Honeywell 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

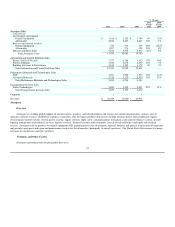

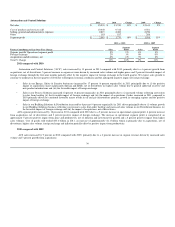

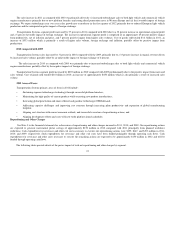

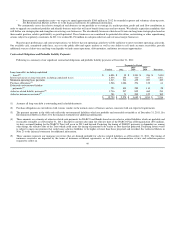

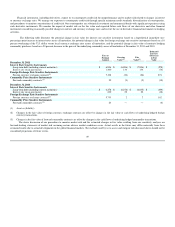

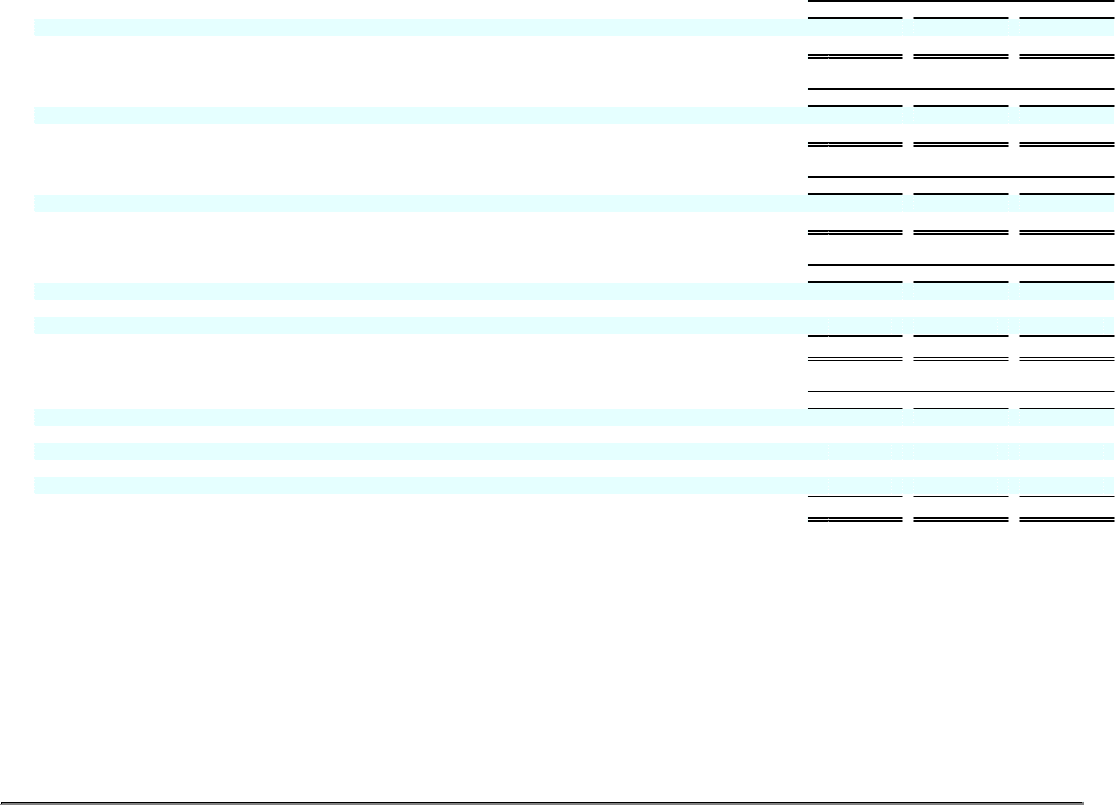

Years Ended December 31,

2011 2010 2009

Aerospace

Net repositioning charge $ 29 $ 32 $ 31

Years Ended December 31,

2011 2010 2009

Automation and Control Solutions

Net repositioning charge $ 191 $ 79 $ 70

Years Ended December 31,

2011 2010 2009

Performance Materials and Technologies

Net repositioning charge $ 41 $ 18 $ 9

Years Ended December 31,

2011 2010 2009

Transportation Systems

Net repositioning charge $ 82 $ 20 $ 50

Asbestos related litigation charges, net of insurance 146 158 112

$ 228 $ 178 $ 162

Years Ended December 31,

2011 2010 2009

Corporate

Net repositioning charge $ 11 $ — $ —

Asbestos related litigation charges, net of insurance 3 17 43

Probable and reasonably estimable environmental liabilities 240 212 145

Other — 62 7

$ 254 $ 291 $ 195

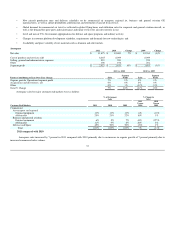

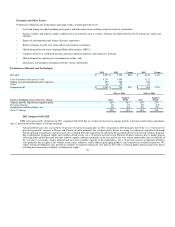

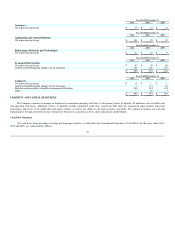

LIQUIDITY AND CAPITAL RESOURCES

The Company continues to manage its businesses to maximize operating cash flows as the primary source of liquidity. In addition to our available cash

and operating cash flows, additional sources of liquidity include committed credit lines, short-term debt from the commercial paper market, long-term

borrowings, and access to the public debt and equity markets, as well as the ability to sell trade accounts receivables. We continue to balance our cash and

financing uses through investment in our existing core businesses, acquisition activity, share repurchases and dividends.

Cash Flow Summary

Our cash flows from operating, investing and financing activities, as reflected in the Consolidated Statement of Cash Flows for the years ended 2011,

2010 and 2009, are summarized as follows:

42