Honeywell 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

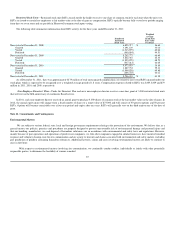

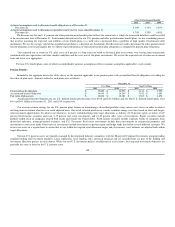

ongoing analysis of the probable insurance recovery, insurance receivables are recorded in the financial statements simultaneous with the recording of the

estimated liability for the underlying asbestos claims. This determination is based on our analysis of the underlying insurance policies, our historical

experience with our insurers, our ongoing review of the solvency of our insurers, our interpretation of judicial determinations relevant to our insurance

programs, and our consideration of the impacts of any settlements reached with our insurers. Insurance receivables are also recorded when structured

insurance settlements provide for future fixed payment streams that are not contingent upon future claims or other events. Such amounts are recorded at the

net present value of the fixed payment stream.

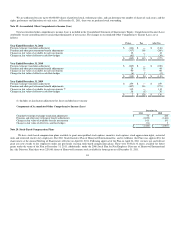

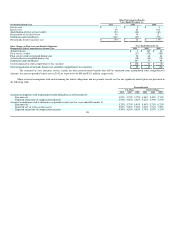

On a cumulative historical basis, Honeywell has recorded insurance receivables equal to approximately 40 percent of the value of the underlying

asbestos claims recorded. However, because there are gaps in our coverage due to insurance company insolvencies, certain uninsured periods, and insurance

settlements, this rate is expected to decline for any future Bendix related asbestos liabilities that may be recorded. Future recoverability rates may also be

impacted by numerous other factors, such as future insurance settlements, insolvencies and judicial determinations relevant to our coverage program, which

are difficult to predict. Assuming continued defense and indemnity spending at current levels, we estimate that the cumulative recoverability rate could

decline over the next five years to approximately 33 percent.

Honeywell believes it has sufficient insurance coverage and reserves to cover all pending Bendix related asbestos claims and Bendix related asbestos

claims estimated to be filed within the next five years. Although it is impossible to predict the outcome of either pending or future Bendix related asbestos

claims, we do not believe that such claims would have a material adverse effect on our consolidated financial position in light of our insurance coverage and

our prior experience in resolving such claims. If the rate and types of claims filed, the average resolution value of such claims and the period of time over

which claim settlements are paid (collectively, the "Variable Claims Factors") do not substantially change, Honeywell would not expect future Bendix related

asbestos claims to have a material adverse effect on our results of operations or operating cash flows in any fiscal year. No assurances can be given, however,

that the Variable Claims Factors will not change.

Other Matters

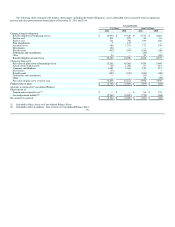

We are subject to a number of other lawsuits, investigations and disputes (some of which involve substantial amounts claimed) arising out of the

conduct of our business, including matters relating to commercial transactions, government contracts, product liability, prior acquisitions and divestitures,

employee benefit plans, intellectual property, and environmental, health and safety matters. We recognize a liability for any contingency that is probable of

occurrence and reasonably estimable. We continually assess the likelihood of adverse judgments of outcomes in these matters, as well as potential ranges of

possible losses (taking into consideration any insurance recoveries), based on a careful analysis of each matter with the assistance of outside legal counsel and,

if applicable, other experts. Included in these other matters are the following:

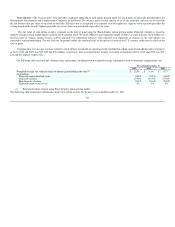

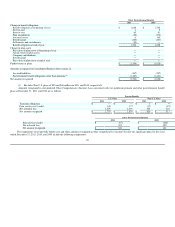

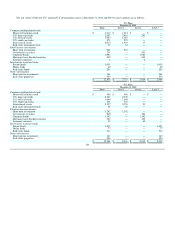

Allen, et al. v. Honeywell Retirement Earnings Plan—Pursuant to a settlement approved by the U.S. District Court for the District of Arizona in

February 2008, 18 of 21 claims alleged by plaintiffs in this class action lawsuit were dismissed with prejudice in exchange for approximately $35 million

(paid from the Company's pension plan) and the maximum aggregate liability for the remaining three claims (alleging that Honeywell impermissibly reduced

the pension benefits of certain employees of a predecessor entity when the plan was amended in 1983 and failed to calculate benefits in accordance with the

terms of the plan) was capped at $500 million. In October 2009, the Court granted summary judgment in favor of the Honeywell Retirement Earnings Plan

with respect to the claim regarding the calculation of benefits. In May 2011, the parties engaged in mediation and reached an agreement in principle to settle

the three remaining claims for $23.8 million (also to be paid from the Company's pension plan). Settlement documents have been submitted to the court for

classwide approval. A preliminary settlement order has been approved by the court and a fairness hearing on the settlement is scheduled for April 2012. Upon

court approval of the settlement, all claims in this matter will be fully resolved.

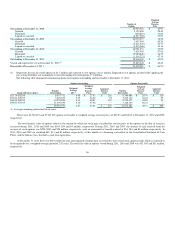

Quick Lube—On March 31, 2008, S&E Quick Lube, a filter distributor, filed suit in U.S. District Court for the District of Connecticut alleging that

twelve filter manufacturers, including Honeywell, engaged in a conspiracy to fix prices, rig bids and allocate U.S. customers for aftermarket automotive

filters. This suit is a purported class action on behalf of direct purchasers of filters from the defendants. Parallel purported class actions, including on behalf of

indirect purchasers of filters, have been filed by other plaintiffs in a variety of jurisdictions in the United States and Canada. The U.S cases have been

consolidated into a single multi-district litigation in the Northern District of Illinois. In June 2011, plaintiff's principal witness pled guilty to a felony count of

having made false statements to federal investigators. In February 2012, Honeywell reached an agreement in principle to resolve the multi-district litigation

class action as to all plaintiffs, subject to finalization of the agreement and approval by the court. As previously reported, the Antitrust Division of the

Department of Justice notified Honeywell in January

94