Honeywell 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

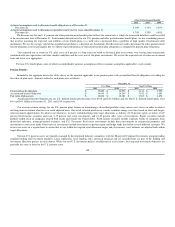

administrators of the funds. Investments in private equity, debt, real estate and hedge funds and direct private investments are valued at estimated fair value

based on quarterly financial information received from the investment advisor and/or general partner. Investments in real estate properties are valued on a

quarterly basis using the income approach. Valuation estimates are periodically supplemented by third party appraisals.

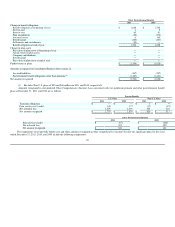

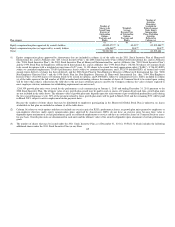

Our general funding policy for qualified pension plans is to contribute amounts at least sufficient to satisfy regulatory funding standards. In 2011, 2010

and 2009, we were not required to make contributions to our U.S. pension plans, however, we made voluntary contributions of $1,650, $1,000 and $740

million, respectively, primarily to improve the funded status of our plans. These contributions do not reflect benefits paid directly from Company assets. In

2012, we expect to make cash contributions of $800 million to $1 billion ($250 million was made in January 2012) to our global defined benefit pension plans

principally to improve the funded status of our plans and also to satisfy regulatory funding standards in our non-U.S. plans.

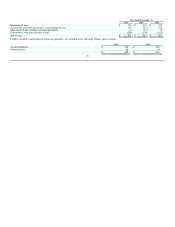

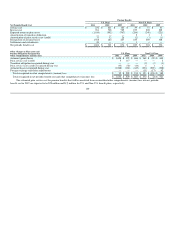

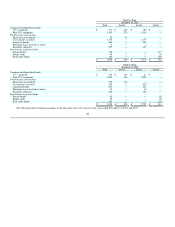

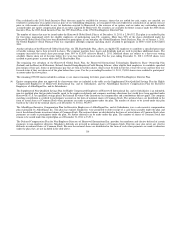

Benefit payments, including amounts to be paid from Company assets, and reflecting expected future service, as appropriate, are expected to be paid as

follows:

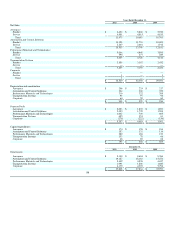

U.S. Plans Non-U.S. Plans

2012 $ 1,025 $ 185

2013 1,025 189

2014 1,051 193

2015 1,101 197

2016 1,084 203

2017-2021 5,473 1,097

Other Postretirement Benefits

The Medicare Prescription Drug, Improvement and Modernization Act of 2003 (the Act) provides subsidies for employers that sponsor postretirement

health care plans that provide prescription drug coverage that is at least actuarially equivalent to that offered by Medicare Part D. The March 2010 enactment

of the Patient Protection and Affordable Care Act, including modifications made in the Health Care and Education Reconciliation Act of 2010 resulted in a

one-time, non-cash charge of $13 million related to income taxes in the first quarter of 2010. The charge results from a change in the tax treatment of the

Medicare Part D program.

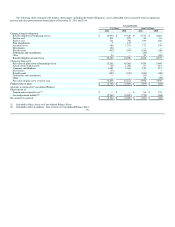

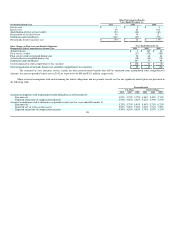

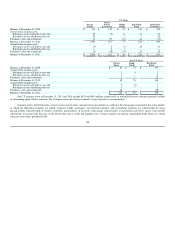

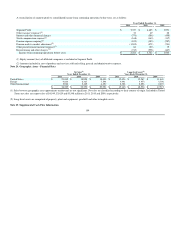

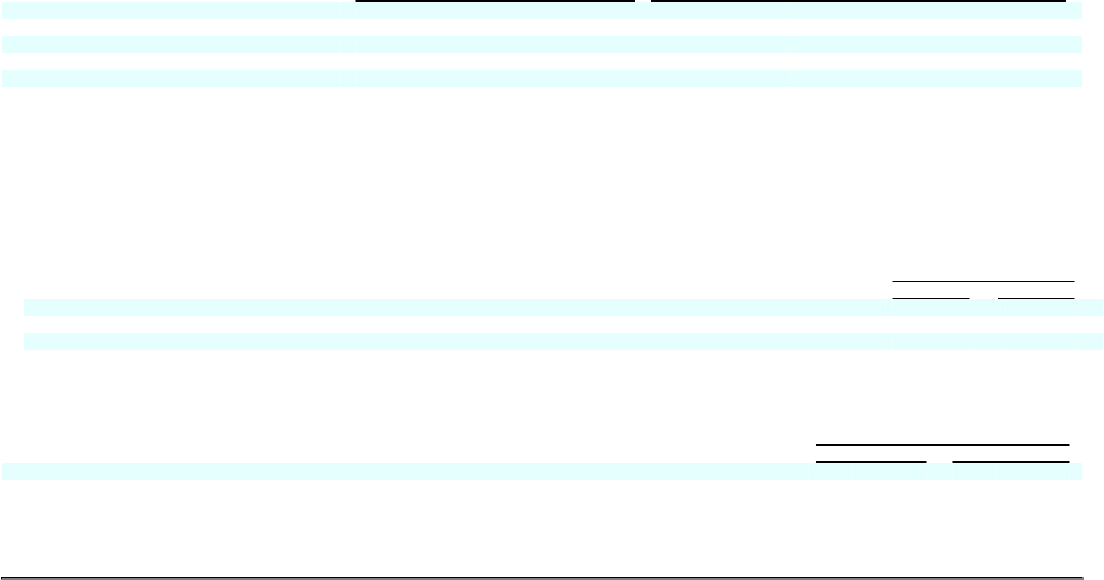

December 31,

2011 2010

Assumed health care cost trend rate:

Health care cost trend rate assumed for next year 7.50% 8.00%

Rate that the cost trend rate gradually declines to 5.00% 5.00%

Year that the rate reaches the rate it is assumed to remain at 2017 2017

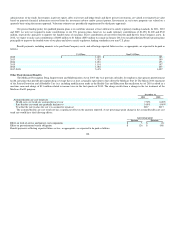

The assumed health care cost trend rate has a significant effect on the amounts reported. A one-percentage-point change in the assumed health care cost

trend rate would have the following effects:

1 percentage point

Increase Decrease

Effect on total of service and interest cost components $ 5 $ (3)

Effect on postretirement benefit obligation $ 126 $ (80)

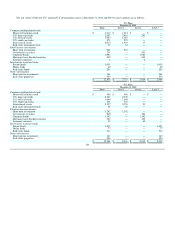

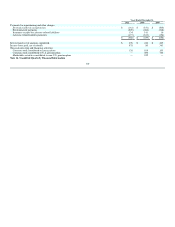

Benefit payments reflecting expected future service, as appropriate, are expected to be paid as follows:

106