Honeywell 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

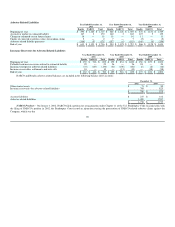

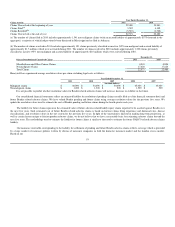

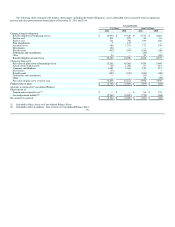

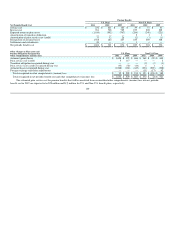

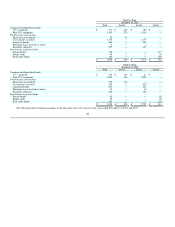

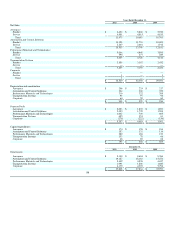

The following tables summarize the balance sheet impact, including the benefit obligations, assets and funded status associated with our significant

pension and other postretirement benefit plans at December 31, 2011 and 2010.

Pension Benefits

U.S. Plans Non-U.S. Plans

2011 2010 2011 2010

Change in benefit obligation:

Benefit obligation at beginning of year $ 14,990 $ 13,620 $ 4,373 $ 4,266

Service cost 232 221 59 51

Interest cost 761 768 239 228

Plan amendments 5 117 — —

Actuarial losses 566 1,211 171 150

Divestitures (26) — — —

Benefits paid (952) (947) (189) (181)

Settlements and curtailments — — (25) —

Other 24 — 20 (141)

Benefit obligation at end of year 15,600 14,990 4,648 4,373

Change in plan assets:

Fair value of plan assets at beginning of year 12,181 10,306 3,939 3,488

Actual return on plan assets (41) 1,788 87 414

Company contributions 1,681 1,034 124 313

Divestitures (33) — — —

Benefits paid (952) (947) (189) (181)

Settlements and curtailments — — (25) —

Other — — 22 (95)

Fair value of plan assets at end of year 12,836 12,181 3,958 3,939

Funded status of plans $ (2,764) $ (2,809) $ (690) $ (434)

Amounts recognized in Consolidated Balance

Sheet consist of:

Prepaid pension benefit cost(1) $ — $ — $ 84 $ 135

Accrued pension liability(2) (2,764) (2,809) (774) (569)

Net amount recognized $ (2,764) $ (2,809) $ (690) $ (434)

(1) Included in Other Assets on Consolidated Balance Sheet

(2) Included in Other Liabilities - Non-Current on Consolidated Balance Sheet

98