of 0.125 percent per

annum on the aggregate commitment.

Interest on borrowings under the Credit Agreement would be determined, at Honeywell's option, by (a) a competitive bidding procedure; (b) the highest

of the floating base rate publicly announced by Citibank, N.A. 0.5 percent above the Federal funds rate or Libor plus 1 percent; or (c) the Eurocurrency rate

plus Honeywell's credit default swap spread, subject to a floor and a cap (applicable margin).

The facility fee, the applicable margin over the Eurocurrency rate and the letter of credit issuance fee, are subject to change, based upon a grid

determined by our long term debt ratings. The Credit Agreement is not subject to termination based upon a decrease in our debt ratings or a material adverse

change.

In the fourth quarter of 2011, the Company repaid $500 million of its 6.125% notes. The repayment was funded with cash provided by operating

activities.

78