Honeywell 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

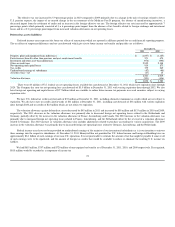

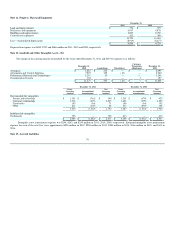

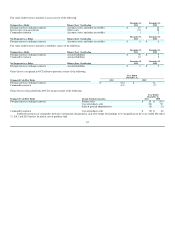

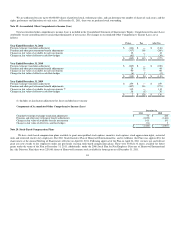

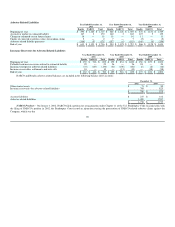

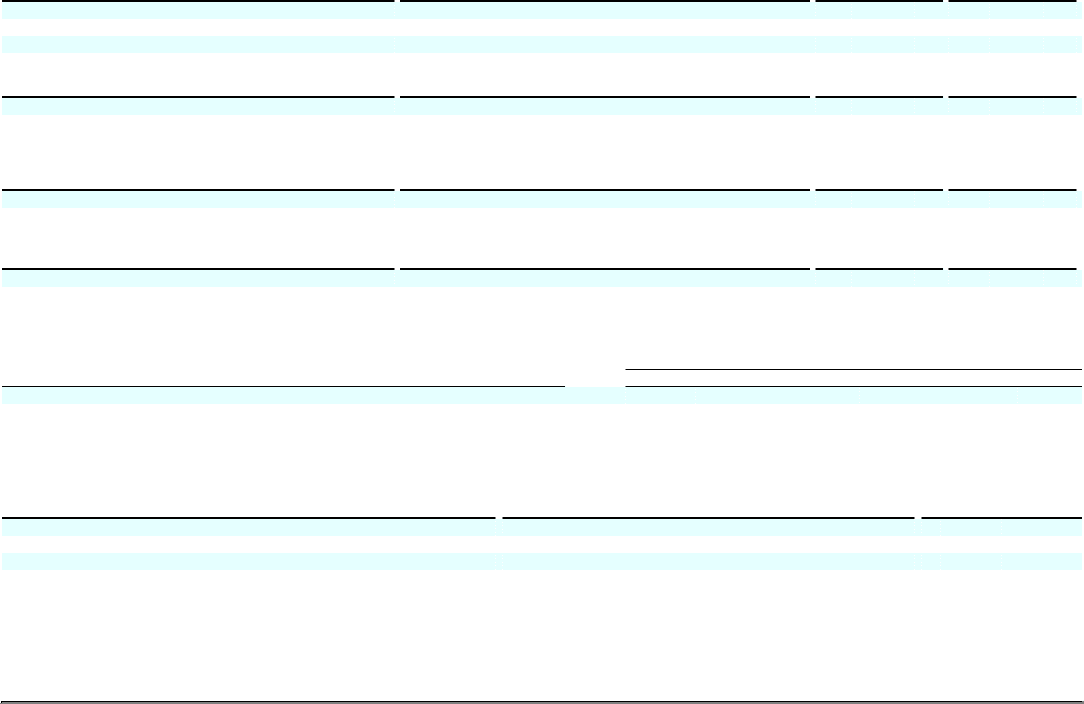

Fair value of derivatives classified as assets consist of the following:

Designated as a Hedge Balance Sheet Classification December 31,

2011 December 31,

2010

Foreign currency exchange contracts Accounts, notes, and other receivables $ 18 $ 10

Interest rate swap agreements Other assets 134 22

Commodity contracts Accounts, notes, and other receivables 1 2

Not Designated as a Hedge Balance Sheet Classification December 31,

2011 December 31,

2010

Foreign currency exchange contracts Accounts, notes, and other receivables $ 8 $ 6

Fair value of derivatives classified as liabilities consist of the following:

Designated as a Hedge Balance Sheet Classification December 31,

2011 December 31,

2010

Foreign currency exchange contracts Accrued liabilities $ 50 $ 9

Commodity contracts Accrued liabilities 10 2

Not Designated as a Hedge Balance Sheet Classification December 31,

2011 December 31,

2010

Foreign currency exchange contracts Accrued liabilities $ 2 $ 5

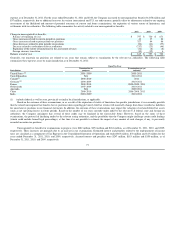

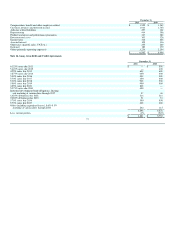

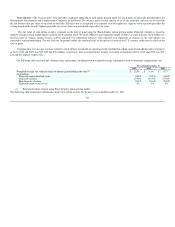

Gains (losses) recognized in OCI (effective portions) consist of the following:

Year Ended

December 31,

Designated Cash Flow Hedge 2011 2010

Foreign currency exchange contracts $ (42) $ 12

Commodity contracts (12) (7)

Gains (losses) reclassified from AOCI to income consist of the following:

Year Ended

December 31,

Designated Cash Flow Hedge Income Statement Location 2011 2010

Foreign currency exchange contracts Product sales $ 29 $ (19)

Cost of products sold (34) 30

Sales & general administrative (8) (3)

Commodity contracts Cost of products sold $ (2) $ (8)

Ineffective portions of commodity derivative instruments designated in cash flow hedge relationships were insignificant in the years ended December

31, 2011 and 2010 and are located in cost of products sold.

82