Honeywell 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

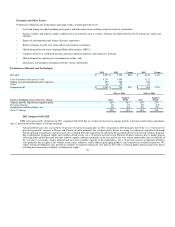

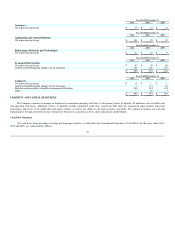

Economic and Other Factors

Performance Materials and Technologies operating results are principally driven by:

• Level and timing of capital spending and capacity and utilization rates in refining and petrochemical end markets;

• Pricing volatility and industry supply conditions for raw materials such as cumene, fluorspar, perchloroethylene, R240, natural gas, sulfur and

ethylene;

• Impact of environmental and energy efficiency regulations;

• Extent of change in order rates from global semiconductor customers;

• Global demand for non-ozone depleting Hydro fluorocarbons (HFCs);

• Condition of the U.S. residential housing and non residential industries and automotive demand;

• Global demand for caprolactam and ammonium sulfate; and

• Demand for new products including renewable energy and biofuels.

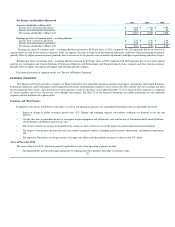

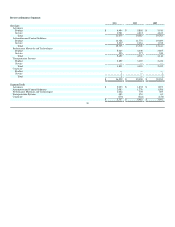

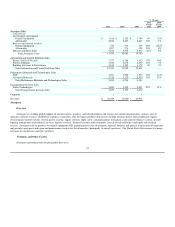

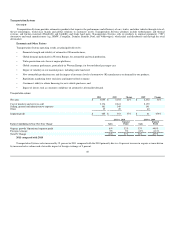

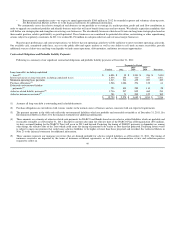

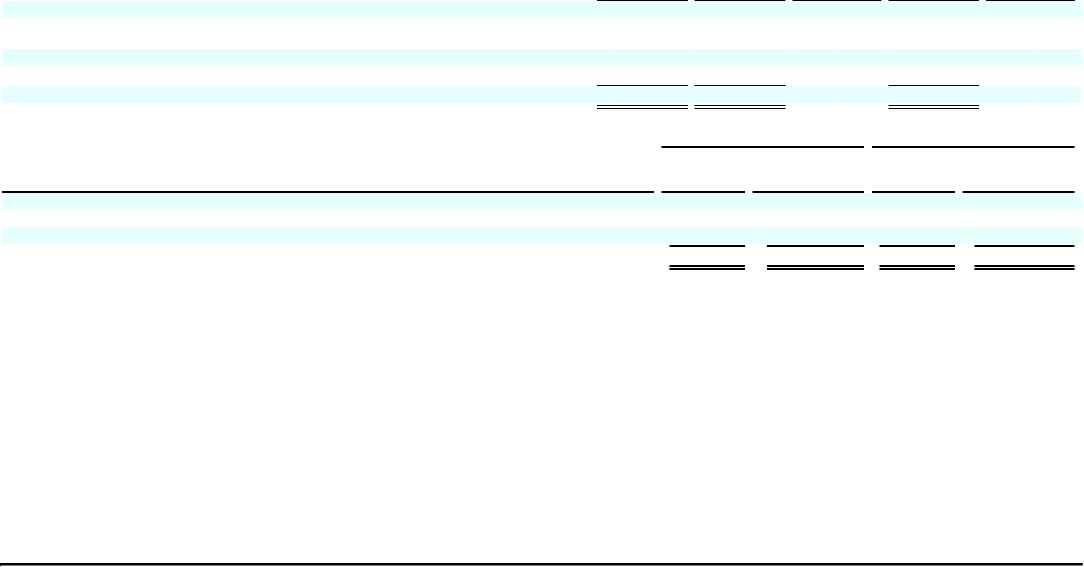

Performance Materials and Technologies

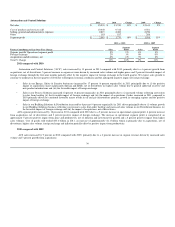

2011 2010 Change 2009 Change

Net sales $ 5,659 $ 4,726 20% $ 4,144 14%

Cost of products and services sold 4,151 3,554 3,127

Selling, general and administrative expenses 420 345 345

Other 46 78 67

Segment profit $ 1,042 $ 749 39% $ 605 24%

2011 vs. 2010 2010 vs. 2009

Factors Contributing to Year-Over-Year Change Sales Segment

Profit Sales Segment

Profit

Organic growth/ Operational segment profit 16% 38% 14% 25%

Foreign exchange 1% 1% 0% (1)%

Acquisitions and divestitures, net 3% 0% 0% 0%

Total % Change 20% 39% 14% 24%

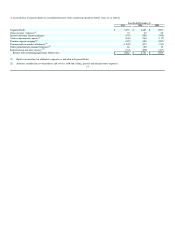

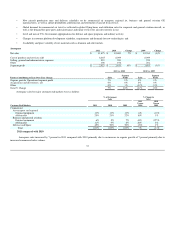

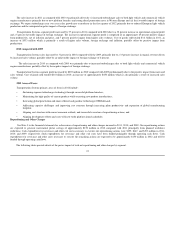

2011 compared with 2010

PMT sales increased by 20 percent in 2011 compared with 2010 due to a 16 percent increase in organic growth, 3 percent growth from acquisitions,

and a 1 percent favorable impact of foreign exchange.

•Advanced Materials sales increased by 18 percent (12 percent organically) in 2011 compared to 2010 primarily driven by (i) a 33 percent (18

percent organically) increase in Resins and Chemicals sales primarily due to higher prices driven by strong Asia demand, agricultural demand,

formula pricing arrangements and increased sales resulting from the acquisition of a phenol plant, partially offset by decreased volumes primarily

due to disruptions in phenol supply and weather related events, (ii) a 10 percent increase in our Fluorine Products business due to higher pricing

reflecting robust global demand and tight industry supply conditions primarily in the first half of the year, which moderated in the second half of

the year due to seasonally weaker demand and increased available capacity in the marketplace, (iii) a 12 percent increase in Specialty Products

sales primarily due to higher sales volume in our armor, additives, and healthcare packaging products, and commercial excellence initiatives. We

expect Advanced Materials sales growth to continue to moderate during the first half of 2012 due to slowing global demand and lower prices

resulting from increased availability of refrigerants supply. 38