Honeywell 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

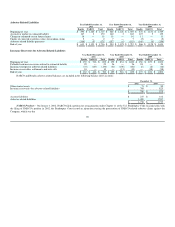

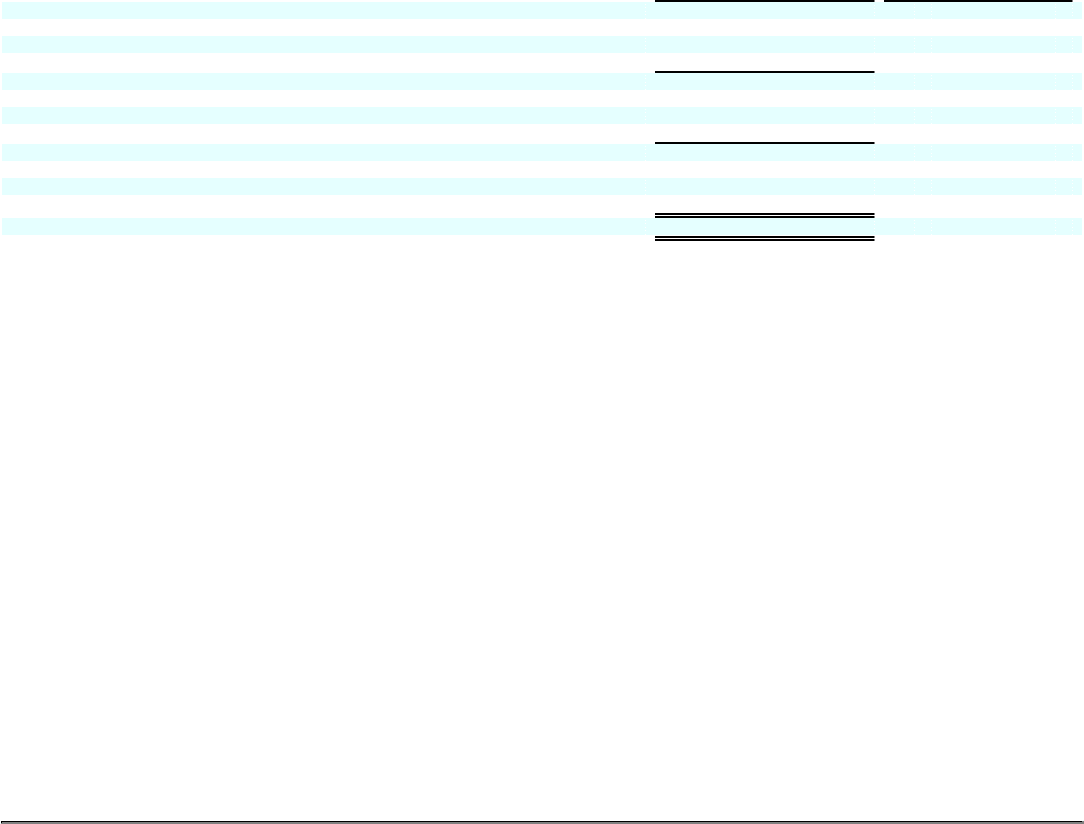

Restricted Stock Units—Restricted stock unit (RSU) awards entitle the holder to receive one share of common stock for each unit when the units vest.

RSUs are issued to certain key employees at fair market value at the date of grant as compensation. RSUs typically become fully vested over periods ranging

from three to seven years and are payable in Honeywell common stock upon vesting.

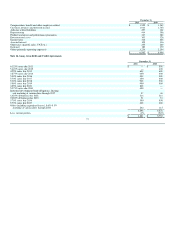

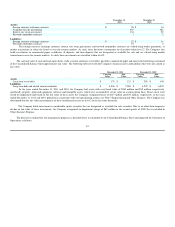

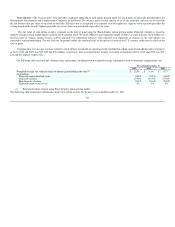

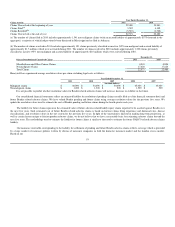

The following table summarizes information about RSU activity for the three years ended December 31, 2011:

Number of

Restricted

Stock Units

Weighted

Average

Grant Date

Fair Value

Per Share

Non-vested at December 31, 2008 6,825,717 $ 46.63

Granted 3,691,129 30.16

Vested (1,313,975) 40.44

Forfeited (940,094) 44.51

Non-vested at December 31, 2009 8,262,777 40.49

Granted 3,842,367 42.33

Vested (1,593,979) 48.71

Forfeited (537,212) 40.45

Non-vested at December 31, 2010 9,973,953 39.89

Granted 1,887,733 55.11

Vested (1,509,528) 49.48

Forfeited (605,725) 40.11

Non-vested at December 31, 2011 9,746,433 $ 41.35

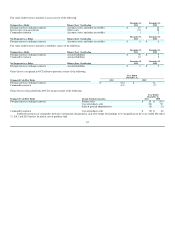

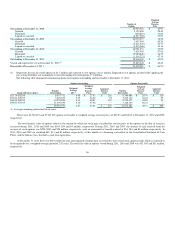

As of December 31, 2011, there was approximately $179 million of total unrecognized compensation cost related to non-vested RSUs granted under our

stock plans which is expected to be recognized over a weighted-average period of 1.8 years. Compensation expense related to RSUs was $109, $109 and $79

million in 2011, 2010, and 2009, respectively.

Non-Employee Directors' Plan—Under the Directors' Plan each new non-employee director receives a one-time grant of 3,000 restricted stock units

that will vest on the fifth anniversary of continuous Board service.

In 2011, each non-employee director received an annual grant to purchase 5,000 shares of common stock at the fair market value on the date of grant. In

2012, the annual equity grant will change from a fixed number of shares to a target value of $75,000 and will consist of 50 percent options and 50 percent

RSUs. Options will become exercisable over a four-year period and expire after ten years. RSUs will generally vest on the third anniversary of the date of

grant.

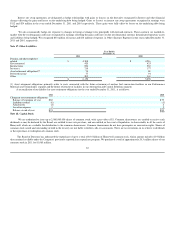

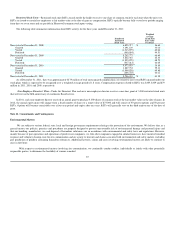

Note 21. Commitments and Contingencies

Environmental Matters

We are subject to various federal, state, local and foreign government requirements relating to the protection of the environment. We believe that, as a

general matter, our policies, practices and procedures are properly designed to prevent unreasonable risk of environmental damage and personal injury and

that our handling, manufacture, use and disposal of hazardous substances are in accordance with environmental and safety laws and regulations. However,

mainly because of past operations and operations of predecessor companies, we, like other companies engaged in similar businesses, have incurred remedial

response and voluntary cleanup costs for site contamination and are a party to lawsuits and claims associated with environmental and safety matters, including

past production of products containing hazardous substances. Additional lawsuits, claims and costs involving environmental matters are likely to continue to

arise in the future.

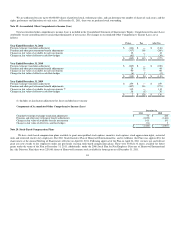

With respect to environmental matters involving site contamination, we continually conduct studies, individually or jointly with other potentially

responsible parties, to determine the feasibility of various remedial

87